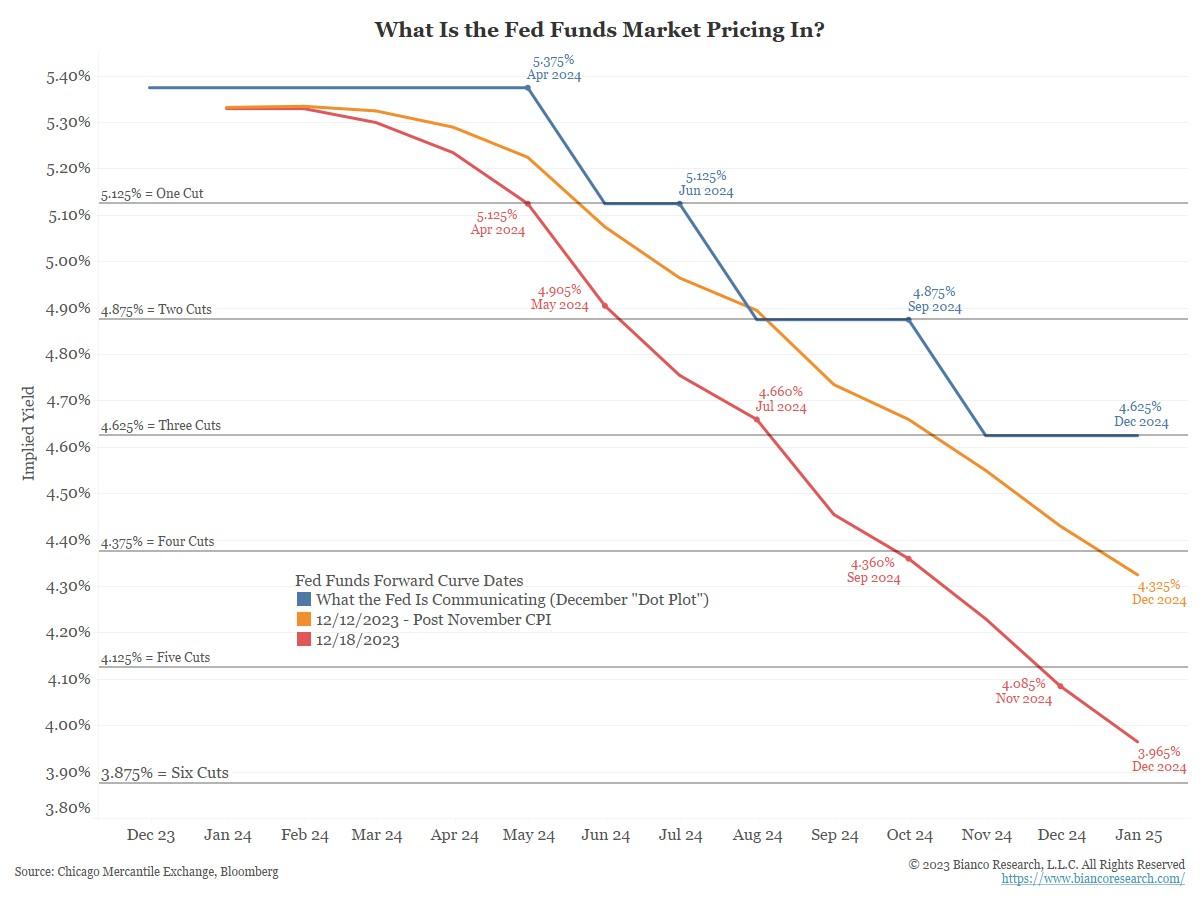

The shift in expectations for future interest rates has become the top narrative of markets. Following last week’s FOMC meeting, markets were thrilled to see the Fed add rate cuts to their Dot plot (SEP Projections) and talk about the potential for rate cuts.

Source: Bianco as of 12.18.2023

Source: Bianco as of 12.18.2023

Just a few weeks back, Powell communicated rather bluntly that the Fed wasn’t even considering rate cuts. Markets appreciated this change of tune. Currently, the odds of a March rate cut remain over 70%, and over 140 bps in rate cuts are expected for all of 2024, twice what the Fed just projected.

