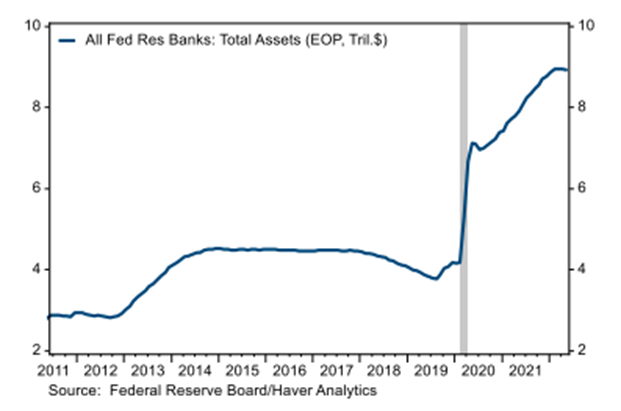

We are beginning a new regime as the Fed moves to reduce the size of its balance sheet which has grown to nearly $9 Trillion. Since March 2020, the Fed has made more than $4T in bond purchases. Now, to fight inflation, the Fed will begin to let some of their bonds mature (without replacing them). According to the central bank, roll offs will ramp up to $95 billion in September including a $60 billion reduction in U.S. Treasuries (“UST”) and a $35 billion reduction in Mortgage-Backed Securities (“MBS”). The first three months, however, will begin at half that pace, $47.5 billion, comprised of $30 billion UST and $17.5 billion MBS. That compares to a peak roll off of $50 billion a month when the Fed performed the exercise starting back in 2017.

Source: Haver Analytics. As of 5/31/22

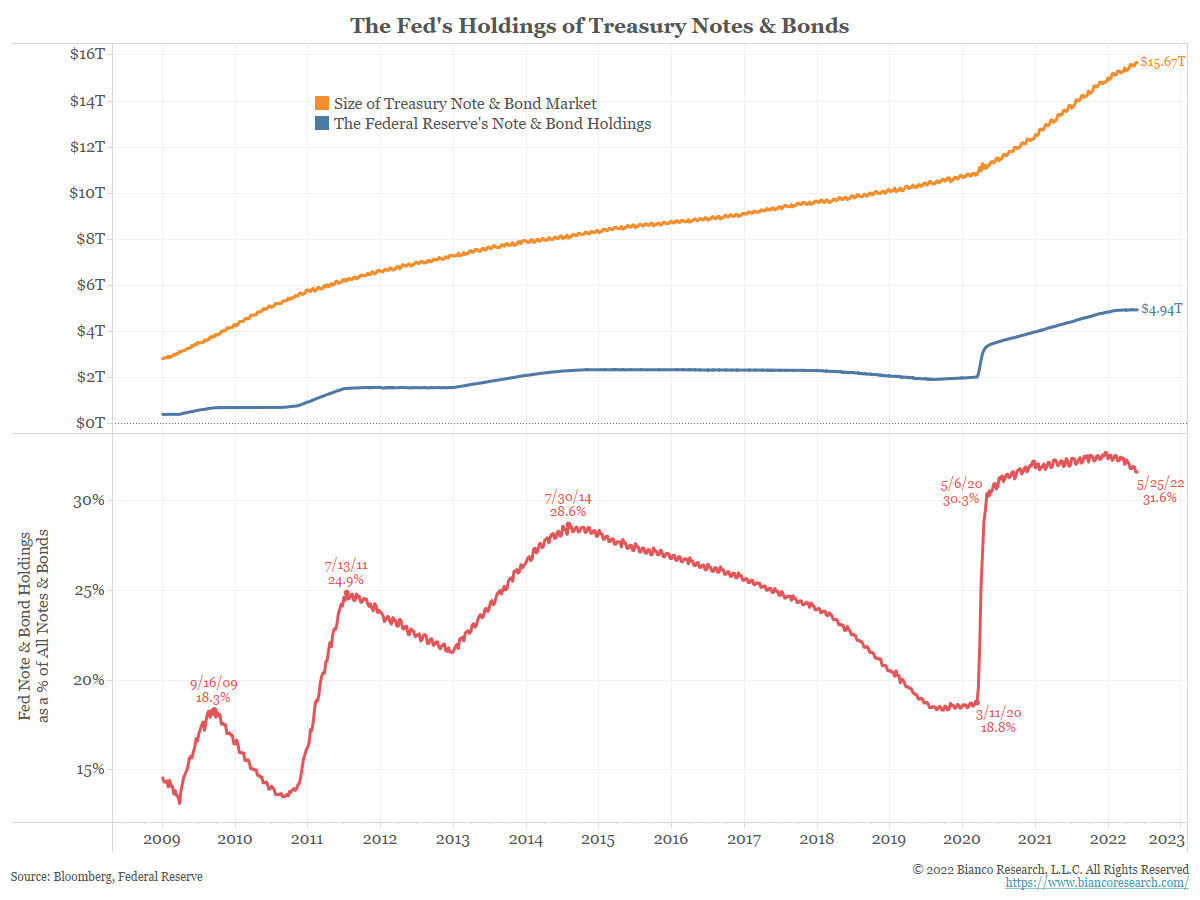

The Fed Owns A LOT of the Treasury Market (& MBS Market)

The Fed has expanded its balance sheet from essentially zero to $8.39T since pre GFC. This means they own roughly 30% of the U.S. bond market (excluding Corporates and High Yields). Drilling down specifically to notes and bonds, the Fed owns about 32% of the market. On top of that, they own ~36% of the MBS market. These are approximations based on Bloomberg’s universe of bonds and MBS (from Jim Bianco, president of Bianco Research), but most figures we’ve seen are in the ballpark.

