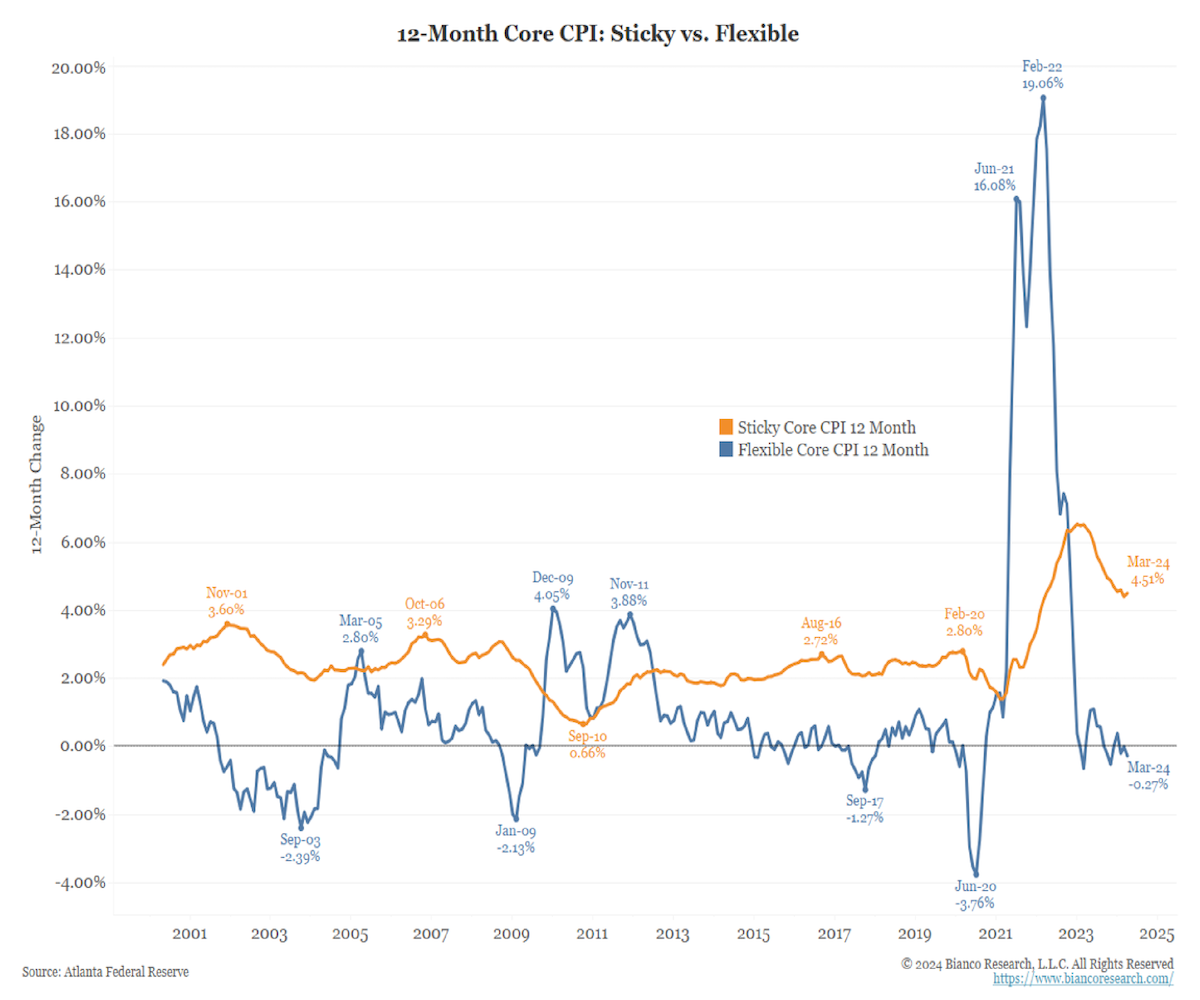

The flexible components of core CPI have been in deflationary territory over the past year (blue line in the chart below). The stickier components of core CPI, however, are still running well above their pre-pandemic average (orange line).

