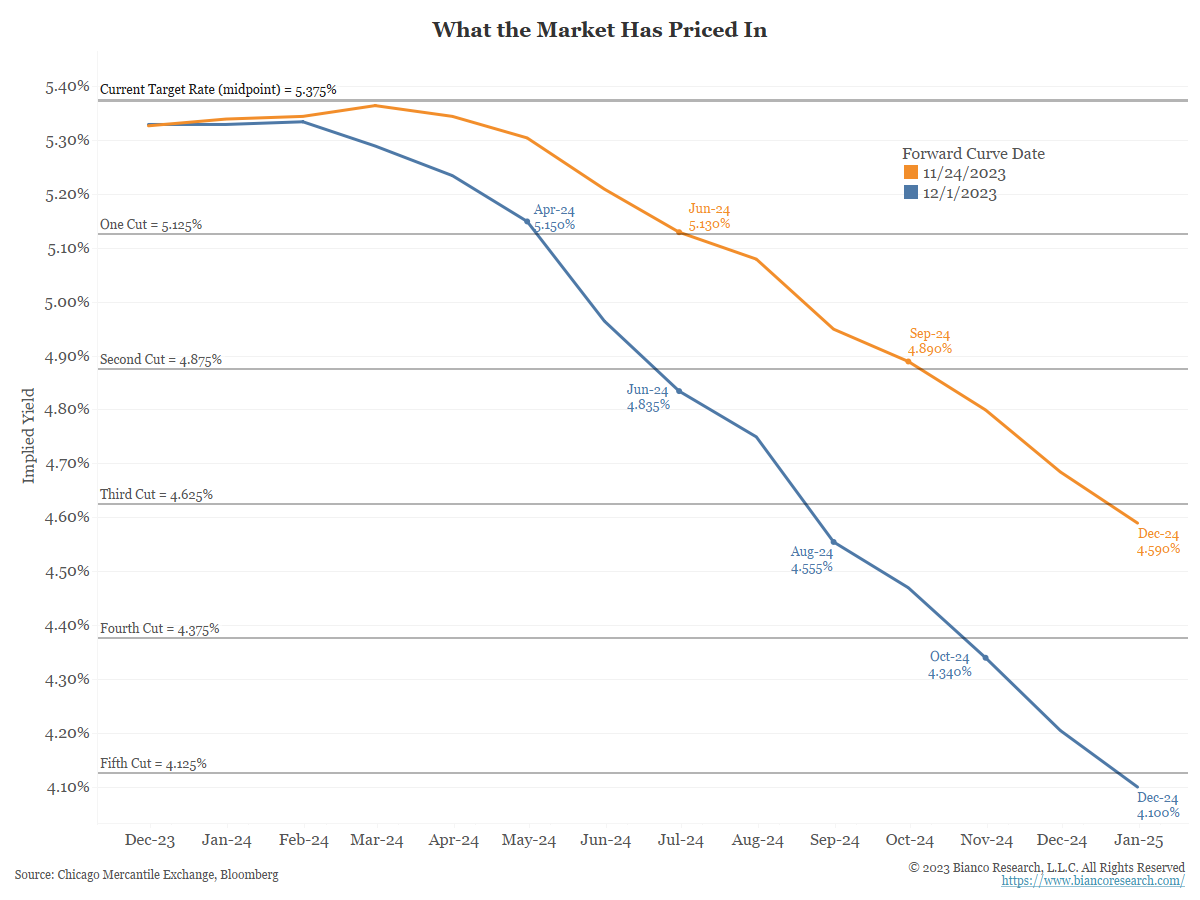

Fed expectations moved drastically last week. On Friday, November 24, markets were pricing in three cuts in 2024, with the first in June (orange). By Friday, December 1, the market was pricing in five cuts in 2024, starting around April (blue).

