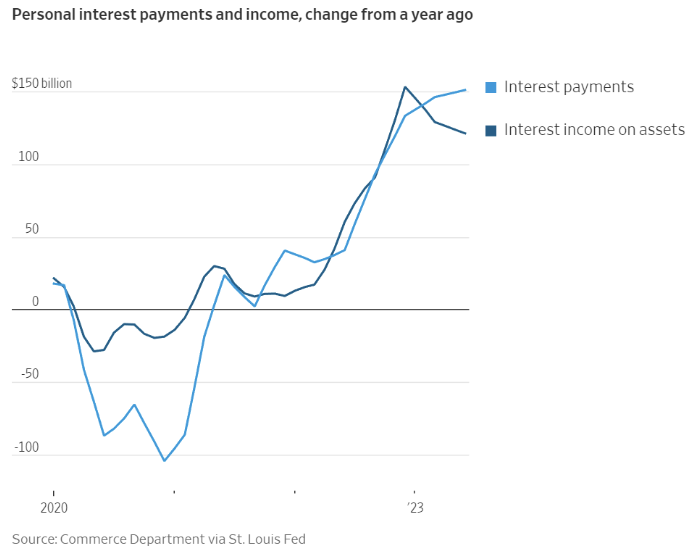

Rise in Interest Income is Helping Buoy the Consumer

The increase in interest rates over the last 15-18 months has made it is more expensive to borrow money but on the flip side, they have higher yielding options to put cash to work.

Source: WSJ as of 07.31.2023

Source: WSJ as of 07.31.2023

According to the Commerce Department data through June, American households are earning an additional $121 billion from income on investments annually versus a year ago. The higher income has helped offset the $151 billion increase in interest payments on mortgages, credit cards and other loans.

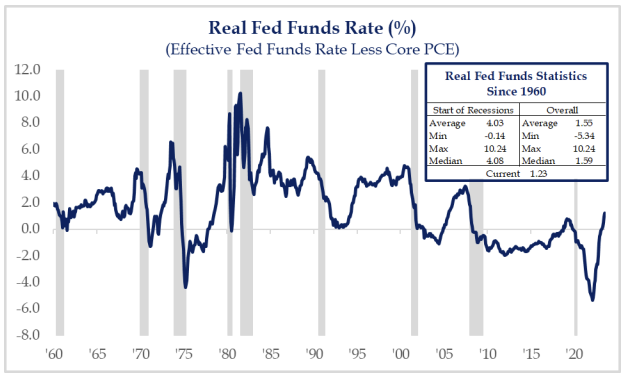

Real Rates Are Finally Restrictive

Positive real rates are needed to slow inflation. Following COVID, we spent considerable time at meaningfully negative real yields which spurred many poor capital allocation decisions.

Source: Strategas as of 07.31.2023

Source: Strategas as of 07.31.2023

Now that there is a real cost of capital, we should continue to see it weigh on economic growth and inflation. The problem is we just now got into positive territory, and will likely need to remain here for some time until the full effects are felt.