Source: Bianco as of 04.21.2024

Source: Bianco as of 04.21.2024

Shelter costs have proven to be the biggest stumbling block in taming U.S. inflation. OER (Owners’ Equivalent Rent) and RPR (Rent of Primary Residence) make up almost half of the sticky price index. Given that flexible components of inflation are already back near historical norms it appears they will be hard-pressed to provide additional tailwinds for lower inflation. It is the sticky components, namely shelter, that will need to do the heavy lifting from here on out.

One Man’s Interest Expense is Another Man’s Interest Income

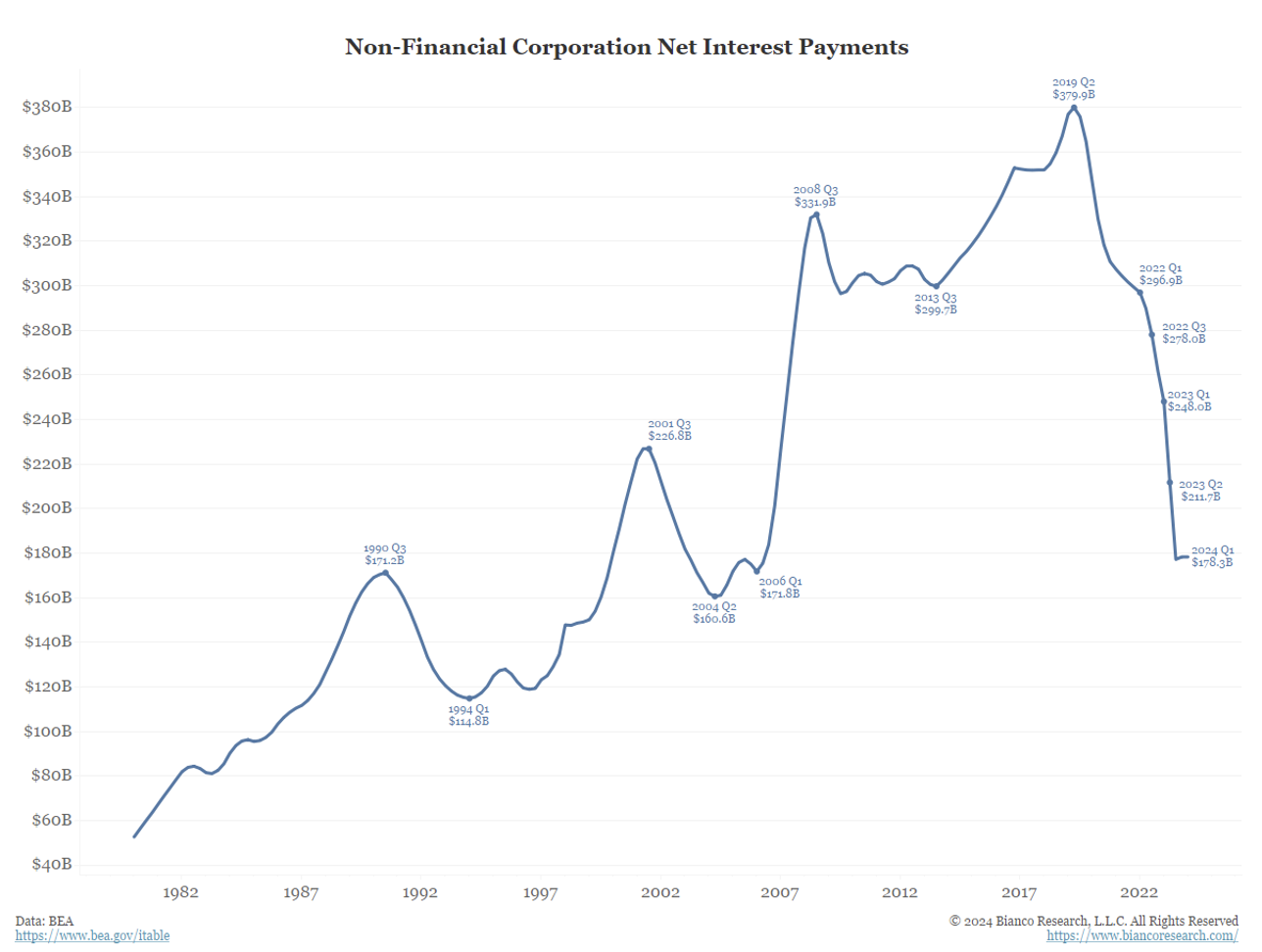

The graphic below shows the total non-financial corporations’ “net” interest expense since 1980. Interest expense rose in the zero-interest rate period after the 2008 financial crisis where it peaked at $379.9 billion in Q2 2020.

Source: Bianco as of 04.22.2024

Source: Bianco as of 04.22.2024

Since rates started rising, and significantly since Q2 2022 (when the Fed started hiking), net interest expenses have plummeted to $178 billion, the lowest level since 2006.

Many corporations played the system, raising debt while interest rates were low and sitting on massive cash as rates rose. Maybe cash at 5% isn’t trash, especially if you have all your fixed-rate debt termed out at below-market levels.