Source: Bianco as of 12.04.2023

Source: Bianco as of 12.04.2023

Markets have run with comments from Fed Governor Waller where he stated, “If the decline in inflation continues for several more months … three months, four months, five months … we could start lowering the policy rate just because inflation is lower (which leads to unnecessarily high real yields),” he said. “It has nothing to do with trying to save the economy. It is consistent with every policy rule. There is no reason to say we will keep it really high.”

In some ways, it does appear that “immaculate disinflation” was a reality in the US. Thus far, we’ve seen CPI rates are back near the Fed’s target, even without serious destruction in the labor market. Markets rose substantially in November in response to the good news.

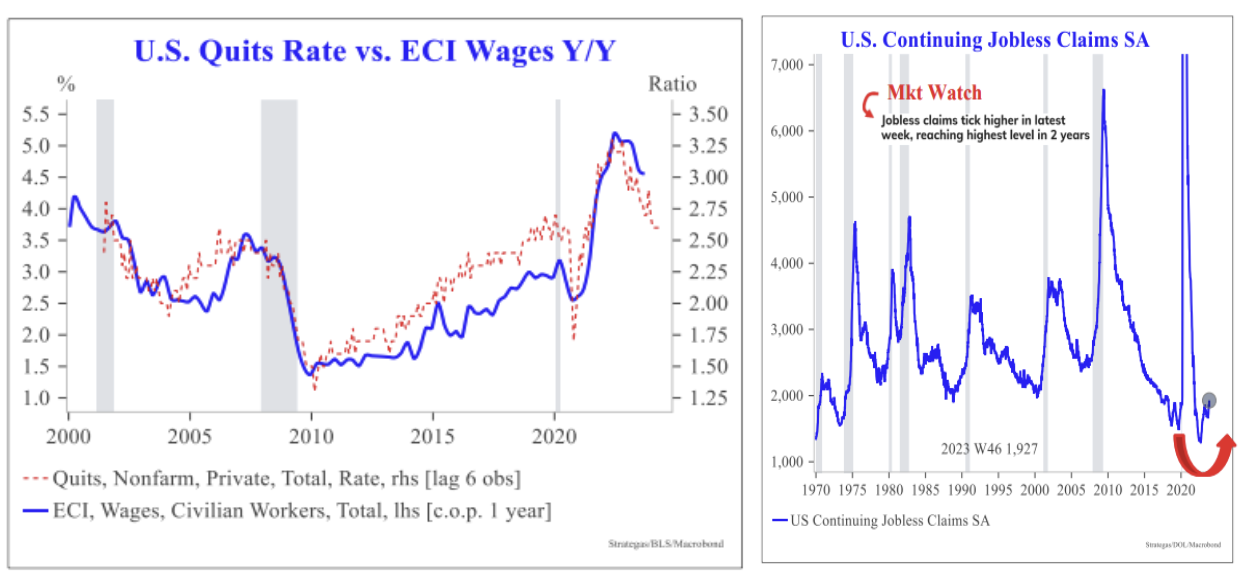

Update on the Jobs Market

U.S. job openings declined sharply in Oct, falling to 8.7 million. The quits rate (voluntary separations) held at 2.3%, the same level as seen in late 2019. Labor demand is still above labor supply (i.e., the job market is still tight).

Source: Strategas as of 12.06.2023

Source: Strategas as of 12.06.2023

However, recent U.S. labor data is showing some signs of cracks. Jobs are becoming harder to get, continuing jobless claims are rising, the workweek is declining, temporary employment is falling, unemployment & under-employment is ticking higher, and the payroll diffusion index slipping.

The quits rate in the Job Openings & Labor Turnover Survey (JOLTS) indicates that the U.S. labor market has been cooling off. This data tends to lead the Employment Cost Index (ECI) for wages Y/Y by roughly 6 months, which points to a continued slowdown into 2024. Bottom line, recent data reinforces the Fed pause.

