US inflation topped forecasts for a third straight month. Both the Core and the Headline consumer price index increased 0.4% from February.

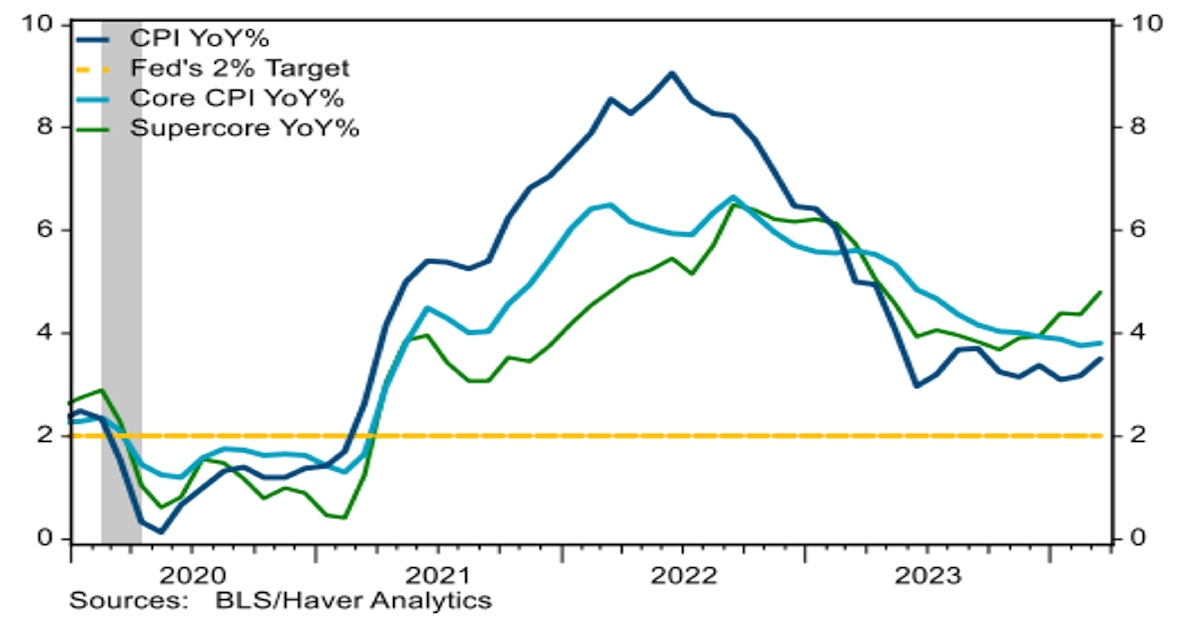

Source: Stifel as of 04.10.2024

Source: Stifel as of 04.10.2024

March CPI:

- Headline: +0.4% (Exp: +0.3%)

- Core: +0.4% (Exp: +0.3%)

YoY:

- Headline: +3.5% (Exp: +3.4%)

- Core: +3.8% (Exp: +3.7%)

From a year ago, Core CPI advanced 3.8%, holding steady from the prior month. Supercore inflation (services ex-energy and housing), closely watched by the Fed, rose for a fifth straight month.

Market Response

After the report, the curve saw rates pop over 20bps, with the 10-yr Treasury settling near 4.55%. Equity markets struggled as they priced in fewer rate cuts and the impact of a higher 10-yr Treasury rate. Stock-bond correlation was firmly positive, negatively impacting traditional asset allocations.

