Powell Pivot or Powell Plunge… Which is It?

The Fed’s aggressive tightening over the last 3 months has been a vicious attempt to regain their credibility after insisting inflation was merely transitory for all of 2021 + the first quarter of ‘22. In turn, for their delay, they’ve let uncomfortably high inflation and future expectations for inflation gain a strong and concerning footing amongst consumers. While the tightening cycle (which isn’t close to over) has reigned in financial conditions and caused pain in risk assets, we don’t believe market participants cry for “uncle” this time will see the Greenspan, Bernanke, Yellen, or Powell Puts of the past.

Is this Time Different?

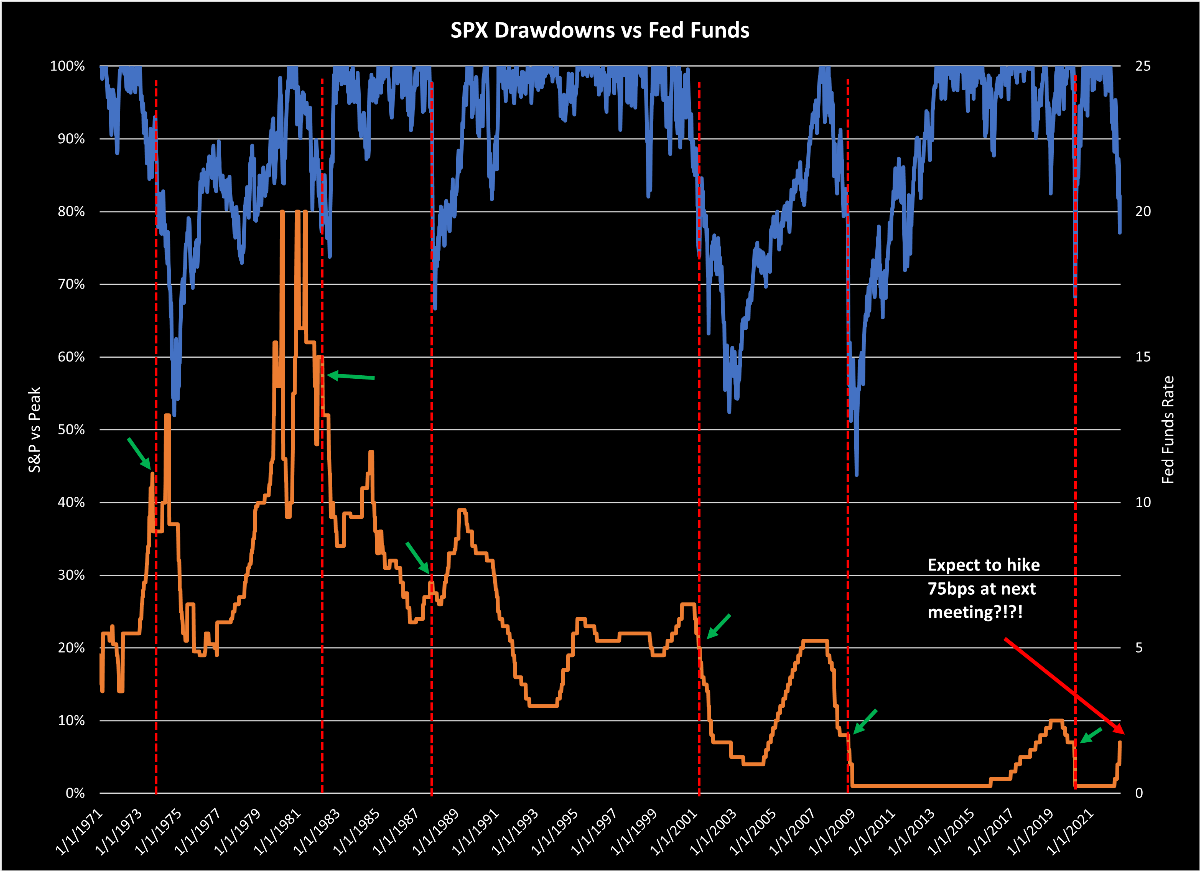

Since the creation of Fed Funds in 1971, we have never witnessed a 20% decline in the S&P 500 without the Federal Reserve cutting the Fed Funds at least once. Never. In fact, this time they are discussing hiking by 75bps at the next meeting.

