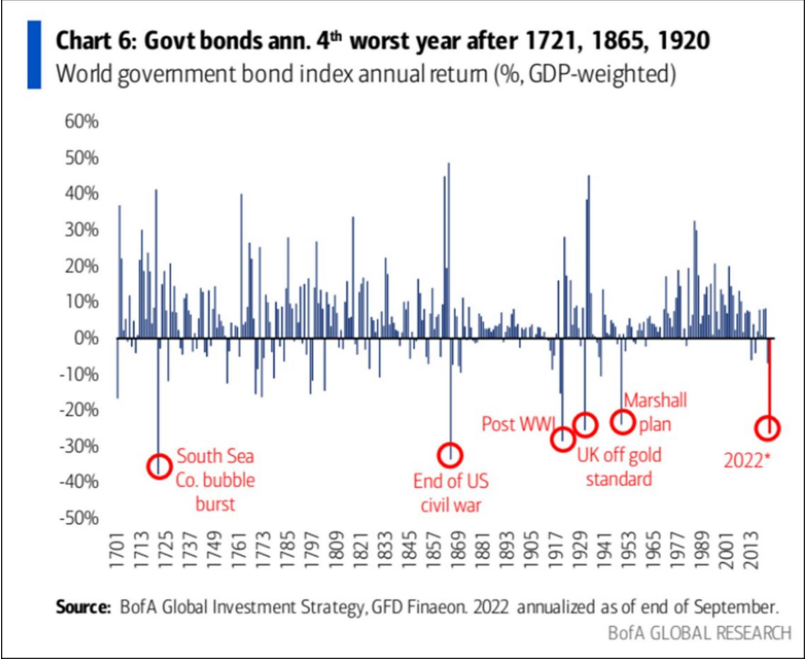

We’ve had a number of questions regarding peak interest rates. Interest rates have of course been a hot topic in 2022… the 4th worst year for government bonds since 1721 has led to an interesting backdrop of uncharted waters. Interest rates can be confusing, and we’ve had questions on whether the rise in rates we’ve experience is an opportunity to invest (in bonds) just because rates are higher now than what we’ve seen in 10-15 years. We’d note caution to this logic.

Source: BAML as of 10/28/22

Source: BAML as of 10/28/22

Interest rates can be a complex subject. There are many types of rates which makes it even more confusing (policy rates, short term rates, long term rates, risk free rates and credit spreads just to name a few). We will try to simplify it as best we can and look to post more detailed interest rate primers covering these topics in the future.

What are Interest Rates and Why are They Important?

Interest rates give a notion of the time value of money or the price of time. Interest rates are also determined by the supply and demand for savings. Interest rates are the cost of leverage and the price of risk. “Interest is the difference in monetary values across time, the rate at which present consumption is exchanged for future consumption.” Plain and simple interest is the time value of money.

Where Yields Come From

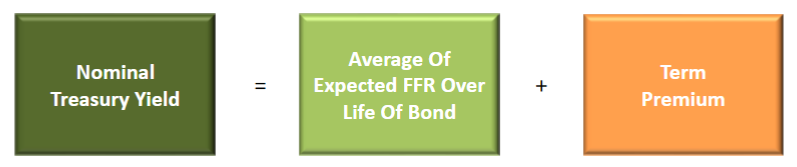

Bond yields are a function of economic activity, expected future inflation, and supply and demand. We use this graphic as a basic decomposition to look at Treasury yields that helps simplify some of the noise. Treasury yields (Risk-free bonds) have a Fed policy component (Fed Funds rate) and a term premium, which can comprise anything else other than Fed policy (liquidity, inflation, supply & demand, etc.). For bonds that aren’t risk free, there would be a credit spread added in (credit spread) to the calculation.

Source: PSC. As of 10/28/22

Source: PSC. As of 10/28/22

Right now, the average of the expected Fed Funds rate is driving rates higher. The Fed will have taken policy from 0% to 3.75% by November 2, and likely to 4.5%-4.75% by the end of the year.

How High Can Rates Go?

The Fed wants policy to be above neutral in order to bring inflation down; in the short run, the neutral Fed Funds rate is currently greater than 3%, although it probably declines to around 2.5% in the longer run (several FOMC members said that policy would have to be brought up to a “restrictive” level, and that means above neutral).