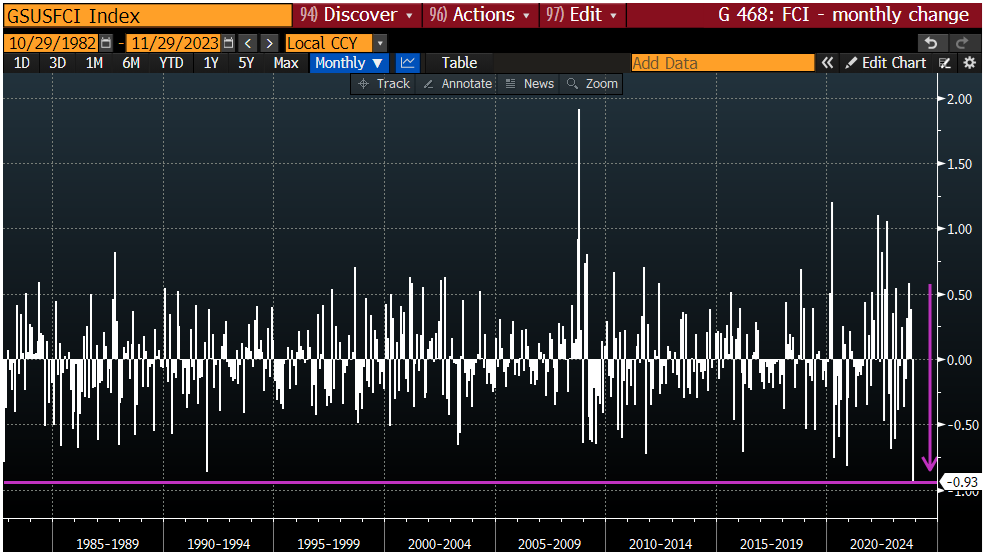

BIG Move in 10s: Overdone or Is the New Trend Lower?

The move to lower rates has been swift. There has been somewhat of a perfect storm of data and circumstance which has led to a large duration rally in bonds.

Source: Strategas as of 12.06.2023

Source: Strategas as of 12.06.2023

While the lower rate trend could continue, it does seem potentially overdone. We’d caution as highlighted in the chart above that “we’ve seen this happen before”.

Financial Conditions Ease Big in November

According to the Goldman Sachs Financial Conditions Index, the month of November saw the largest easing in US financial conditions of any single month in the past four decades.

Source: Bloomberg as of 12.04.2023

Source: Bloomberg as of 12.04.2023

The question remains whether this easing will spur new repercussions on the inflation front that cause the Fed to crank back up their hawkish speak.