No Cuts in 2024 is Gaining Traction

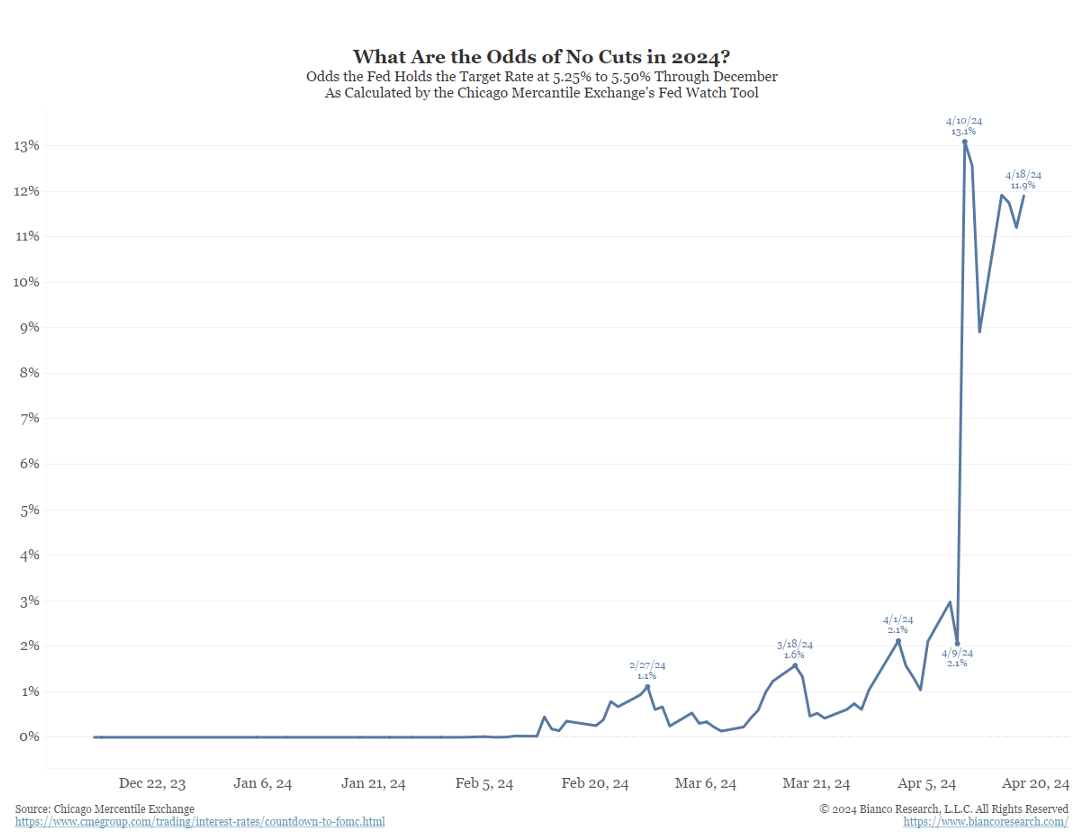

Just 4 months ago the market was expecting 6+ cuts in 2024. As we approach May, not only have we seen zero rate cuts, but we’ve experienced a firming of inflation and a return of the “higher for longer” chatter.

Source: Bianco as of 04.23.2024

Source: Bianco as of 04.23.2024

We were vocal in our call for fewer cuts than the market was pricing earlier this year. There simply was not time for enough bad data to prompt the Fed to cut as aggressively as the market hoped.

As we stand now, the idea of no cuts in 2024 is gaining steam. We are currently sitting at about a 12% chance for zero rate cuts this year. If the data (growth and inflation) continues to surprise toward the upside, we expect the chance of no rate cuts to push higher.

