Another Sizable Hike

The Fed raised its policy rate by 75 bps as expected, which according to Chairman Powell brings the Fed Funds target range back to “neutral”. Powell indicated decisions moving forward would be data dependent. Following the market responses (large market rally), we expect Fed governors to sound more hawkish in the coming weeks if the Fed is displeased with the equity/bond market reactions.

The differentiation in rate expectations between the bond market and the Fed has become increasingly wide. We believe someone is wrong. The bond market is now pricing in rate increases to 3.3% by late 2022, falling to 2.7% by late 2023, while the median Fed forecast is 3.4% by late 2022 and 3.8% by end of 2023. In sum, the bond market is betting on a slowing of hikes and rate decreases in 2023, while the Fed is projecting both more rate increases on top of rates staying in restrictive territory for longer.

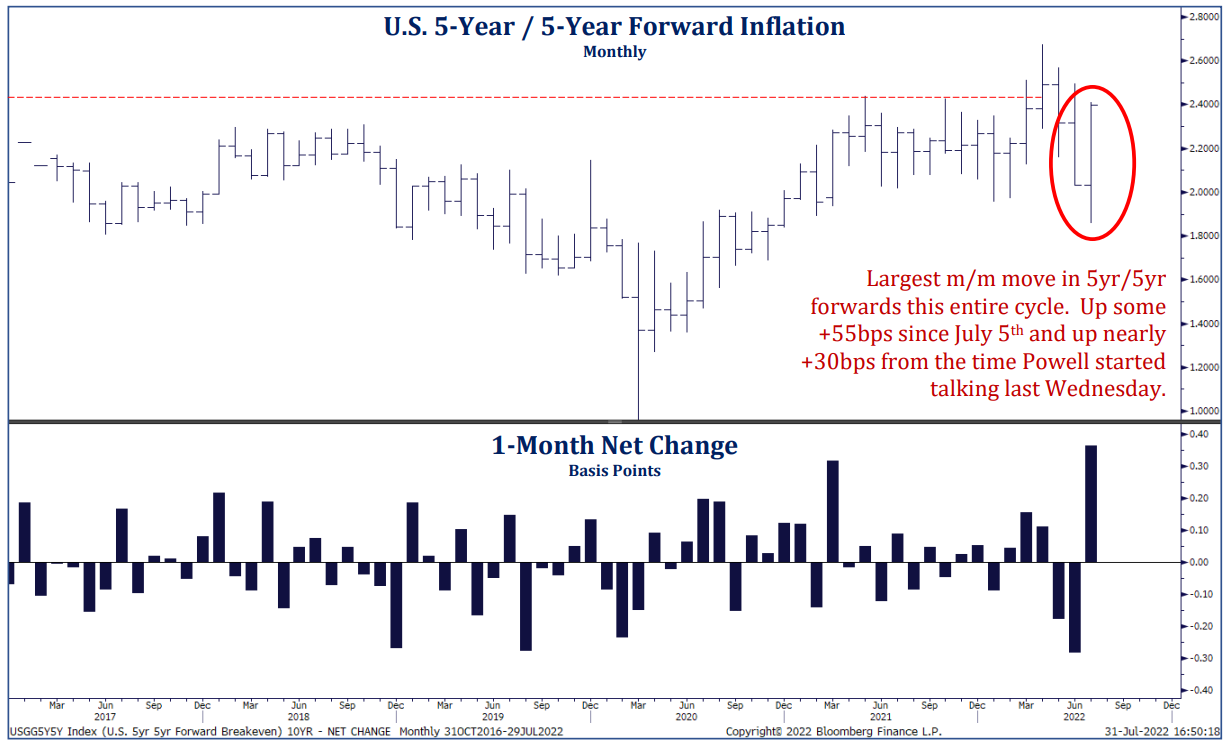

5yr/5yr Rates Rip Higher

The surge in 5-year / 5-year forward breakeven inflation over the last few weeks has gotten our attention, particularly after Powell’s press conference on Wednesday afternoon. July marked the largest m/m change for the series this entire cycle (up some 55bps since July 5th) where the bulk of that move came in just the last several days. We believe this could be the market’s way of saying, “OK FOMC, if you get more dovish now, you’re going to lose the progress you’ve made on anchoring longer-term inflation expectations.” The answer may be more nuanced, but against the backdrop of a consensus “peak inflation” call, this move seems notable to us.

Strategas. As of 8/1/22

Strategas. As of 8/1/22

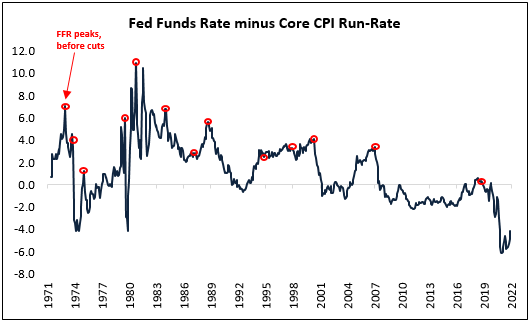

A Fed tightening cycle, dating back ~50 years, has not peaked without the Fed Funds Rate above the 6-month moving average of annualized MoM core CPI. The bottom line is the absolute level of inflation is too high. The Fed Funds Rate is too low (relative to core CPI) which in turn makes real rates too low (meaning monetary policy still accommodative). Like we’ve mentioned consistently the past weeks, the market is expecting rate cuts too quickly (1Q23).