Source: Tier 1 Alpha. As of 7/6/22

Source: Tier 1 Alpha. As of 7/6/22

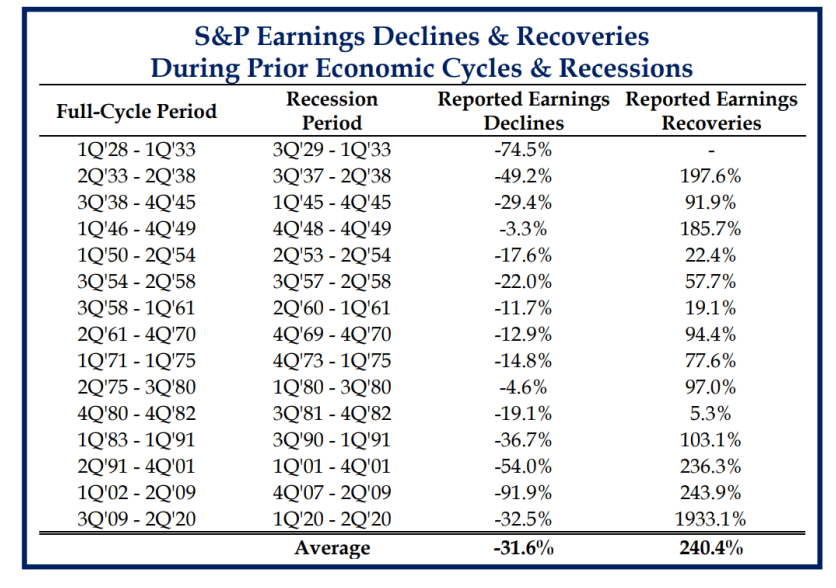

A study of the past 10 recessions shows that S&P500’s max drawdown was 57% and average was 34%, as compared to the current drawdown of 22%. Indeed, we have yet to see an earnings drawdown, with S&P500’s max earnings drawdown of 31% and average of 17% in past recessions. This all compares to stable and higher earnings numbers projected for the future at least up until this point in 22’. While reported annual earnings are usually a lagging indicator, downgrades in forecasts overlaps with market corrections, indicating we could see further downside in case of a recession.

Source: Strategas as of 07/05/2022

Source: Strategas as of 07/05/2022

Earnings… Should we Worry?

The Price to Earnings multiple (P/E) tells us how the market is willing to pay for the index’s earnings (comprising the company’s earnings inside the index). The inputs that drive the pricing of the index are the price multiple of the S&P 500 and the earnings component (or more importantly the expectation of future earnings).

If you remember, we came into ’22 with multiple pieces urging investors to “Curb Their Enthusiasm” for future market returns given what we believed to be the end of the goldilocks environment faced since March of 2020.