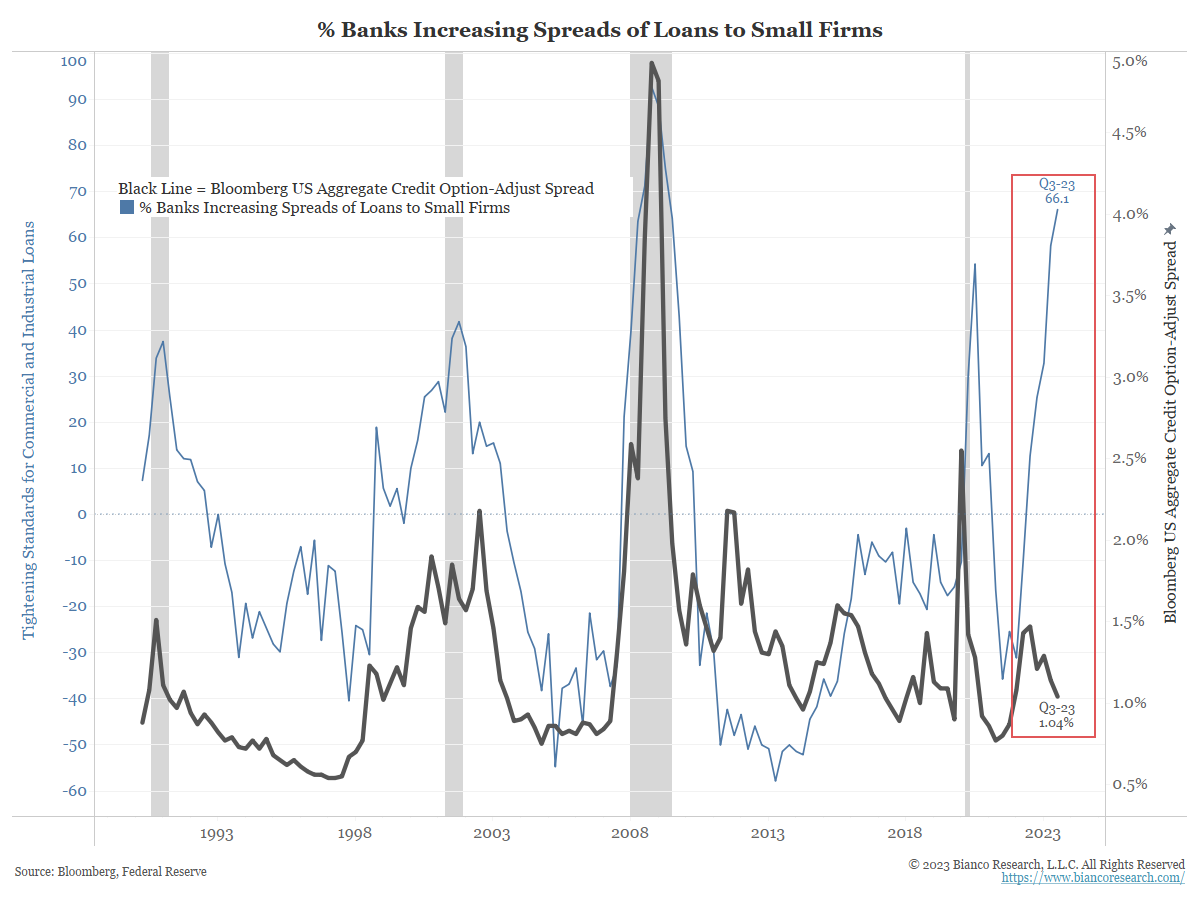

Bank Lending is Tightening

Monday afternoon the Federal Reserve released its latest Senior Loan Officer Opinion Survey (SLOOS). domestic banks increasing spreads on loans. The survey measures spreads for loans or the amount charged over the risk-free rate to measure the compensation banks are demanding for the perceived risk of the loans. The chart below shows banks are widening spreads as they perceive a significant risk.

Source: Bianco as of 08.01.2023

Source: Bianco as of 08.01.2023

The current levels are often seen during recessions. While this is important for small and middle America, only about one-third of all economic credit comes from banks. Capital markets supply more credit and are diverging hard from bank lending standards (as highlighted above). The red box below shows a record divergence between the banks’ increasing spreads and the spreads on investment-grade corporate bonds (black).

Many are scratching their heads at the reason. We think the simple answer is the bank walk of deposits is forcing banks to tighten lending standards as their cost of funds rises.