Long-Duration Treasuries Exhibiting Similar Volatility to Equities

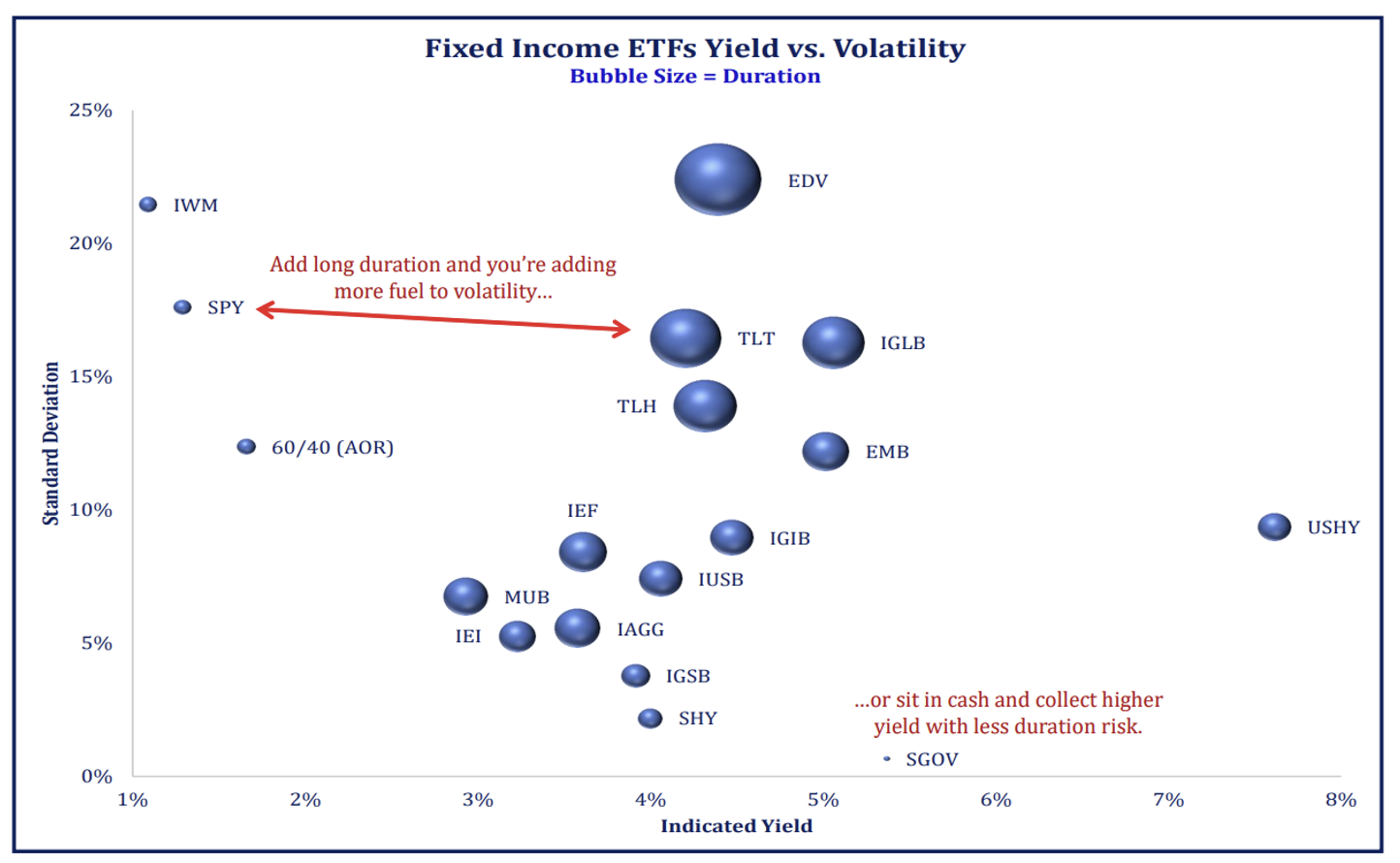

Adding a long-duration exposure, such as TLT (20+ Year Treasury Bond ETF), adds a very similar volatility profile to large-cap equities.

Source: Strategas as of 04.23.2024

Source: Strategas as of 04.23.2024

While the label reads “Treasuries”, the (duration) risks embedded have been severe. On the other hand, cash-like ETFs continue to yield more with no volatility effect.