Remember the neutral rate is just an ideal equilibrium state where monetary policy neither stimulates nor restrains the economy. This means that the Federal Funds rate (terminal rate) will keep increasing for the foreseeable future and will likely remain at its peak rate for a while once it reaches it. This outlook begs the obvious question of what a reasonable estimate of the peak Fed Funds rate is. The answer is not straightforward, so we go through the details below. This brings in the importance of the terminal rate.

Terminal Rate

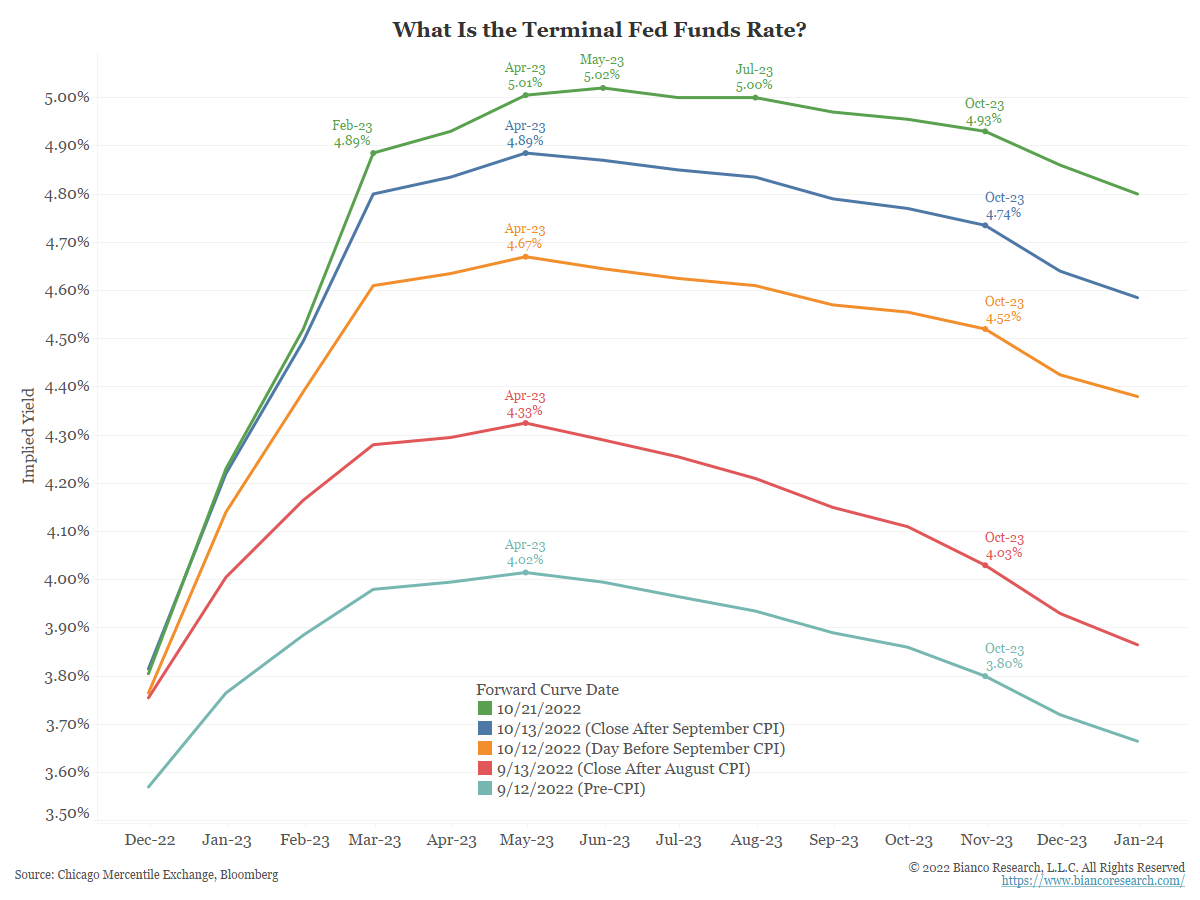

The Fed’s terminal rate can be accessed via the Fed Funds curve. This rate shows the markets expectation of Fed policy (i.e., the peak policy rate). Following is an updated Fed Funds curve:

Source: Bianco. As of 10/21/22

Source: Bianco. As of 10/21/22

The past 6 months, the terminal rate has continually pushed higher as the Fed has proven serious in fighting inflation and expectations for rate hikes have increased. One other thing we’d note is that no “pivot” is priced between February and October of 2023. In other words, the Fed is expected to hike to a range of 4.75% and 5.00% and largely stay there until late 2023.