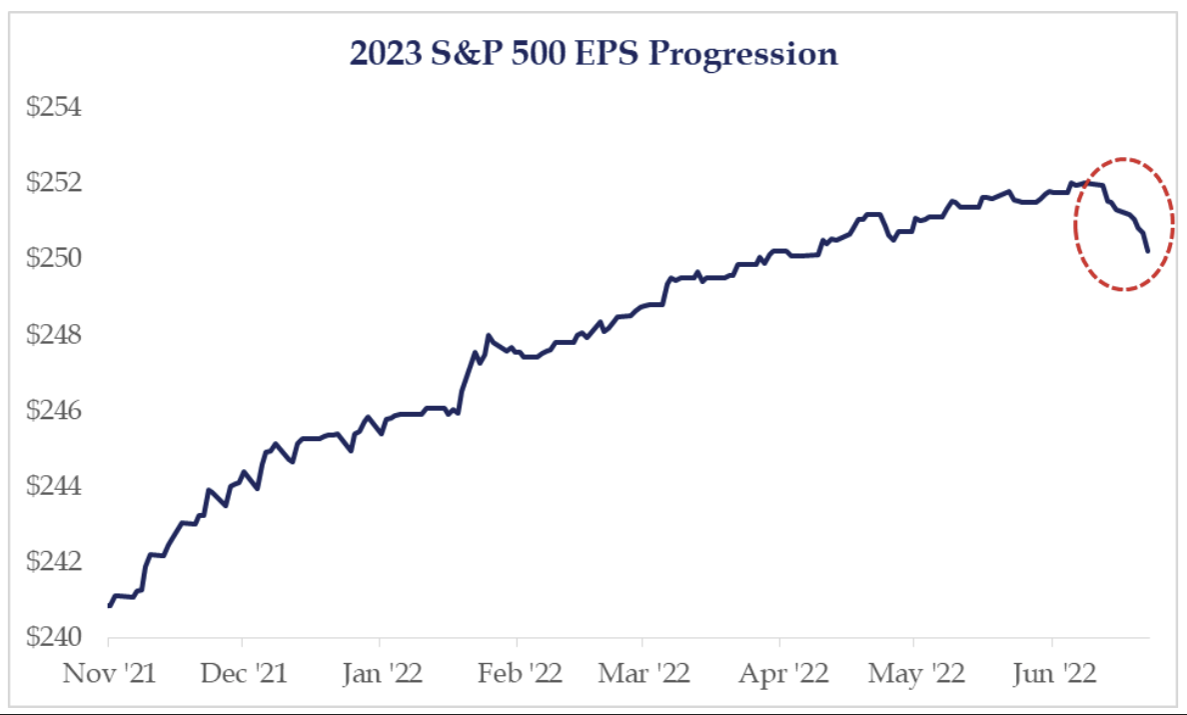

The market started ’22 at a ~21x P/E. Over the course of the year, the price of S&P 500 has decreased from 4700 to 3750 and in turn decreased the P/E multiple to ~16x forward earnings. The drop in the market has been SOLEY due to price of numerator dropping (the “P” part of P/E). In fact, the estimation for “E” has moved slightly higher. NOW the question from here is does “E” drop? If it does, this would inflate the current P/E metric to a higher level than 16x (which is a fairly normal level, historically). From this point, we likely are facing a denominator problem… As analyst estimates and companies’ Q2 earnings/ Q3 and beyond guidance start to hit the tape the next few weeks, could we see more pressure on the index?