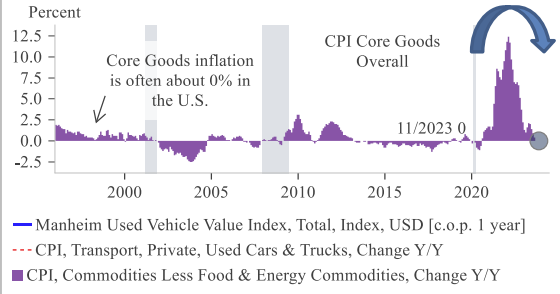

Core Goods vs Core Services: The Pathway to 2% Inflation

One of the features of the stable inflation experience over the last 20 years has been goods inflation running ~0% (thanks, China).

Source: Strategas as of 12.18.2023

Source: Strategas as of 12.18.2023

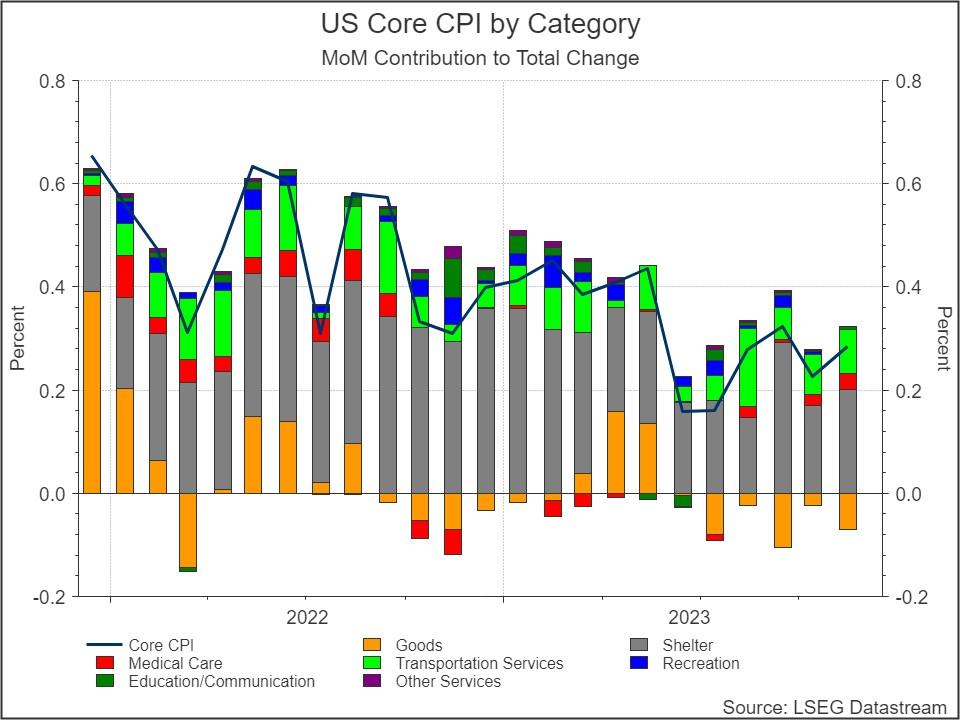

We believe one of the key recipes of inflation returning sustainably to 2% is goods inflation decreasing back to 0% and services inflation decreasing to 2-4% (currently service inflation 3m annualized is running near 6%).

Source: LSEG as of 12.18.2023

Source: LSEG as of 12.18.2023

To get service inflation down, we likely need weakness in employment.

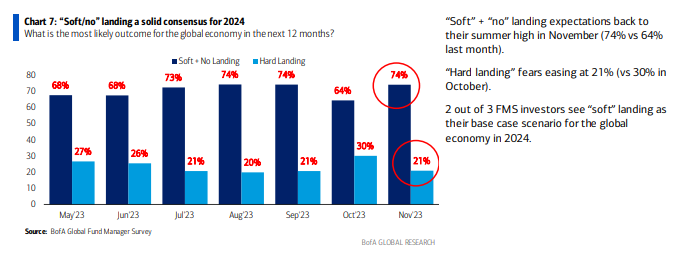

Dreams of a Soft Landing… Will They Come True?

The recent move lower in interest rates has been swift, which has been reinforced by the prevalence of a “soft landing” scenario. Investors continue to see the Fed as being able to bring down inflation without significant impact on the economy or labor market. Thus far, that’s been the case!

