A Look Back on TIPS

Treasury Inflation-Protected Securities (TIPS) are a type of government bond issued by the US Treasury Department. Unlike conventional bonds, TIPS are designed to protect investors from inflation. This is done by adjusting the bond’s principal value in response to changes in the Consumer Price Index (CPI).

The interest rate on TIPS is fixed at the time of issuance, but the bond’s principal value adjusts every six months to reflect changes in the CPI. This means that if inflation increases, the bond’s principal value will increase, and if inflation decreases, the bond’s principal value will decrease. The interest payments on TIPS are based on the adjusted principal value of the bond. One other notable to keep in mind: The value of a TIPS investment can never fall below par value at maturity, even in a time of severe deflation.

How Have TIPS Performed?

Source: Bloomberg. As of 3/31/23.

Source: Bloomberg. As of 3/31/23.

*STIP = iShares 0-5 Year TIPS bond ETF (duration = 2.44yrs)

*SCHP = Schwab TIPS ETF (duration = 6.99yrs)

*AGG = iShares U.S. Aggregate Bond Index (duration = 6.86yrs)

The above graphic shows the performance of TIPS versus the Aggregate Bond index, since the inflationary scare poked its head into the news narrative in late June of 2020. From June 2020 – February 2023, monthly CPI inflation has averaged .5% MoM or 16.4% in aggregate which equates to 5.96% annualized. This is nearly 3x the Fed’s mandate of 2%.

Inflation led to a record Fed tightening cycle, pushing interest rates drastically higher. As we’ve consistently said the last several years, we believe the worst investments to own in an inflationary environment are fixed cash flow vehicles (i.e., bonds but ARKK was worse, lol). During the studied period, the AGG has returned -10.97% total return or -4.14% annualized. Remember this is in NOMINAL terms. In real terms, the numbers are much worse. So, getting to our point, surely inflation-protected securities did well? Relative to fixed bonds you’d be correct BUT in real terms, both were negative returns which might come as a surprise to TIPS investors.

The starting point for buying TIPS matters. Negative real yields detract from the benefit of TIPS. Unfortunately for many TIPS investors, they bought when real yields were deeply negative and in turn breakeven yields the highest.

Components of TIPS

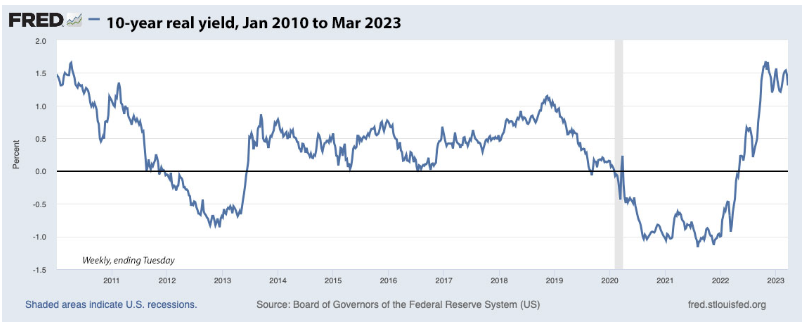

Real Yields

Real yields are calculated as nominal yield less inflation expectations. Real yields can be calculated across the interest rate curve (i.e., 1YR, 3YR, 5YR & 10YR yields). Once the Fed began tightening policy, real yields started shifting higher, breaching positive territory in June of 2022 and have risen significantly since.

Source: Tipswatch.com. As of 3/23/23.

Source: Tipswatch.com. As of 3/23/23.

Breakeven Rates

The breakeven inflation rate is the spread between the yield on a nominal Treasury security and that on a Treasury inflation-protected security (TIPS) of comparable maturity. This is often used as a real-time proxy for market participants’ inflation expectations. Keep in mind, this spread is an imperfect measure, as it contains other components that can drive a wedge between inflation compensation and market participants’ true inflation expectations…as seen post-COVID due to supply and demand dynamics.

Source: Bloomberg. As of 3/31/23.

Source: Bloomberg. As of 3/31/23.