Source: Strategas. As of 7/5/22

Source: Strategas. As of 7/5/22

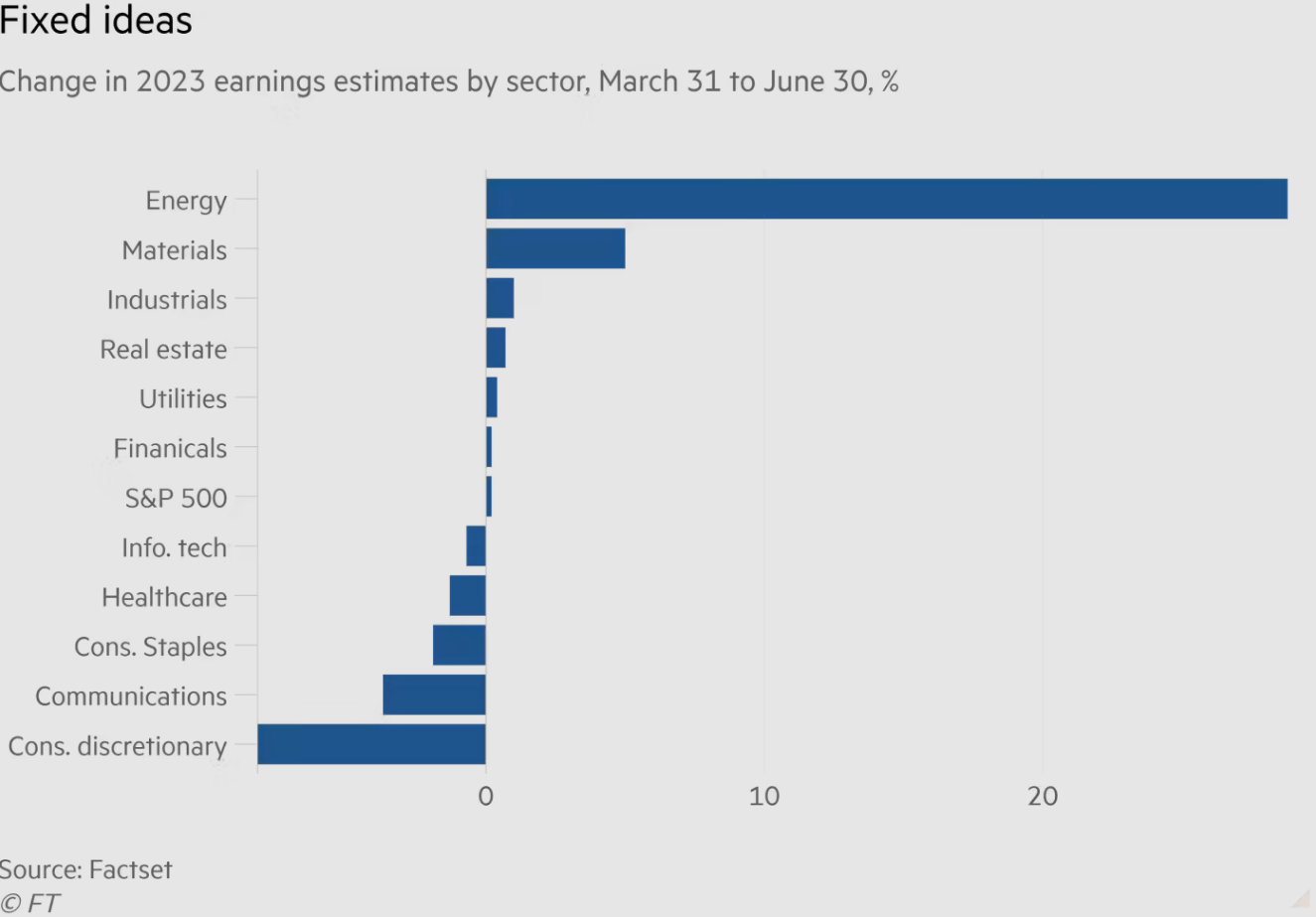

Again, we have seen strong earnings thus far YTD as reflected above, where do we go from here? What sectors will see the biggest headwind as our now hawkish fed navigates inflation?

Source: Financial Times. As of 7/5/22

Source: Financial Times. As of 7/5/22

So What Would it Take for a Fed Pivot?

Recent investor memory is that the Fed will come to the rescue. The Fed usually comes to save the day after the market delivers some pain… here recently we’ve had a lot of questions of when that breaking point might come…

First things first, we do not think the Fed is close to pausing or changing it’s course. BUT we put together a list of things that could cause them to change their tune. The first two are considering the Fed’s two objectives: inflation & the labor market. The last three involve poltics, sentiment, and corporate earnings.

- Inflation: The Fed is tightening policy because inflation is too high. Until that changes, they will be forced to keep the pedal to the metal. The Fed governor’s have openly stated that an un-anchoring of inflation expectations from the masses is very frightening.