Problematic Supercore CPI Acceleration

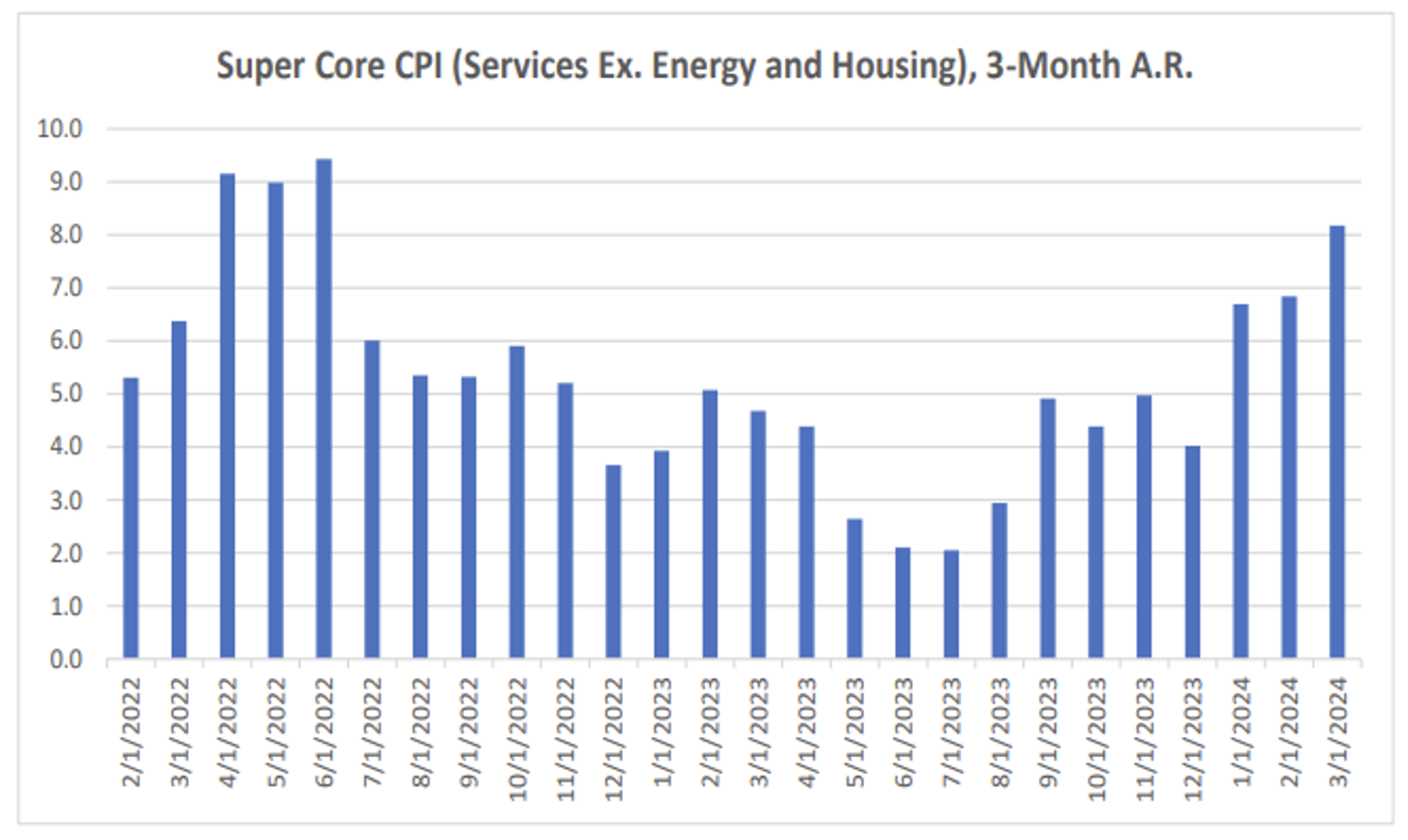

The “Supercore” inflation metric was created by the Bureau of Labor Statistics (BLS) at the behest of the Fed, to try and glean the potential “passthrough” from the labor market into inflation given the noise from supply-side disturbances (both positive and negative). After the so-called Supercore inflation fell to 2.1% for several months last summer, the three-month growth of Supercore CPI is now up to a rate of 8.2% annualized rate in March.

Source: MKM as of 04.10.2024

Source: MKM as of 04.10.2024

This is the highest reading since the summer of 2022 which was right around the time the Fed began to lift short rates in 75 bps increments. The trend is uncomfortably higher.

