2 Years a Movin’

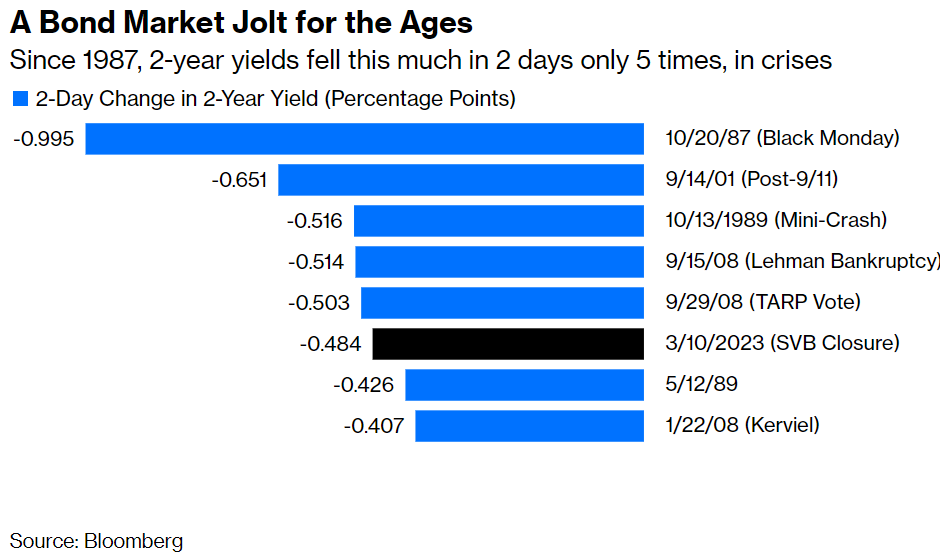

To give some perspective on the move in Fed Funds rate the last couple days, we have just witnessed one of the fastest/ largest slides since 1987.

Source: Bloomberg. As of 3/13/23.

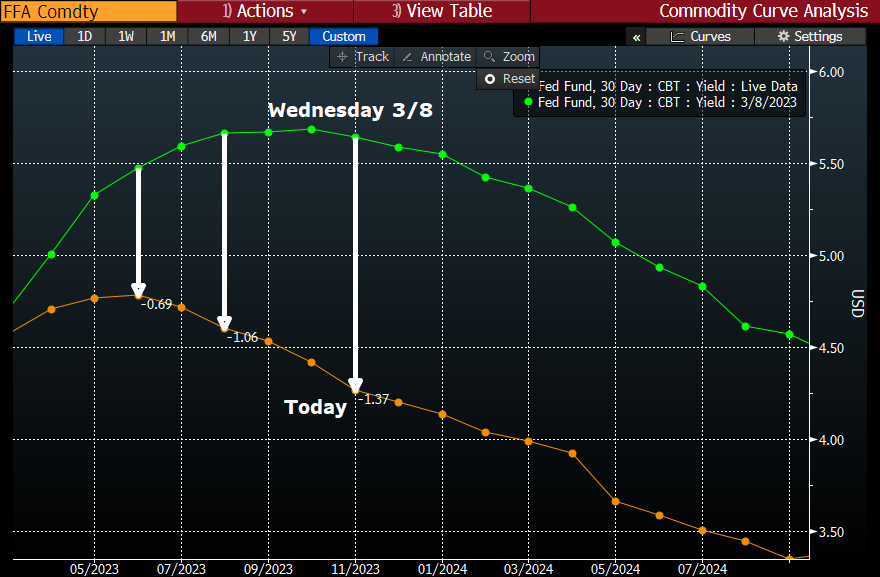

The chart above shows Fed Funds curve last Wednesday versus today. The terminal rate (peak FFR) has dropped ~100bps while the year-end rate has dropped ~150bps. Yields have repriced lower, in both a flight-to-safety trade, and in sympathy of lowered rate-hiking expectations by the Fed. Bottom line, this is an off the charts move from a statistical perspective.

Source: Bloomberg. As of 3/13/23.

Where Does That Leave Us?

Yields have been repricing lower following fears of a widespread banking crisis that gained steam over the weekend. While we think the issues with Silicon Valley Bank were unique to that bank (Dave’s note last week), we are seeing a lot of public opinion that the view is it’s best to shoot first and ask questions later. Currently, the 10yr is yielding 3.50% and the 2yr is at 4.08%. The flight-to-safety trade is in vogue right now.

Source: Bianco. As of 3/13/23.