- Labor Market: The labor market remains very strong. The June unemployment rate just registered at 3.6%. Until the labor market materially weakens, the Fed will remain focused on inflation. One key forward indicator to focus on is the jobless claims which tells us where the unemployment rate will go. While claims recently have ticked higher, they are no where near a place that calls for policy change.

- Politics: Currently politicians are begging the Fed to fix inflation. This further serves as a green light for the Fed to keep hiking. We all know political winds shift quickly and material changes in the labor market should be highly scrutinized.

- Inflation Expectations: The worst thing that can happen for the Fed is the market and consumers deeming them as unreliable or untrustworthy. The Fed takes these future expectations very seriously, but with Fed action (75 bps hike in June & likely again in July), credibility has risen.

- Downside Earnings Revisions: Material degradation in earnings expectations likely leads to pressure on the jobs market (i.e., recession) which then plays to the dual mandate (full employment). We will be watching the upcoming earnings data and guidance for future direction.

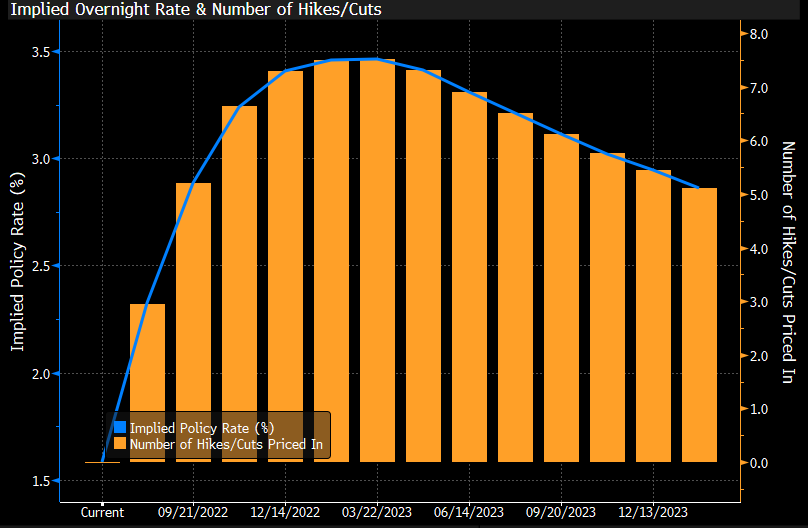

One Caveat… Are Markets Sniffing out a Pivot?

Source: Bloomberg LP. As of 7/11

Source: Bloomberg LP. As of 7/11

Even though the Fed is currently max hawkish, the interest rate markets are starting to price in Fed rate cuts in 2023. Specifically, the markets now expect the Fed to keep tightening through 2022 and then to begin turning more dovish by next calendar year as economic conditions deteriorate. Given what’s happening with recession indicators, Treasury illiquidity, widening high yield spreads, and other factors, we do think this is a reasonable estimation the Fed will have to do something, eventually. What we do know is the Fed will in our opinion perform significant rate hikes during the July and September FOMC meetings (75, 75 or 75,50). The further we go beyond that point though, the harder it will be for the Fed to keep tightening policy at an aggressive pace as they get the Fed Funds Rate higher than the neutral rate.

We believe the problem with estimates for rate cuts in 2023 is that is they assume the Fed will tighten “enough” to break inflation. After breaking inflation, they will then be able to return to a more normal policy stance some time in 1H of 2023. The question here is if the Fed does overtighten, what actions do they then do to fix the markets without stoking another leg higher in inflation.

Bottom line

The Fed is likely a long way from achieving the stable inflation many have been hoping for. This means there is likely more pain in risk assets as the Fed continues to raise rates and tighten financial conditions. The pain thus far in ’22 has come from multiple compression. The Fed doesn’t have a history of reacting to declines in P/E ratios. Until we reach on the breaking points mentioned above, we don’t see a likely shift in Fed policy.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Projections or other forward looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2207-13.