Source: BAML as of 12.18.2023

Source: BAML as of 12.18.2023

If the soft landing narrative continues to play out with real data, we could continue to see strength from equities. We would caution that the move in rates does appear to be stretched.

It’s difficult to see more upside for bonds unless there is a recession. While it is true that real softness in the economy could lead to lower rates (call it 3.5% for the 10-year bond), the likelihood of returning to the ZIRP policies of the early ‘20s is highly unlikely.

In our opinion, the lingering inflation risk to long-term bonds, a massive supply of bonds coming to market in 2024, negative term premium, and the positive correlation between stocks and bonds should cause investors to require higher compensation for their longer-duration bonds.

Investors are still earning >5% in cash alternatives which, in our opinion, is a better hedge against market calamity than what long bonds are offering now considering the ambitious rate cut projections.

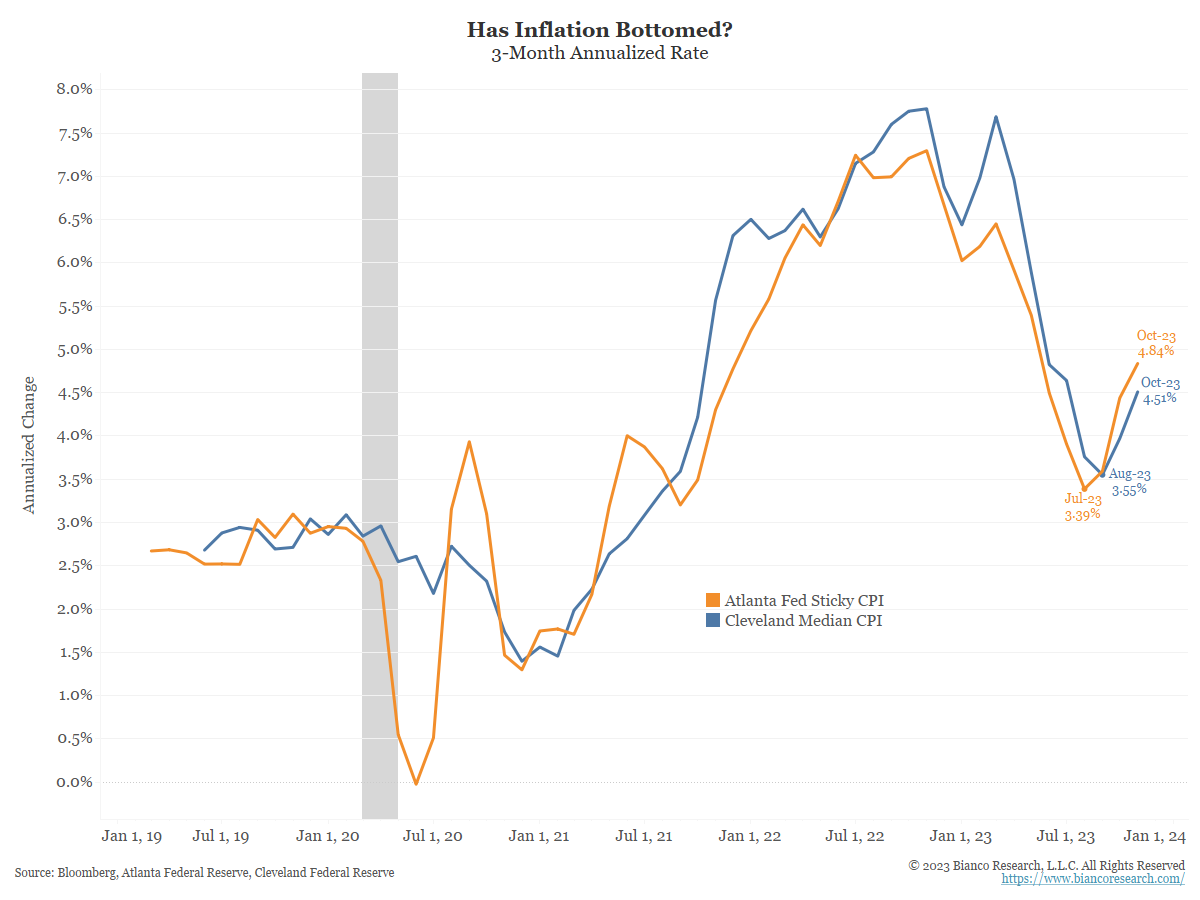

Alternative Inflation Data Bottoming and Reaccelerating?

