Stocks Fall on the “No Pivot” Powell Speech

SPX down over -5% in the past 3 days since Jackson Hole.

Additional Fedspeak:

- BARKIN: JOB MARKET STILL VERY TIGHT, DEMAND IS HEALTHY

- BARKIN: WON’T PREJUDGE SIZE OF NEXT RATE HIKE, DEPENDS ON DATA

- BOSTIC: COULD DIAL BACK 75 BPS HIKES IF PRICES CLEARLY COOLING

- BOSTIC: INFLATION IS TOO HIGH, POLICY NEEDS TO BE RESTRICTIVE

- WILLIAMS: RESTRICTIVE FED POLICY NEEDED THROUGH NEXT YEAR

Source: Bloomberg as of 8.1.22

Source: Bloomberg as of 8.1.22

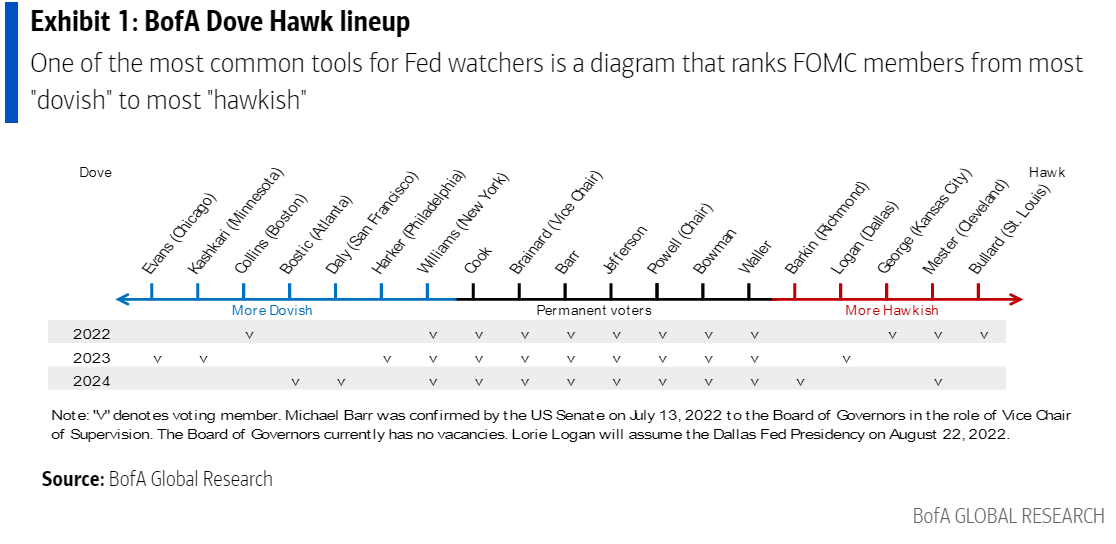

Inflation Made the Doves Cry

Since the Volcker years and the early part of the Greenspan years, there have been very few “perma-hawks” or “perma-doves” on the FOMC. This is because there is a strong consensus around both targeting inflation at 2% and the idea that there is no permanent trade-off between the two goals of the Fed-maximum employment and price stability. Hence, the debate has tended to revolve more around forecasts than around goals.

Starting last fall, there has been an ongoing capitulation by the Committee to the point where they are all nearly on the same page:

- Prioritizing inflation control Willing to risk a recession in the process

- Viewing the inflation peak as just a small first step

- Looking for a substantial cooling off of the job market

- Agreeing to multiple large rate hikes

- Pushing the funds rate into restrictive territory (i.e., above neutral).

In reading the comments (see examples above) of the various Committee members, it is now hard to tell who the supposed “doves” are and who the “hawks” are.

While it’s fun to be hawkish, the big test will come when the Committee faces a serious trade-off between growth and inflation. What if the economy is clearly sliding into a recession but inflation is getting stuck at ~3%? Faced with a serious trade-off, are they fully committed to getting inflation down to 2% in a timely manner? Do they acknowledge that their inflation forecast is wrong and remain hawkish? We will then see what the new nest really looks like.

Data as of 08.29.2022

Data as of 08.29.2022

Neel Kashkari (MN Fed Governor) “Happy” to See Stock Market Selloff

Since Jackson Hole, the equity markets have felt the “wrath” of higher for longer interest rates, as Chairman Powell assures the market he is serious about inflation. Kashkari was on the popular Odd Lots podcast Monday where he mentioned he was happy to see the market’s reaction post-speech. Below are some quotes from the recording:

“People now understand the seriousness of our commitment to getting inflation back down to 2%.” … “I certainly was not excited to see the stock market rallying after our last Federal Open Market Committee meeting,” he said. “Because I know how committed we all are to getting inflation down. And I somehow think the markets were misunderstanding that.” … “One of the biggest mistakes they made in the 1970s at the Fed is they thought that inflation was on its way down. The economy was weakening. And then they backed off and then inflation flared back up again before they had finally quashed it,” Kashkari said. “We can’t repeat that mistake.” “The way to deal with the lags for me is just to get somewhere and sit there until we’re really convinced that we’ve got inflation licked,” he said.