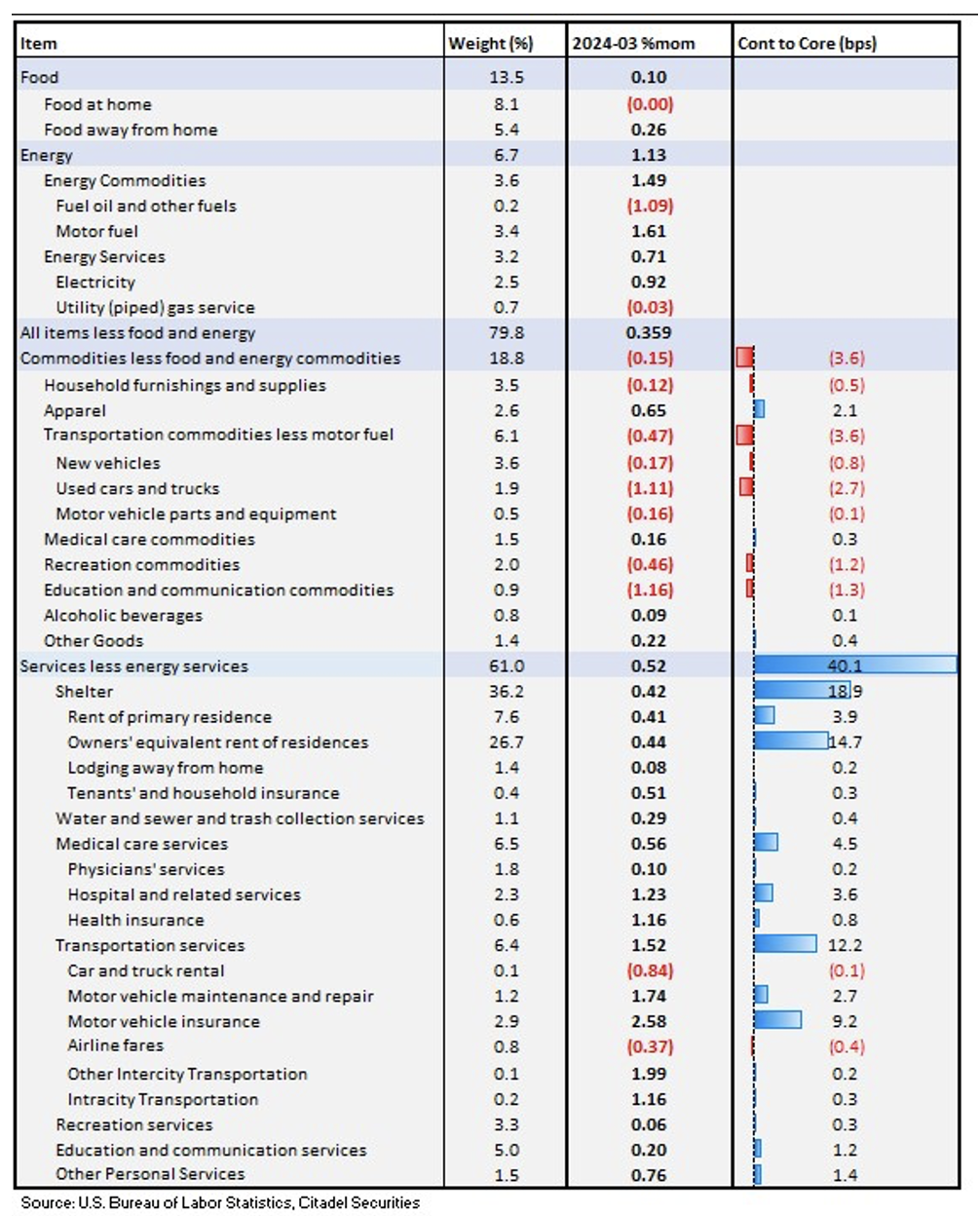

Core Inflation Components

Notables:

- Funeral services rose 1.5% M/M (actual, not annualized)

- Hospital services rose 1% M/M with healthcare services firmer than expected

- Transportation prices were firm, with auto repair and insurance jumping 1.7% and 2.6%, respectively

