We group portfolio risk into two categories:

- Longevity Risk

- Drawdown Risk (A form of volatility risk)

Risk #2 dominates the minds of most advisors and clients we speak with.

Behaviorally, most of us have an aversion to losses. Mathematically, large drawdowns are disruptive to long-term compounded rates of return.

We talk more about the importance of minimizing drawdown here: Volatility Tax

What keeps us up at night are the unseen consequences of moves to safety. These moves can open the door to the real problem – longevity risk.

Before we go any further, let’s define longevity risk and set the stage.

Longevity risk is realized when compounded returns aren’t sufficient to accomplish desired outcomes. The consequence is some sort of sacrifice by the client: working longer, saving more, reducing spending, etc. How do you defend against it? Simple…generate sufficient compounded returns.

Our approach to portfolio construction is designed to address both longevity and drawdown. It’s our firm belief that we are not in the market of the past. We can no longer depend on bonds to provide correlation benefits and real returns.

More portfolios are reliant on asset relationships that just ain’t so, and we don’t want to be one of them. Sure, some of that is our opinion, but some of it is just the numbers.

Fiscally Responsible

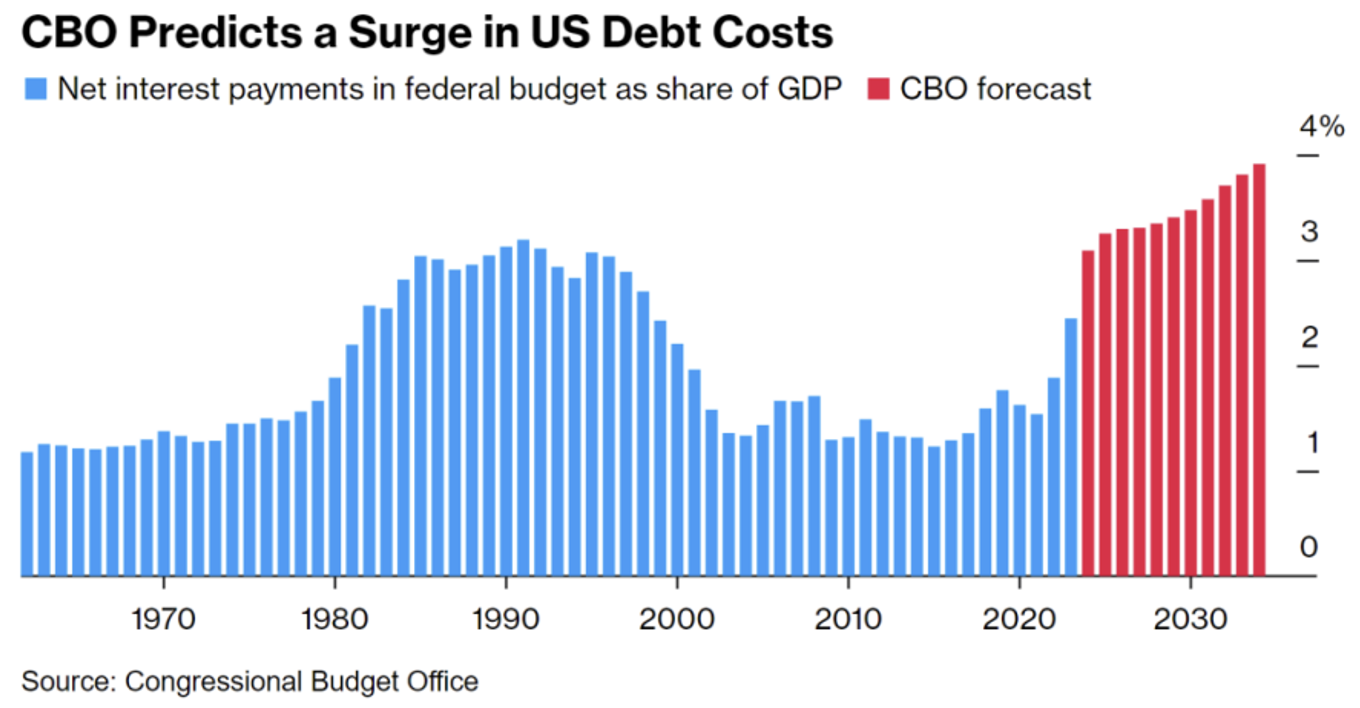

US debt to GDP is currently ~120%. Our deficit spending to GDP is roughly 7-8%. According to the Congressional Budget Office, the cost of our debt is set to continue to climb.

“Net Interest payments will climb to 3.1% of GDP next year, the highest level in records going back to 1940, and then go on to hit 3.9% in 2034.” CBO Director, Phillip Swagel, said in a statement.

Data as of February 2024

Data as of February 2024

Those numbers project nothing but increases in federal revenues (taxes). In other words, no recession is factored in.

