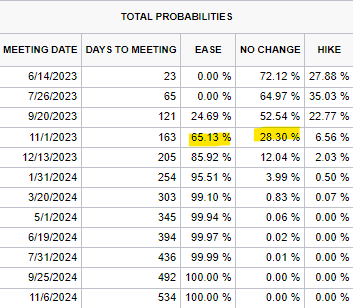

Not too long ago, markets were pricing potential for a rate cut at the July meeting. That has been pushed out to November as the “hold-and-see” narrative takes over from the hiking rates narrative as the data continues to hold up stronger than expected.

Source: CME as of 05.22.2023

Source: CME as of 05.22.2023

Remember virtually everyone has been calling for an “imminent” recession since last October. Kind of like calling inflation transitory for 12+ months…bottom line is we still think higher for longer is more likely than markets expect.

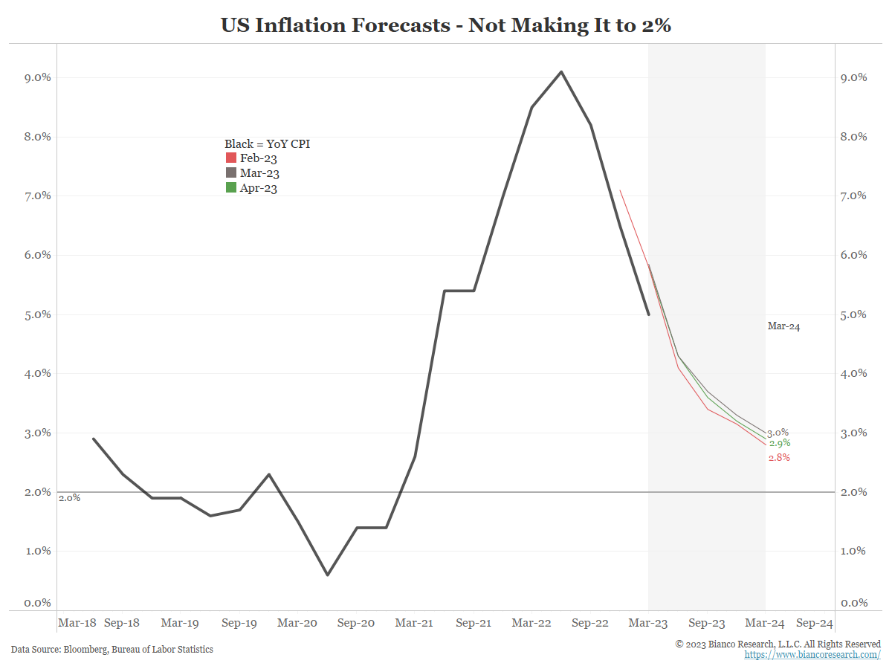

Inflation Target Moving?

The belief that the Fed will be able to reign inflation back to their 2% target is becoming more suspect to the market.

Source: Bianco as of 05.22.2023

Source: Bianco as of 05.22.2023

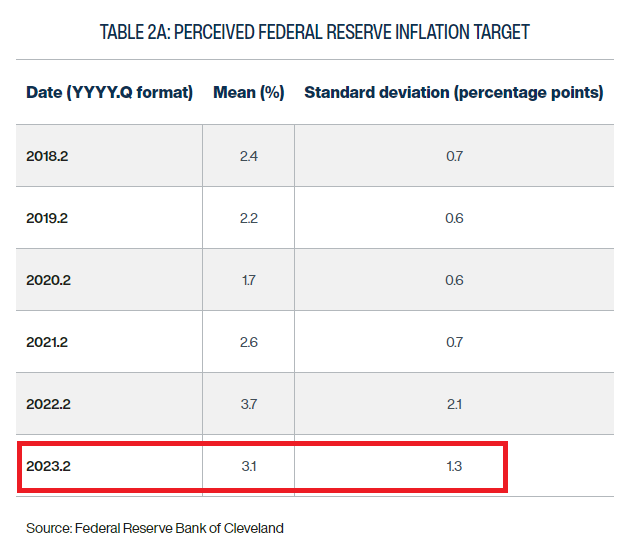

In fact, the Cleveland Fed’s survey on the inflation expectations of corporate executives indicates that CEOs are beginning to think Fed has moved its inflation target up to 3%. Note in the table below that the inflation expectations are both above target and have doubled in standard deviation relative to their pre-Covid average.

Source: Cleveland Fed as of 05.22.2023

Source: Cleveland Fed as of 05.22.2023

BUT if you were to ask a Fed official whether inflation above 3% is acceptable over the medium term, and they would respond “definitely not” (target is 2%, period). For the talk of killing inflation, central banks seem eager to halt their tightening cycles – even with inflation stubbornly above their targets.

VanEck compiled some interesting data stating that since 1960, it has taken 12 years on average for inflation to slow to 2% or lower once the US consumer price index has breached 5%… time will tell if that’s the case this time.

Inflation volatility and uncertainty are a situation the Fed wants to avoid. Jay Powell has said this repeatedly the last couple years. The longer inflation stays elevated, the better chance it has of becoming entrenched.

In addition, higher inflation would continue to turn bonds into certificates of confiscation where inflation eats into real returns as we’ve now seen in the last 10 years… this brings us to our next point.