Longevity Risk in Real Time

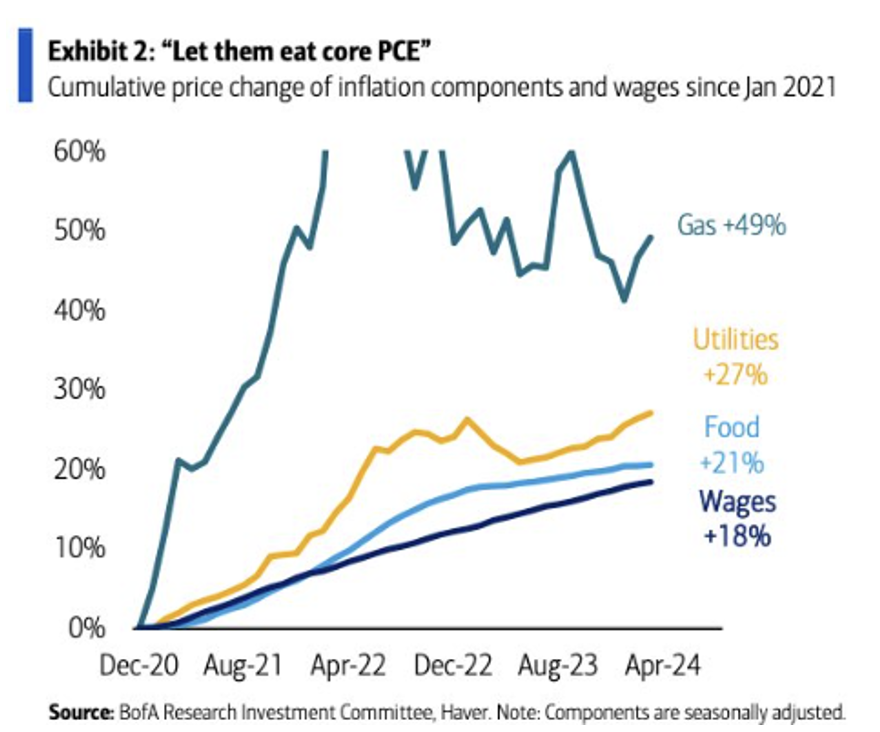

We spend A LOT of time talking about the impacts of real returns when we communicate our investment philosophy. Longevity risk is the silent killer to long long-term financial plans, where costs of living can slowly but surely erode client lifestyles. We tend to also argue that government inflation data understates the real cost of living (purposefully).