Where Do Short Term Rates Peak?

What does a 5% terminal rate mean for market-based interest rates, such as the 2-year Treasury? Bianco research ran an interesting analysis on the 2yr UST vs the Fed rate (shown below). The orange line below shows the target funds rate. The blue line shows the 2-year yield.

As the table shows, the last five rate hike cycles ended with the 2-year yield above the terminal Fed Funds rate. So, if the market projection of a 5% funds rate is correct, then history suggests the 2-year yield should be higher than this terminal rate. If the market is correct in its assumption of the terminal rate, we believe this will continue to push both front end and back-end rates interest higher.

Source: Bianco. As of 10/21/22

Source: Bianco. As of 10/21/22

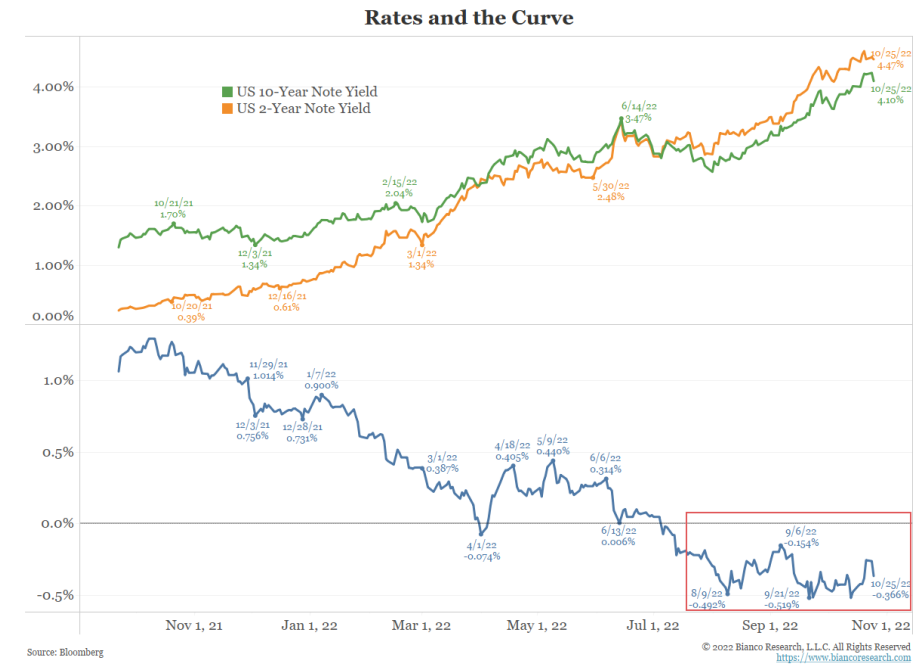

What Does This Mean For Long Rates, Like the 10-Year Yield?

As the 2-year yield (orange) keeps climbing, the level of curve inversion has been bound by the inverted yield curve (blue). In other words, we think it’s highly unlikely to see the yield curve invert -75 or -100 basis points (at least not yet). If/when the economy turns lower or a financial scare takes place, the long end will rally and yields will drop, producing a more inverted curve. But until then, as the 2-year climbs with hawkish Fed talk, the 10-year will more or less shift higher in a parallel manner.

So, with a Fed Funds Rate ending 2022 at 4.5%-4.75%, in our opinion, we think the level of front-end rates will keep the 10-year yield, even though inverted, to the high “3s” or low “4s” with a possibility it could continue to rise to a level closer to 5% considering the economy doesn’t break.

Source: Jefferies. As of 10/26/22

Source: Jefferies. As of 10/26/22

With that said, long end rates will likely be peaking the next several months (considering the Fed stops hiking sometime Q1/Q2 of ’23). As the above table illustrates, the 10-year yield on average peaks 1.3 months (max 4 months) before a sustained rate-hike-pause. The rates futures market currently expects a peak in May 2023 (~5% implied rate).

Assuming the Fed is at 4.50-4.75% by end of year 22, we are likely within months of a peak/pause in longer term rates. We’d caution though that just because the Fed stops raising front end rates doesn’t directly mean they will revert to cutting rates anytime soon, which will likely keep short and long term rates elevated for longer.