- Shelter came in as expected at 0.4%

Source: Citadel as of 04.10.2024

Source: Citadel as of 04.10.2024

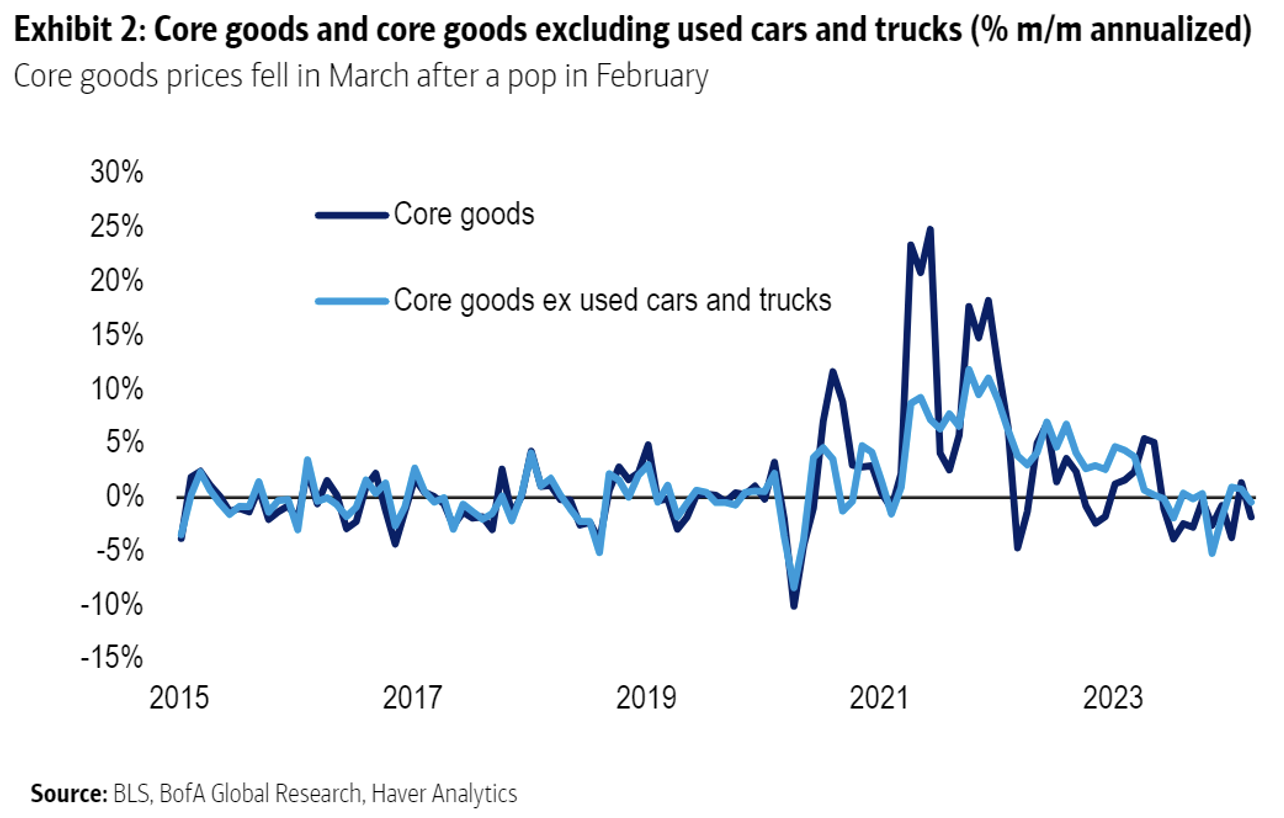

Silver Lining…Goods Inflation Continues to Trend Lower

Core goods prices declined -0.15% M/M in March. We think this shows a mix of softening consumer demand (although arguably spending has just pivoted to services) and improving supply chains.

Source: BAML as of 04.10.2024

Source: BAML as of 04.10.2024

It does appear Core Goods can continue to help push the disinflation story a bit further.