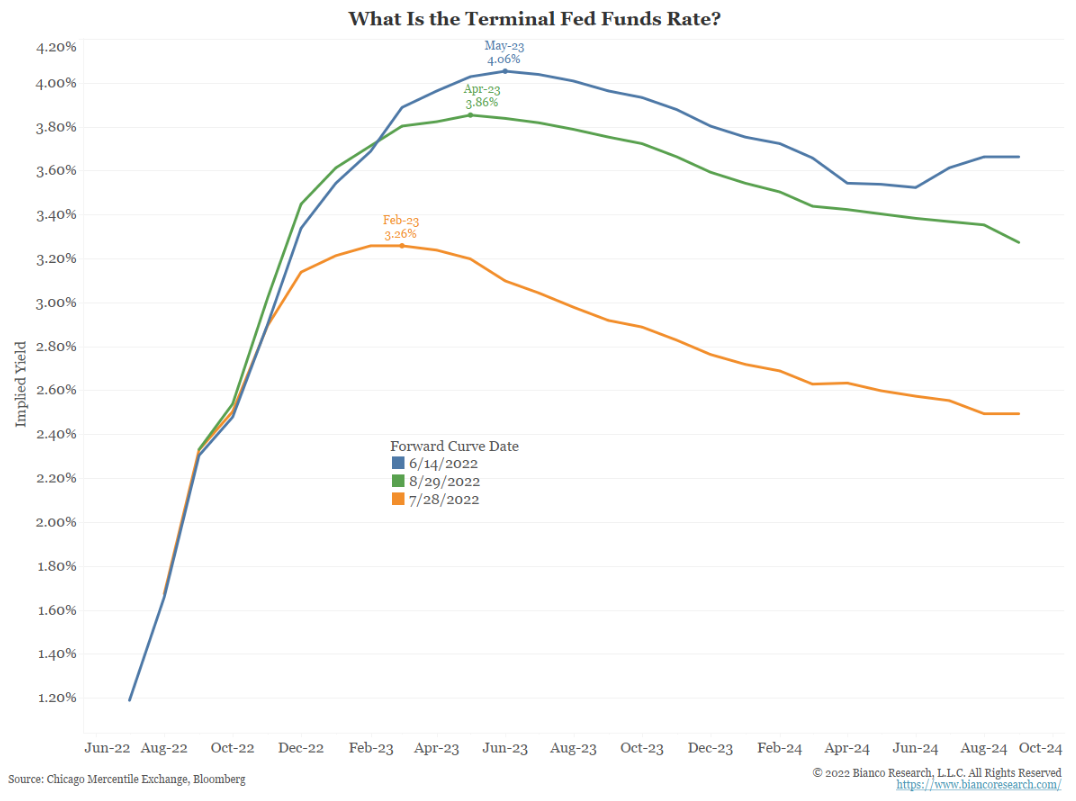

The comments from Kashkari (and other Fed governors) are FAR from the dovish pivot the market was hoping for back in late July/ early August, which drove equity markets up double digits. The bottom line is we’ve got a Fed hell-bent on curing the inflation disease our country is facing, and the market is starting to believe them! The chart below shows the change in expectations of the Fed Funds rate (and terminal rate) over the past couple of months. While not back up to the June highs, we are inching closer.

Source: Bianco. As of 8/30/22

Source: Bianco. As of 8/30/22

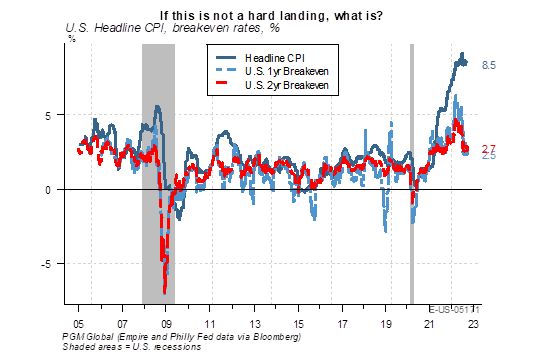

Breakevens Under Control…

Last week’s Jackson Hole symposium was one of the most hawkish meetings we can remember. Chairman Powell focused solely on restoring the Fed’s credibility in fighting inflation and not repeating the mistakes of the 1970s. Breakeven rates (the difference between the yield of a nominal bond and an inflation-linked bond of the same maturity) are pricing a sharp drop in inflation over the next 12 months. We believe the upcoming tightening in financial conditions (rate hikes and QT) will significantly impact interest rate volatility in the coming months.

Source: Pavilion. As of 8/29/22

Source: Pavilion. As of 8/29/22

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2208-28.