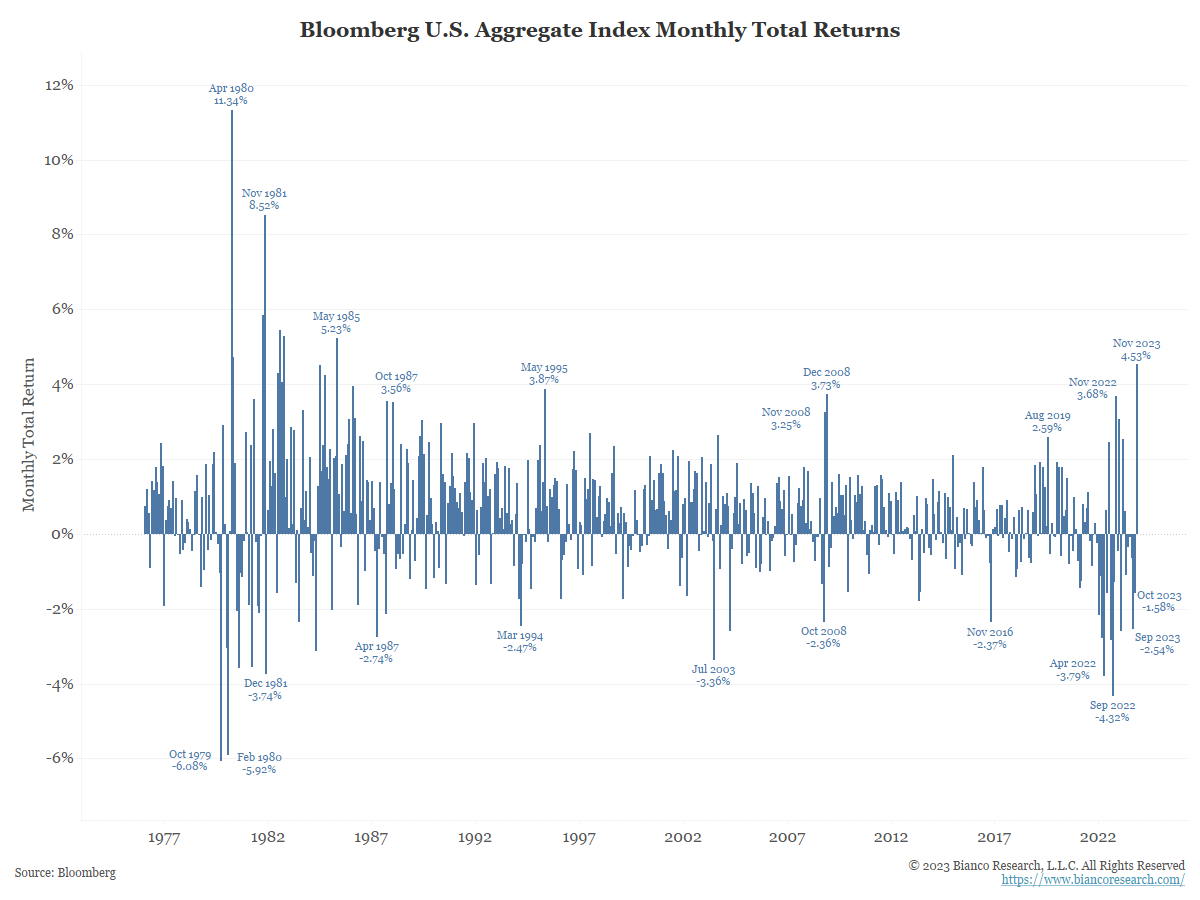

November Was an Incredible Month for Bonds

November proved to be one of the best months for the bond market on record. As the chart below shows, Bloomberg’s U.S. Aggregate Index posted a total return of 4.53% in November, its best month since May 1985.

Source: Bianco as of 12.04.2023

Source: Bianco as of 12.04.2023

A key question for fixed-income investors is whether the market has already moved ahead of itself. The bond rally has been breathtaking as the market moved very quickly to discount about 130 basis points of rate cuts in 2024.

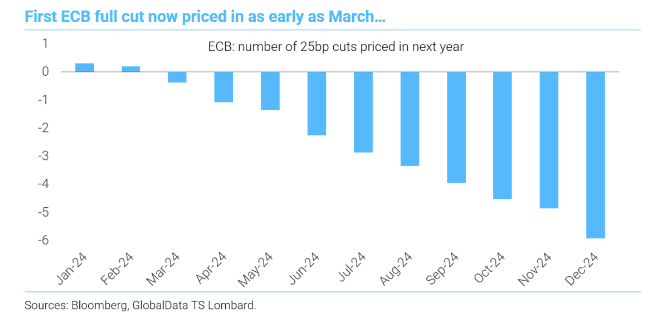

European Markets are Aggressively Pricing in Rate Cuts as Well

Isabel Schnabel, a notable hawkish European Central Bank (ECB) policymaker, had an interview earlier this week that pointed to rate cuts:

“The November flash release was a very pleasant surprise. Most importantly, underlying inflation, which has proven more stubborn, is now also falling more quickly than we had expected. This is quite remarkable”.

Source: TS Lombard. As of 12.062023

Source: TS Lombard. As of 12.062023

She also reluctantly admitted that a further rate increase is “rather unlikely” – the closest a hawk can get to saying that the debate now is about the timing and magnitude of rate cuts. In response, STIR traders fully priced in the first ECB cut as early as March and a hefty 150bps worth of cumulative cuts next year. As could be expected, the Euro edged lower.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-11.