To put the analysis into real terms, currently the 5yr Nominal UST is yielding 3.62%. The 5yr Treasury Inflation-Protected Note is yielding 1.2%. As a reminder, the 1.2% is the “real yield” of the note where the published CPI inflation is then added. While inflation is falling (and expected to continue to fall), the nominal yield on the TIP currently is still north of 6% on a trailing 12 month basis. The breakeven rate on 5yr TIPs is 2.42%. This means that CPI inflation over the next five years needs to be greater than 2.42% for the TIP security to be a better investment versus nominal Treasuries.

How To Think About Breakevens

No one is cheering for higher future inflation, but a higher inflation breakeven rate does indicate that TIPS overall are starting to get “pricey” versus nominal Treasuries. Over the last 10 years, an inflation breakeven rate over 2.5% has proven expensive for TIPS. They usually underperform nominal Treasuries when inflation expectations get very high (unless inflation outshoots expectations), as investors typically anticipate higher inflation that never arrives. This was the case during the 2010-2020 decade of ZIRP and QE.

Structural Issues With TIPS

Fed Ownership of TIPs Following Covid Ballooned

Source: Convexity Maven. As of 12/21/21.

Source: Convexity Maven. As of 12/21/21.

The percent ownership of Treasury Inflation Protected Securities (TIPs) by the Fed jumped from 10% to 26% when they re-started their QE program post-COVID. This created a situation where the Fed purchased more TIPS than the net supply at auction. This action drove the yield on five-year TIPS to a real rate (nominal minus inflation) of negative 1.78%.

Source: Convexity Maven. As of 12/21/21.

Source: Convexity Maven. As of 12/21/21.

Another driver to real negative yields was the significant intervention in markets by the Federal Reserve. Their bond buying spree post Covid drove both nominal yields to very low levels. Due to low nominal yields and rising inflation, real yields got into deeply negative territory especially as inflation began to percolate in late 2021. Remember the real yield is just the nominal yield adjusted for inflation.

To Conclude

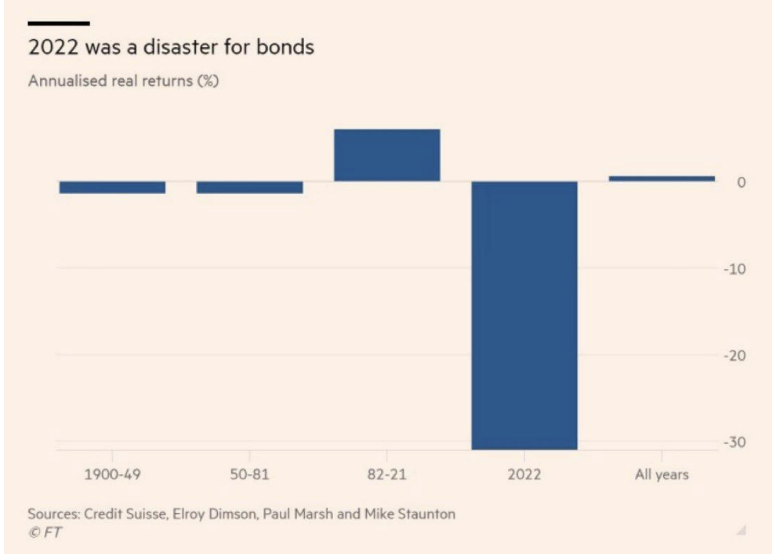

TIPS have been a popular investment vehicle since the COVID stimulus response created an inflation scare of epic proportion (rightfully so). Many investors chased TIPS during the bout of severely negative real yields. But in general, the performance of TIPS was worse than expected due to two misunderstood factors. 1) Investors paid a premium by buying TIPs at negative real yields (i.e., if I buy a TIP with a negative real yield of 1.5%, my return will be inflation less the 1.5% premium I paid) and 2) TIPS do have a duration component, like nominal bonds where their price is negatively impacted by rising rates.

Source: Financial Times. As of 3/31/23.

Source: Financial Times. As of 3/31/23.

While TIPS outperformed nominal bonds the last couple of years, they still failed to keep up with inflation in real terms. This brings us to a bigger point. We continue to believe the results of the preferred asset allocation (60/40) of the last 40 years isn’t likely to be replicated in the next 10 years.

While there are innovative ideas to improve portfolios incrementally, like TIPS, the net performance was still below inflation. We believe other assets like volatility and enhanced yield via options premium will be more effective in improving investor outcomes.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2304-5.