We will keep our bets on a pivot not occurring until either inflation drops dramatically, the jobs market shows cracks, or the Treasury market liquidity falters (something systemic). Bottom line: the Fed has a way to go in their war to reduce inflation and slowdown demand.

Source: Jefferies. As of 8/2/22

Source: Jefferies. As of 8/2/22

The key question remains: is the stance of Fed policy sufficiently restrictive today to anchor long-run inflation expectations? It’s tough to believe policy is overly tight if we are still looking at low/negative real interest rates.

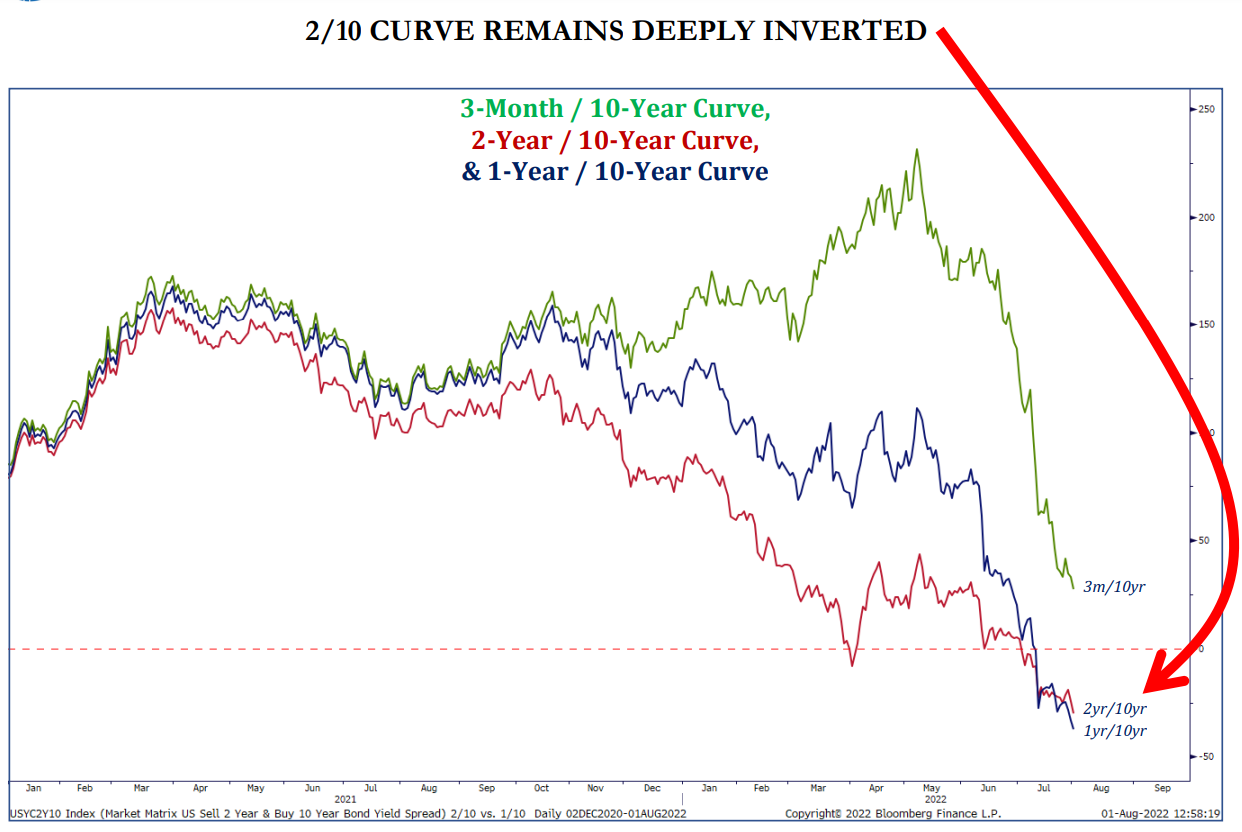

The Curve is Deeply Inverted: The aggressive hiking schedule initiated by the Fed has driven front end yields to levels last seen in 2007 (2018 the 2Y peaked at 2.95%). The Fed’s preferred curve is the 3-month yield minus the 10-year yield (3M/10Y). This curve was +200bps as recently as June 20th and is now on the brink of inversion… another hike in September (especially a supersized one 50 or 75bps) will likely further invert the structure of the yield curve (2Y/10Y is currently 34bps inverted). An inversion of the 3M/10Y has been a very good historical indicator of recessions.

Source: Strategas. As of 8/2/22

Source: Strategas. As of 8/2/22

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The 2 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 2 years.

The 10-2 Treasury Yield Spread is the difference between the 10-year treasury rate and the 2 year treasury rate. A 10-2 treasury spread that approaches 0 signifies a “flattening” yield curve. A negative 10-2 yield spread has historically been viewed as a precursor to a recessionary period.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2208-6.