Source: Bianco Research. As of 06/1/22.

Source: Bianco Research. As of 06/1/22.

The Market Knows QT is Coming

The process of quantitative tightening, or QT, has been widely anticipated by the market as it has been well telegraphed (it was officially announced back in May). The balance sheet drawdown comes at a time when the Treasury market is already grappling with heightened levels of volatility and lower-than-average liquidity. Thus, the impact of QT may not yet be fully priced in as implementing QT + aggressive interest rate hikes brings us into uncharted waters.

Source: Bloomberg LP. As of 06/01/22.

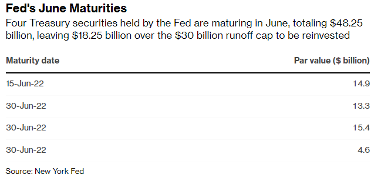

Also, keep in mind, that while June 1 was the announced start date to the process, the first Treasury coupons that mature are on June 15, so the balance sheet won’t actually shrink until then, which could delay any type of market response a couple weeks. Shown above are the balance sheet maturities for the month of June.

Source: Pavilion. As of 5/31/22.

What are the Implications of QT?

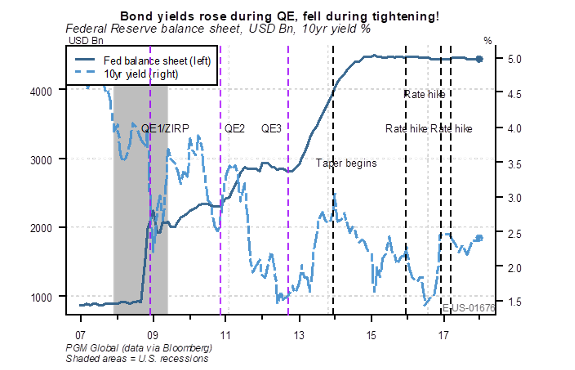

Although it is not intuitive (and even paradoxical), there is substantial evidence in the data showing support for bond prices when the Fed reduces their bonds holdings, i.e., reduce their balance sheet. It all comes back to the perceived effect on economic growth in the context of employment dynamics and the impact on inflation via the Phillips Curve. In saying that, while QT has been supportive of bond prices in the past, there is limited historical precedence but also a 40-year high inflation environment. This time might be a bit different…

Aptus Take

The Fed has well messaged their intention to hike interest rates and reduce their balance sheet to attempt to tamp down inflation. It appears to us that a 50 bps hike in both June and July are all but certain. These moves would hike the Fed Funds rates to 1.75-2%, which happens to be the same level we were at coming into Covid in March of 2020. The market (and us here at Aptus) are continuing to watch carefully on how much further (with rate hikes) the Fed is willing or forced to go to combat inflation. On top of rate hikes, balance sheet reduction should help serve as a liquidity drain for markets which should help curtail speculation and excessive demand. While I believe the balance sheet is not likely to get down to the pre-Covid levels anytime soon (~$4 Trillion), I do think the Fed will be forced to stick to their script and remove the accommodation.

Bottom line

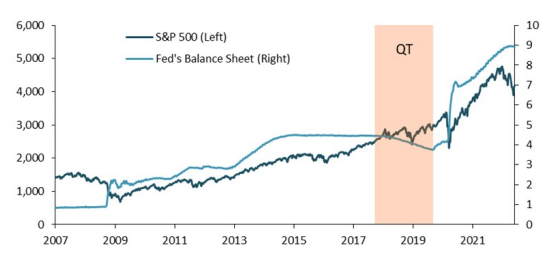

If there are any market effects from QT (if any) they should manifest themselves on auction days—that’s when the supply of securities available to the public increases due to a lack of Fed reinvestments. There haven’t been any auctions yet this month, so yields cannot have changed because of QT (thus far). We don’t expect Treasury yields to be drastically impacted by the flow of QT as it’s so well known by the market and pricing is already incorporated into yields. In other words, yields have already moved because of QT and from now on out they will move for other reasons unless the Fed changes the pace of their QT. Similar logic should apply to the stock market. In fact, the chart below shows that stock prices went up on net during the last QT regime from 2017 to 2019. There were periods of substantial volatility, but we believe those were due to fear about the Fed over hiking rather than fears about the balance sheet (e.g., the sharp stock market decline in the fall of 2018 was associated with Powell’s statement that the Fed will raise rates well above neutral). We will continue to look towards the outlook for rates, rather than QT, as the bigger catalyst of market moves.

Source: PSC. As of 6/3/22

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2206-4.