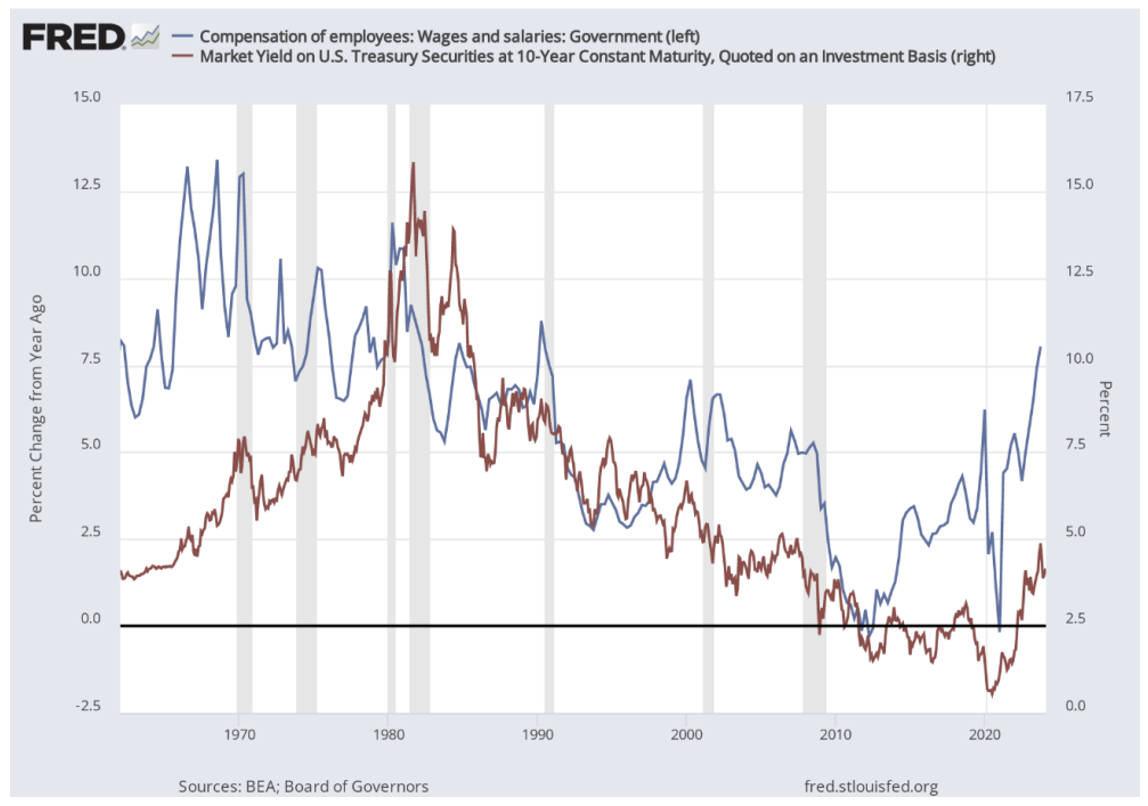

Meanwhile, the rate of compensation increases for government employees is running over 2x the current yield on a 10-year bond.

Data as of February 2024

Data as of February 2024

Does that back drop seem inflationary to you? Please re-read our December post: Taxation by Inflation

For a summary of the post, this is a relevant snip:

“Historically, our government has been a beneficiary of inflation, as large levels of debt have been inflated away. It’s much easier and less transparent to fund certain initiatives through non-transparent confiscation of purchasing power than it is with explicit taxation.”

The Path Out

There seem to be a couple of potential paths out of the current situation we find ourselves in.

Path #1 is we tighten the belt, have some difficult conversations, let some stuff burn, and get back on a sustainable fiscal path. This path is obviously a tough choice to make, and even tougher in an election year.

Path #2 is through a weaker dollar (inflation doesn’t go to 2% and stays). This path most likely leads to higher prices in assets that aren’t bonds. In fact, I’d argue we are seeing this play out in real-time with the S&P 500 up nearly 8% on the year already and things like Bitcoin ripping higher.

Portfolio Implications

As simple as it sounds, stocks can grow. They can grow revenue, dividends, earnings, margins, etc. The ability to grow is a weapon against the silent confiscation of purchasing power.

Bonds have a growth rate of 0%. In inflationary environments, borrowers win. If borrowers win, who’s left holding the bag? Those who have saved in dollars.

The point is simply that when we own units of something with flexible supply, we must constantly be on guard against dilution. We are currently running fiscal deficits which have been monetized by the Fed, and most likely will continue to be.

There’s no doom or gloom in this note, just the recognition that the money printer is on standby, and we should be preparing our portfolios accordingly. We don’t live in a world where we can stash our wealth in dollars under the mattress and maintain its value. For several reasons, we are forced to absorb risk as we search for better alternatives.

Diversifiers vs Hedges – it’s a relevant post for the next couple of paragraphs.

What This Means to Your Portfolios

It is probably obvious by now that Longevity Risk is our main concern. That doesn’t mean we ignore the issues of drawdown.

We believe we can make the allocation shift to stocks away from bonds without too much drawdown exposure, by harnessing volatility. Specifically, we own hedges.

Hedges cost us to own them. They are negative carry holdings. That’s the give. The get is that hedges do not have correlation (or basis) risk. Meaning, we know the correlation of a hedge. If markets go down, hedges go up.

Hedges are designed to protect against the specific drawdown scenario that worries clients and cripples the math behind compounded returns. And they often get mistakenly judged for their siloed negative returns. As David Dredge says, you don’t judge a goalie by their ability to score goals. It’s the concept of Team of Players.

The presence of hedges, and their embedded convexity, can positively impact asset allocation. And it’s at the allocation level where you win the game of compounded returns.

Closing

We talk about seeking to be ‘better in the tails’.

That means, if markets rip higher (right tail), we want to produce compelling upside capture vs. a benchmark. If markets rip lower (left tail), we want to protect capital better than others.

We believe the current setup, especially in an election year, lends itself to higher asset prices. We love our positioning for the upside. If we hit bumps, we have hedges in place to kick in.

As always, thank you for your trust and please don’t hesitate to reach out with any questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2403-5.