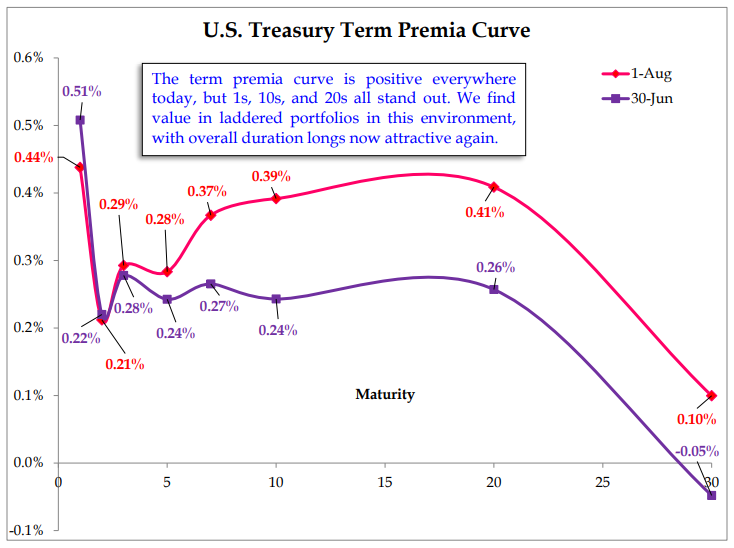

Term Premiums are Rising… a Smidge

A bond’s term premium is the amount of additional yield on a long-term bond versus the yield on shorter-term bonds, which investors typically demand in compensation for lending for longer periods. When the yield curve is inverted, investors expect policymakers to cut rates in the not-so-distant future which lowers the term premium required for lending longer.

Source: Strategas as of 08.01.2023

Source: Strategas as of 08.01.2023

Many dynamics drive term premiums, such as fear of inflation or general market fear/ stress. When you buy a long-duration bond with a negative term premium you must be confident rates will be lower in the future.

We’ve had a couple events in the past few weeks which have driven term premiums higher. First, the fear of a recession and a modest rise in inflation expectations have pushed term premiums higher. Also, last week the Bank of Japan (BOJ) tweaked its yield curve control policy.

The immediate reaction in the U.S. bond market has been a curve-steepening move (as would be expected), pushing 10-year yields back above 4.00%. The Japanese own about $1.1 trillion worth of US debt, where an increase in yields back home repatriates money back to Japan, lowering demand for USTs. In general, as central banks reduce demand for long-duration bonds, and simultaneously raise short-term borrowing costs, they force more duration into the private sector.

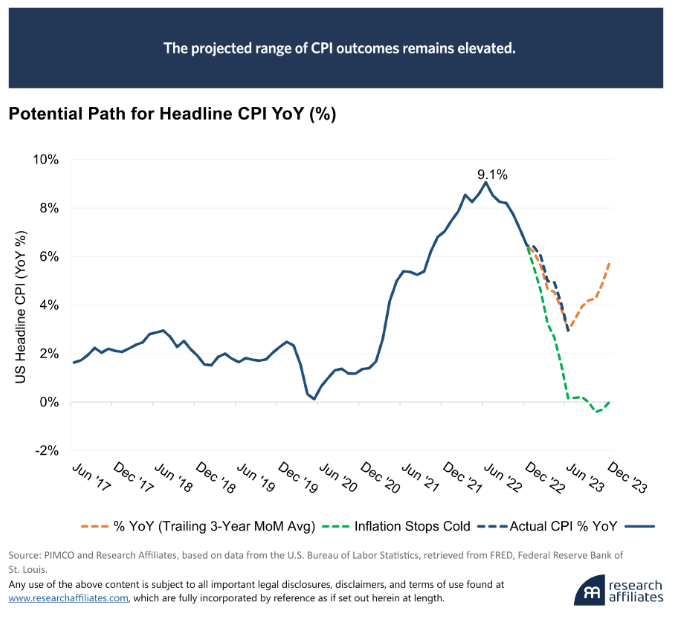

Inflation Another Boost?