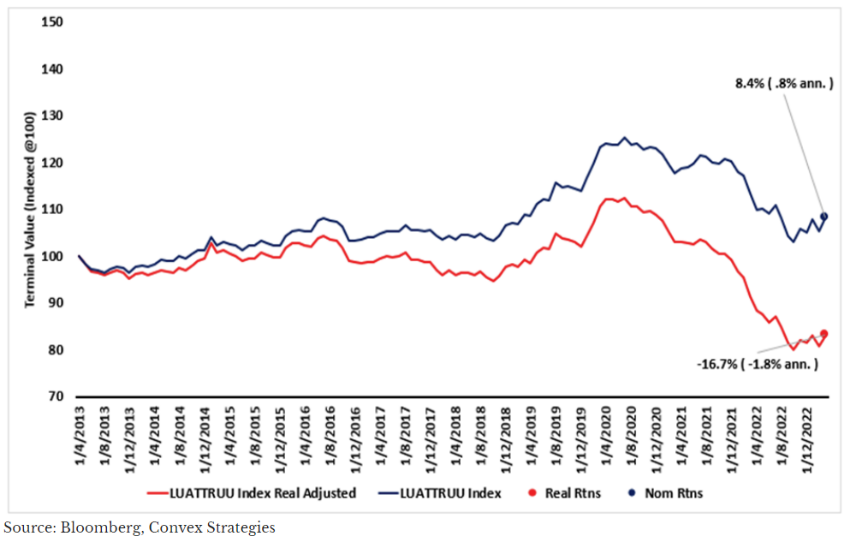

Certificates of Confiscation (i.e., Treasury bonds)

As we’ve said repeatedly in the last several years, the fixed income environment we’ve experienced has not been the historic norm. Many investors have been deceived into believing bonds are a safe haven asset class. We saw an interesting analysis by David Dredge which evaluated how bond holdings have fared from an investment perspective over the last 10 years.

US Treasury Total Return Index Nominal (black) and Real (red): Apr 2013 – Mar 2023

Source: Convex Strategies as of 05.23.2023

Source: Convex Strategies as of 05.23.2023

Not particularly well, particularly when looked at on a real return basis. The chart shows the respective Total Return Bond index that has been deflated with the CPI index. In fact, Treasuries in real terms have been an awful investment.

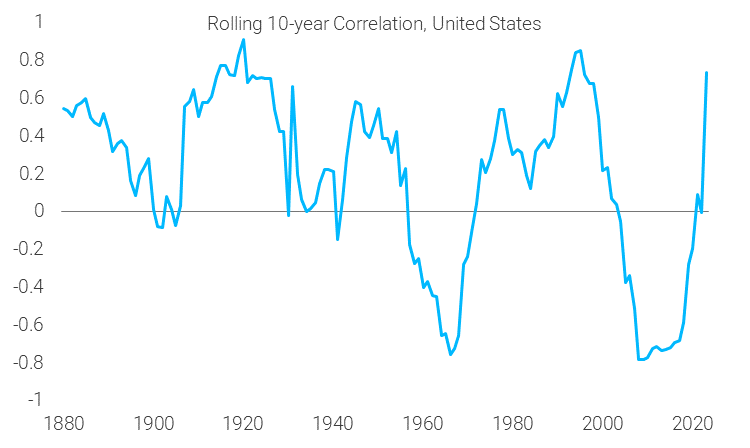

Tack on to that positive correlation with equities and it begs the question as to whether long duration bonds can be a reliable “safety” holding within portfolio construction.

Source: TS Lombard as of 05.15.2023

Source: TS Lombard as of 05.15.2023

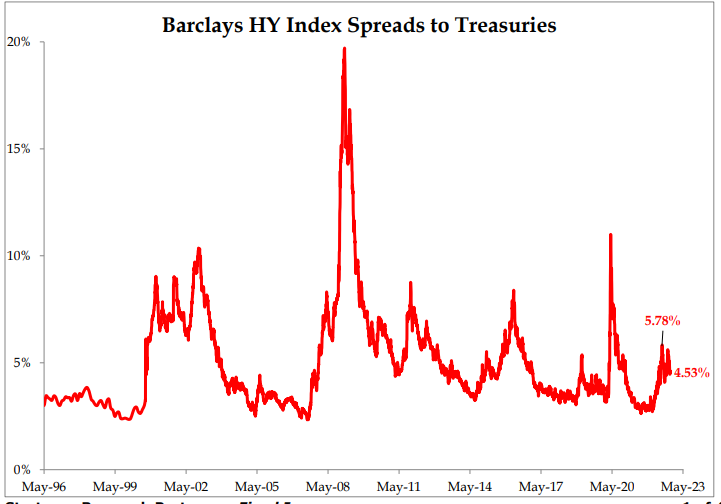

High Yield Spreads Still Tight!

Given where we are in the cycle and the likely implication for less creditworthy borrowers from both a weaker economy and higher interest rates, credit spreads have remained resilient. We believe that high yield investors are baking too much impact from the increase in risk-free yields into overall nominal yields, while forgetting there are risks embedded within junk bonds.

Source: Strategas as of 05.23.2023

Source: Strategas as of 05.23.2023

Thus far, the consumer remains strong and corporate pricing power remains strong. And liquidity remains fruitful, given the Treasury injections (via the TGA drawdown) as well as the Fed’s plethora of emergency facilities, which are all working to tighten credit spreads. Given the likelihood of rising defaults both this year and in years to come, we would not be surprised to see high-yield spreads blow out into any risk asset weakness.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2305-28.