Over the past 3+ years, we’ve seen a real-world demonstration of inflation effects on the common person where living costs have exceeded income growth.

Source: BAML as of 04.18.2024

Source: BAML as of 04.18.2024

While inflation has calmed to closer to 3% growth year over year, the total price level for the last 3+ years has risen drastically. We caution clients from getting sucked into “T-bill and Chill” mode as we believe it will be imperative to lean into higher equity allocations looking forward to “keeping up” with the increase in the overall price level. The next graphic further proves the point, in our opinion.

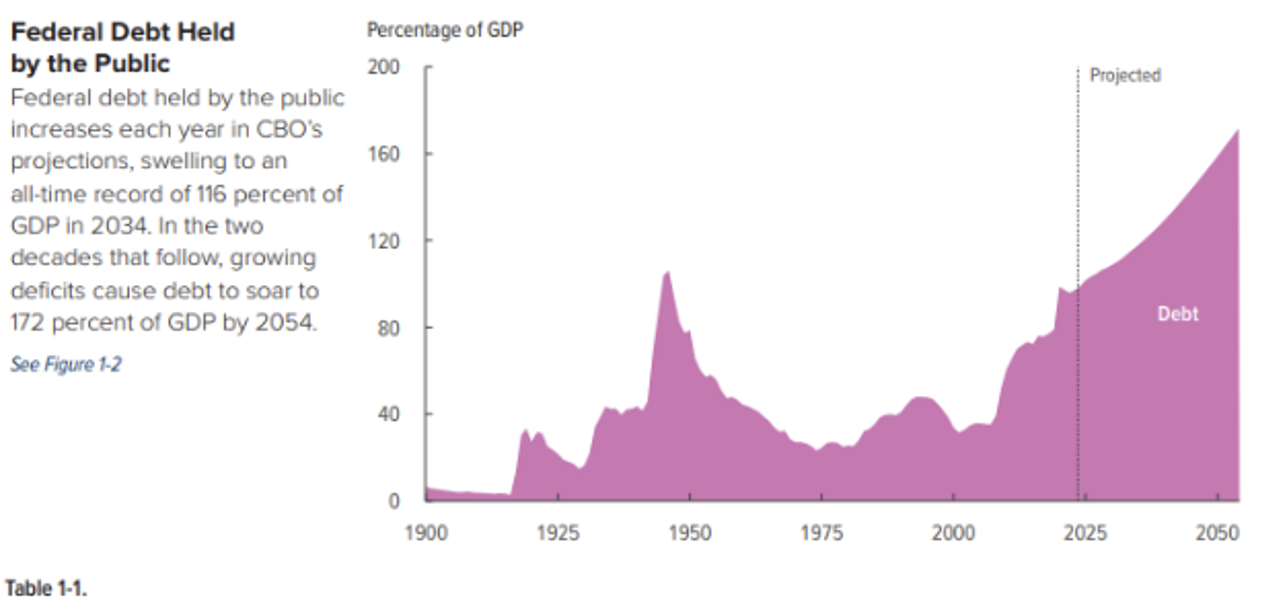

Projected Debt on the Up and Up

The Congressional Budget Office estimates that there will be $20 trillion worth of cumulative fiscal deficits over the next decade. Further, they assume that interest rates will be lower than they are currently and that no recessions will occur.

Source: CBO as of 04.23.2024

Source: CBO as of 04.23.2024

If interest rates are higher than their expectations, or recessions occur within the next decade, then that $20 trillion estimate is likely to be exceeded. Running 5% fiscal deficits into perpetuity will only reinforce the need to alter asset allocations to adapt to the new regime.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies, and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2404-30.