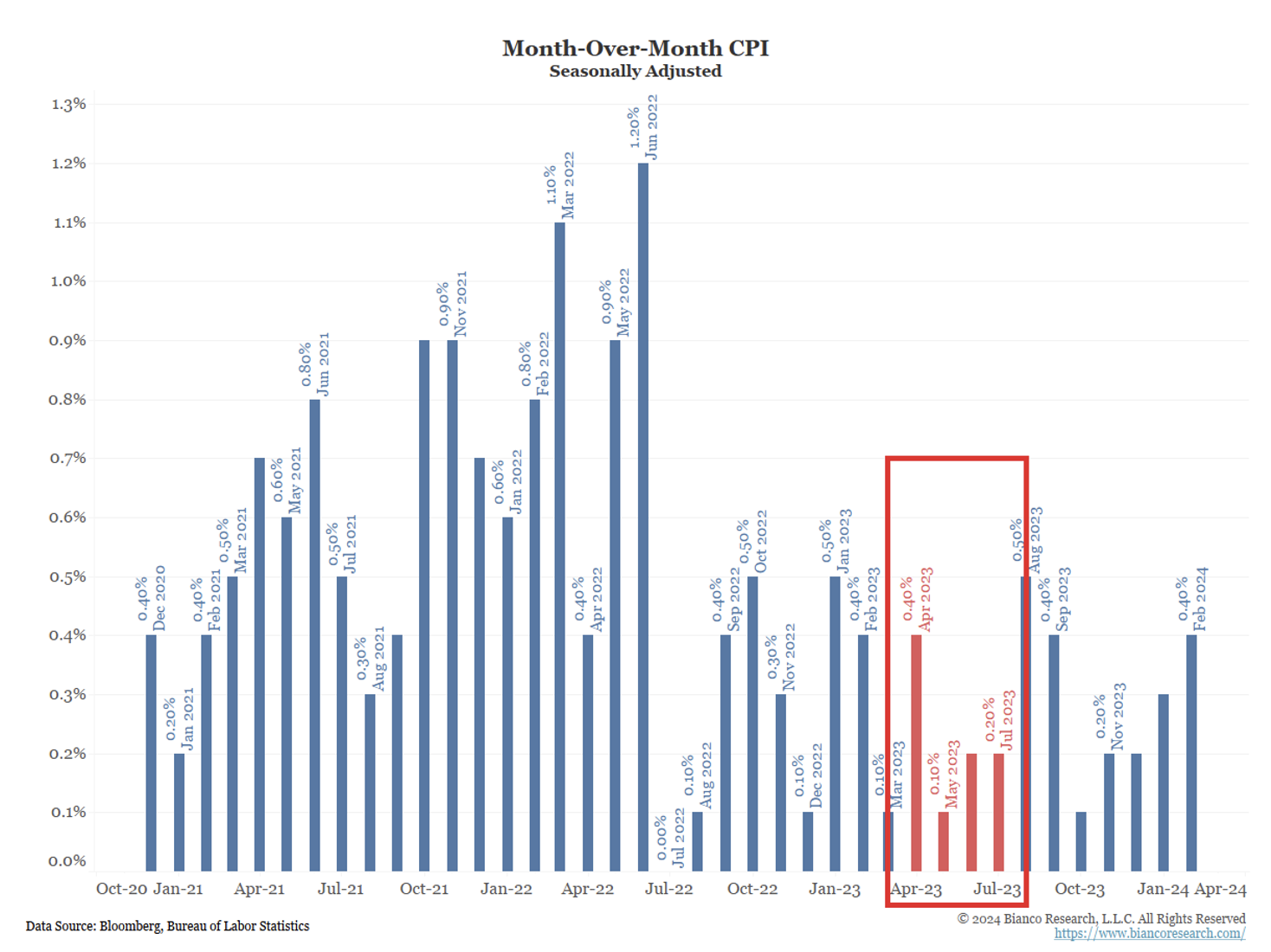

Looking Ahead

The inflation comps in three of the next four months will be replacing low month-over-month growth rates from a year ago (red box in the graph below). As of now, the Cleveland Fed’s CPI Nowcast puts April’s month-over-month headline CPI growth at 0.34%. This would replace the 0.40% monthly growth rate from April 2023, meaning year-over-year inflation might decline a bit. May through July bring trickier Y/Y comps.

Source: Bianco as of 04.10.2024

Source: Bianco as of 04.10.2024

Buckle up for the next several months, as we believe the market will continue to price a higher likelihood of no cuts in 2024 given the continued strength of the data (both economic and inflation).