Source: Research Affiliates as of 08.01.2023

Source: Research Affiliates as of 08.01.2023

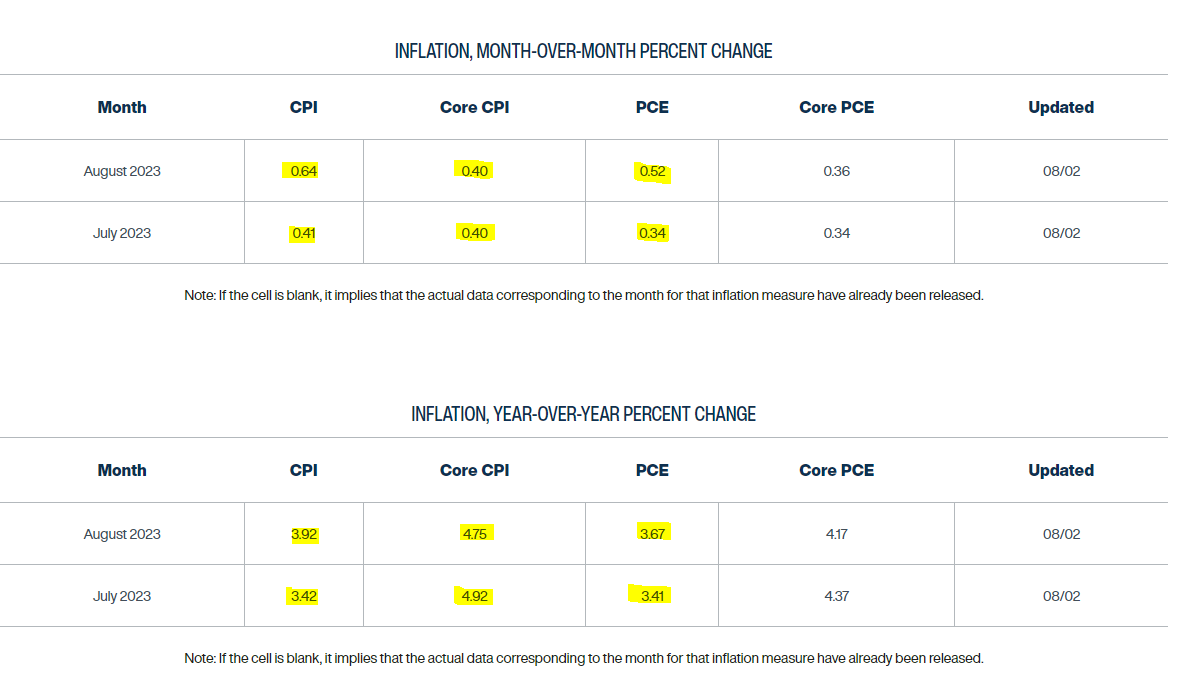

According to the Cleveland Fed’s “Inflation Nowcast” currently projects July inflation at 40 basis points. This figure will replace zero inflation from last July, which will take inflation higher. While the 3% print was largely applauded by markets, we’re curious to see their response to a bounce higher… and based off the August forecast (Cleveland Fed), July doesn’t look like an anomaly, adding further pressures.

Source: Cleveland Fed as of 08.02.2023

Source: Cleveland Fed as of 08.02.2023

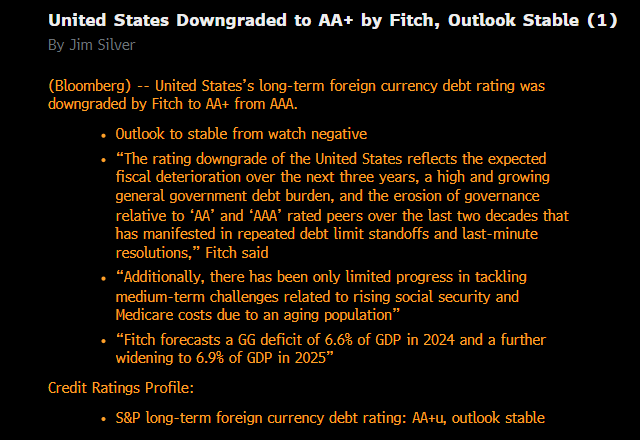

Fitch Downgrades United States to AA+ (from AAA)

Source: Bloomberg as of 08.01.2023

Source: Bloomberg as of 08.01.2023

As all have seen, big news posted last night. Fitch downgraded the credit rating of the United States from AAA to AA+ citing fiscal degradation and erosion of governance. While to anyone paying attention this isn’t revolutionary news (been a long time coming) it could be a shockwave to the system and a further push higher of term premiums on the cost of our debt. We are working on a full piece to share our thoughts — more to come.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2308-3.