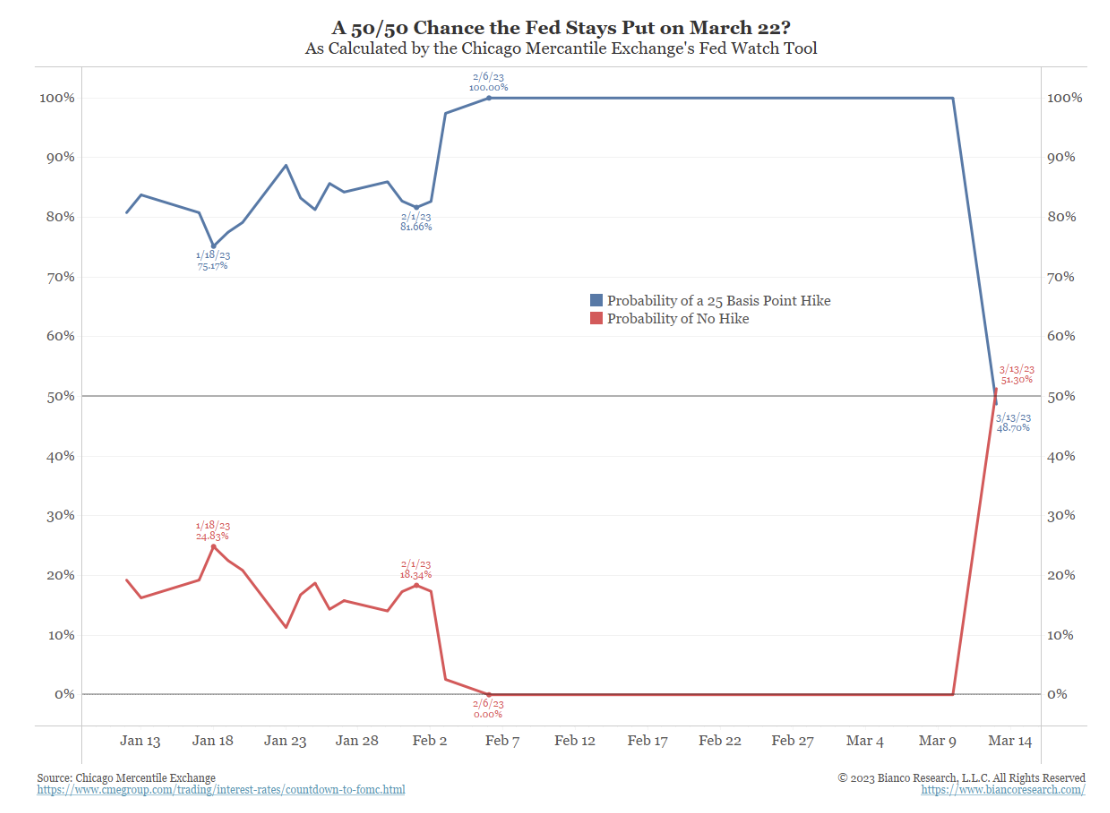

Just Last week, the debate was whether the Fed would hike 50bps or 25bps at the March 22 FOMC meeting. Now, the question is whether they hike 25bps or pause. Currently Fed Funds futures are pricing in just a 65% chance of a 25bps hike. That’s quite the change in a few days but, given the backdrop, is understandable.

Alphabet Soup Is Back!

The Fed’s actions this weekend in response to the three bank failures was to open a temporary lending facility (Bank Term Funding Program – BTFP). The facility offers to lend against HQLA bond collateral at par value ($100) versus the current market price which should be a strong source of backup funding for institutions in need. In simple terms, the new facility allows banks to pledge $80 priced securities as if it were $100. We think that while most (well-managed) banks won’t need the facility, it sends a lifeline to the smaller and medium-sized banks with large duration gaps.

In comparison to the 2008 GFC, ultimately the problem is a mismatch in assets and liabilities (a liquidity story) and not a credit (solvency) story. In our opinion, it is likely that more banks will have to suffer through this over the next weeks to come.

More QE? Looks Inevitable

Our biggest question now is how much will the Fed’s balance sheet grows via this new facility. More balance sheet expansion at the same time as inflation fighting seems counterintuitive. Does this ultimately mean the Fed will have to tighten more because the balance sheet zooms to $10 plus trillion? Time will tell on this matter.

Regardless of what “they” say, this 100% IS a Bailout.

And Now, CPI Tomorrow?

The inflation report tomorrow is expected to post solid increases with the overall number up 0.4% vs. 0.5% in January, while the core rate is also expected up 0.4%, matching the January gain. The YoY overall rate is expected to dip to 6.0% vs. 6.4% and the core rate is expected to dip more grudgingly to 5.5% vs. 5.6% back in January. Thus, the expected inflation numbers will likely force the Fed back into hiking mode once this current crisis passes.

Conclusion

Obviously, the banking industry is under the spotlight right now, and with the explosion of social media since the Great Financial Crisis, a lot of interpretations of the situation can spread quickly and influence depositors to shoot first and ask questions later.

So, while the Fed is using its balance sheet to backstop things in the face of initial systemic problems, it’s sufficient to say the next few days, and possibly weeks, will be critical in assessing depositor behavior.

The government stepping in ultimately doesn’t fix the overall macro backdrop. There remains a case for the Fed to continue to fight inflation. The Fed will remain vigilant and will likely return to its quest of quelling inflation.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2303-17.