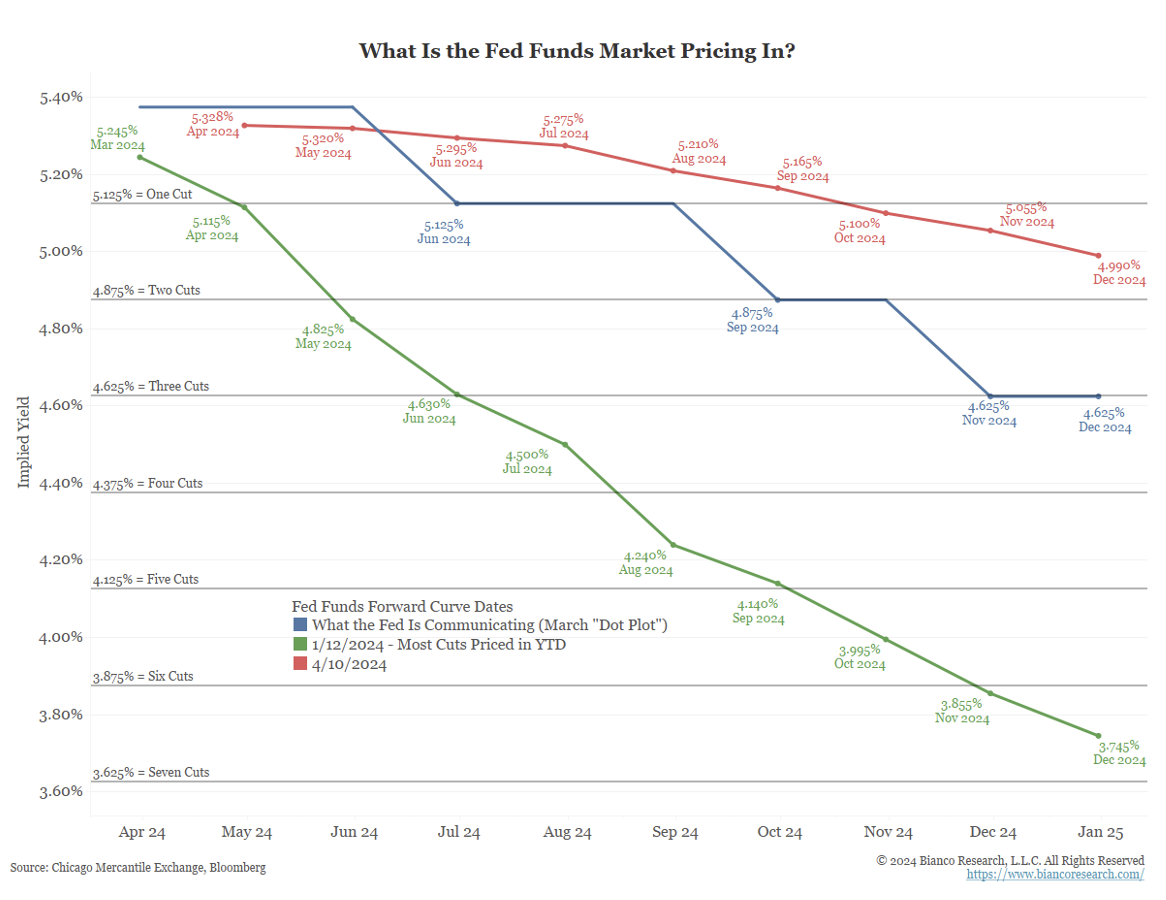

What’s the Market Pricing?

The odds of a rate cut at or before the Fed’s June and July meetings slumped to 22% and 50%, respectively. Currently, futures imply just 47 bps of easing this year (< 2 cuts).

Source: Bianco as of 04.10.2024

Source: Bianco as of 04.10.2024

The market is now pricing rates to remain comfortably above the Fed’s recently communicated March DOT plot. Just 4 months ago the market was pricing in >6 rate cuts in 2024…boy, have the times changed!

Bottom Line

We see the current biggest risk to be that the Fed didn’t raise rates high enough to break inflation, which could allow price pressures to become embedded into the economy. We don’t see the risk of too much tightening, as the Fed can always quickly reverse course if needed.

Based on the data, the Fed just doesn’t have the justification to ease policy, given easy financial conditions and hot Supercore inflation. It would take a major financial disruption, or a material deterioration in labor market conditions (i.e., a more decisive rise in the unemployment rate and a material fall off in payroll growth).

Ultimately, we don’t believe there is a return to 2% inflation without markedly slower growth, no matter the read on any single month’s inflation data.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2404-22.