When Will the Job be Done? Is the Market Hawkish Enough??

We all know the Fed is awake & aggressive (how aggressive remains still to be seen and largely up to the inflation data). The ultimate question is how far will the Fed need to tighten? Is a terminal rate at ~5% enough?

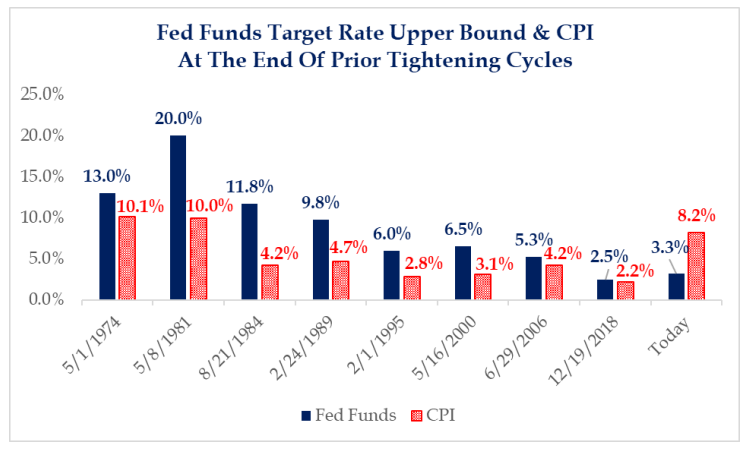

Historically, the minimum condition for restrictive policy is a positive real rate (interest rates > inflation). Using headline, rightly or wrongly, there still is a way to go. As the chart below shows, in the end, the terminal Fed Funds rate has always been higher than the CPI at the end of prior tightening cycles. Will this time be different?

Source: Strategas. As of 10/28/22

Source: Strategas. As of 10/28/22

Another Interesting Historical Data Point Alluding To More Hikes

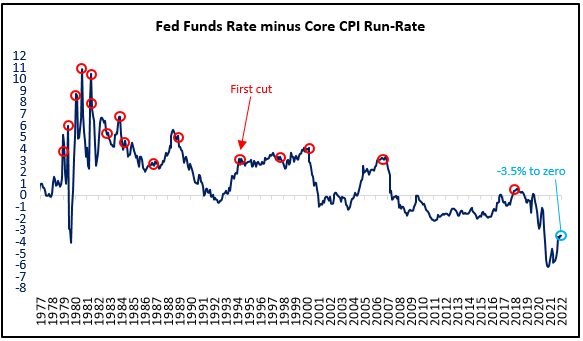

The Fed historically has not cut rates until the Fed Funds Rate has been above the 6-month moving avg of MoM annualized core CPI (“core CPI run-rate”). The FFR is currently 350bps below the core CPI run rate. Following a 75bp hike (all but guaranteed come 11/2), that delta will close to 275bps. So, while we are probably near peak inflation, the drop lower (in inflation) likely won’t be quick, holding rates firm.

Source: Jefferies Trading. As of 10/28/22

Source: Jefferies Trading. As of 10/28/22

Bottom Line

The Fed has never pivoted with the level of interest rates this far below the inflation rate. Will this time be different?

The Fed will be reluctant to cut rates too quickly because, again, of the fear of repeating the experience of ingrained inflation from the 1970s and early 1980s was evident in Powell’s Jackson Hole speech. So, while we don’t anticipate that the Fed will stay at the peak rate for years, we think it’s unlikely there will be rate cuts just a month or two after getting there either. Our presumption is that the funds rate will stay at its peak level for at least a couple of quarters, and so well into the second half of next year.

“Without price stability, the economy does not work for anyone. Without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all. The burdens of high inflation fall heaviest on those who are least able to bear them.”

-Chairman Powell Jackson Hole August 26, 2022

With another Fed meeting on November 2 (another 75bps is all but done at this point), we’ll be watching Powell’s response to the easing of financial conditions over the last couple weeks to see whether he views this softening as acceptable or drops another Jackson Hole bomb on us. To be continued…

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible. Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The 10-year Treasury Note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once every six months and pays the face value to the holder at maturity.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10-year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10-year yield as the “risk free” rate when valuing the markets or an individual security.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2210-32.