Current Rates & the Curve

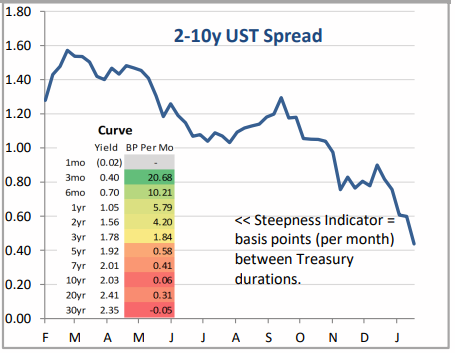

Macro influences like the Russia/ Ukraine news are likely temporary and the major influence over yields remains central bank tightening. That is the key to watch beyond the short term, and the bottom line is that the trend in yields is still higher, the yield curve is still flattening, and interest rate volatility is rising—and that will likely stay the case until we know more about Fed rate hikes and, especially, balance sheet expectations (i.e., how quickly will they reduce the balance sheet?).

Rate Futures & Volatility

We would expect long-dated yield curves to invert prior to the next recession, but let’s cross that bridge when it comes. As the Fed begins to bring up the short end (the pricing of which has flattened various measures of the yield curve that incorporate expectations of front-end rate rises), we would expect the entire curve to rise. A bearish further flattening of the curve would seem to be the most likely trajectory (short end rising faster than the long end). That does not mean the curve will invert this year, although there could be an inversion if the Fed has to get more aggressive, which is why falling behind the curve is important.

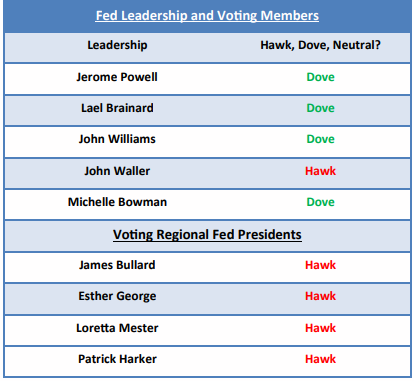

FOMC Members – Who Matters

First, for a bit of background on the Fed, only some of the members of the Federal Open Market Committee vote on policy. That means, practically speaking, if a Fed official makes hawkish or dovish commentary that differs from consensus and he or she is not a voting member of the FOMC, we can largely ignore it. From a market standpoint, that means any immediate reaction to those comments (positively or negatively) likely isn’t sustainable (point being, don’t react to it). The higher the name on this list, the more important and impactful the commentary is. That makes Powell and Brainard the two most important Fed voices, but Williams, Waller and Bowman are also important. Regional Fed Presidents Bullard, George, Mester and Harker will carry the least weight. If a Fed member is not on this list, their commentary is unlikely to contain much merit.

All data and charts sourced from Bloomberg LP. As of 2/16/2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2202-21.