The following chart shows a rolling 3-month annualized rate of two alternative measures which can capture inflation’s trend.

Source: Bianco as of 12.18.2023

Source: Bianco as of 12.18.2023

The blue line shows the Cleveland Federal Reserve’s Median CPI measure. The orange line shows the Atlanta Federal Reserve’s “Sticky” Inflation Index. Atlanta breaks inflation into two parts: flexible and sticky. Sticky is a weighted basket of items that change price relatively slowly. These components need to move lower for inflation to return to 2%.

Both measures bottomed out this summer well above 2% and have crept back above 4% on a three-month annualized basis. If shelter inflation remains hotter than many expect, and these broader measures continue to point to inflation bottoming well above 2% in 2024 (which may disappoint the Fed and market consensus), then in this scenario, the Fed may not be able to cut rates as aggressively as markets are currently hoping for.

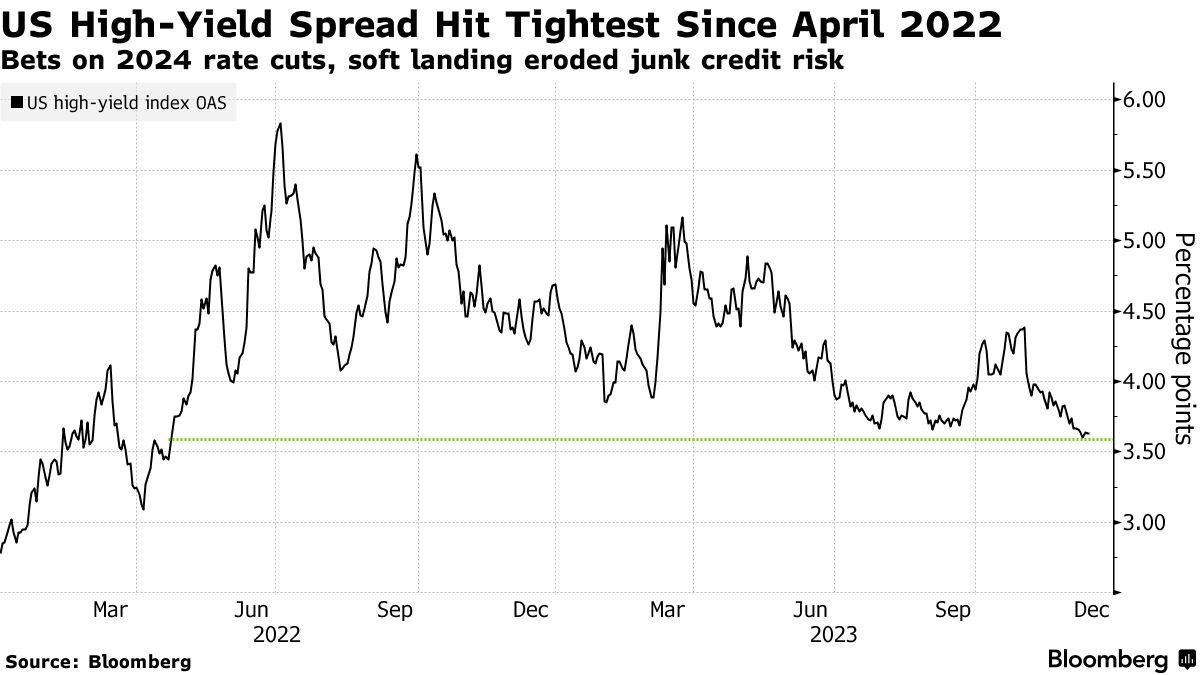

Credit Spreads Have Tightened Drastically

Credit continues to price in line with a soft-landing narrative. While spreads blew out during the market choppiness of September and October, spreads have recovered all that and more following the recent market rally and “dovish” pivot.

Source: Bloomberg as of 12.18.2023

Source: Bloomberg as of 12.18.2023

On the other side of the coin, supply from HY issuers has been lower than typical as companies have figured out other ways to finance themselves, given the increase in the cost of money. We’ve been (wrongly) bearish on HY for the last couple of years, thinking the juice wasn’t worth the squeeze.

We will see what next year brings.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-23.