Source: Strategas as of 06.20.2023

Source: Strategas as of 06.20.2023

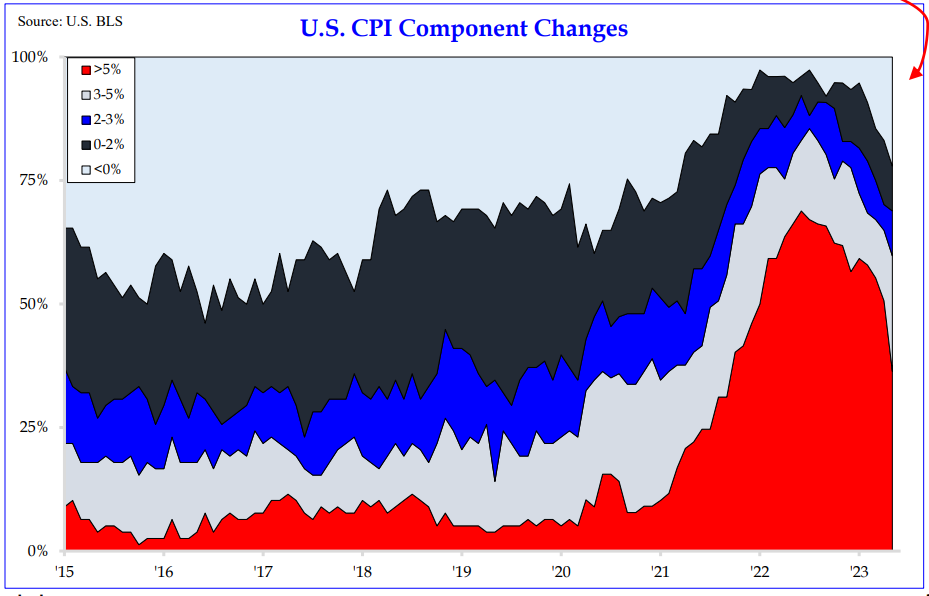

Many of the underlying sources of inflation have cooled over the past year. Supply chains have improved, interest rate sensitive sectors are seeing slower growth, but is it enough to get to the fed’s 2% target? The overhang of liquidity makes a return to low inflation likely only possible if there is a similar return to 30 years of declining prices for goods (as highlighted in a recent Bond Market Update – check out the Goods vs Services section).

Source: TS Lombard as of 06.20.2023

Source: TS Lombard as of 06.20.2023

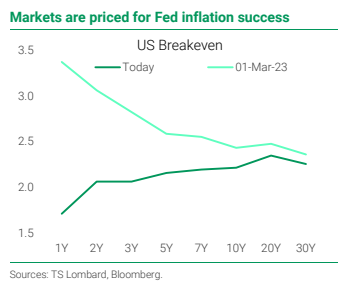

On that note, markets continue to price in victory. This is illustrated by inflation breakevens. The hawkish pause with guidance of two more rate hikes tells us that the fed isn’t ready to claim the win on inflation quite yet.

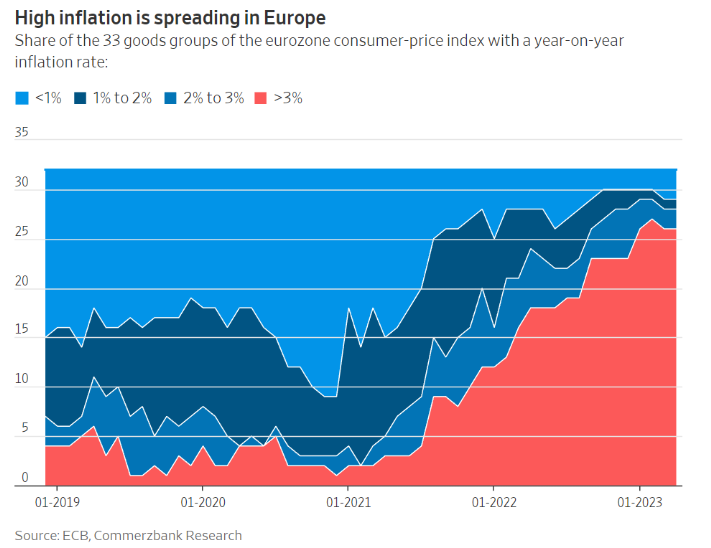

Inflation Globally Remains Problematically High

The ECB hiked rates last week. The Bank of England is expected to hike this week.

Source: ECB as of 6.20.2023

Source: ECB as of 6.20.2023

For many central banks, a slowdown/recession is not the biggest risk, currently. The biggest risk is losing the anchor on inflation. As shown above, inflation continues to run at problematic levels and is taking longer to decrease than expected.

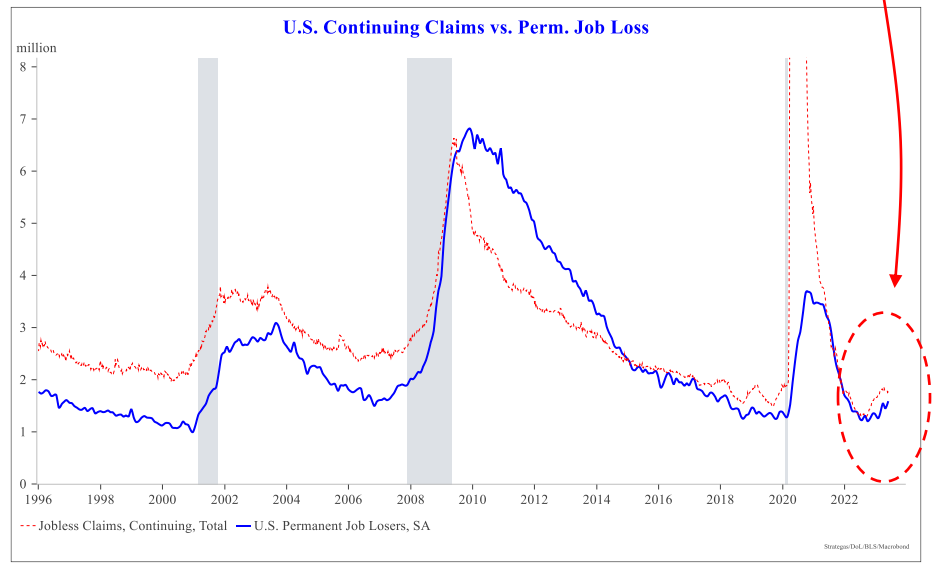

All Eyes on the Labor Markets

The U.S. labor market remains secularly tight and has been a key factor holding the economy up. Labor demand still exceeds labor supply although some progress is being made. U.S. initial jobless claims came in last week flat at 262,000 (after a slight upward revision to the prior week).

Source: Strategas as of 06.20.2023

Source: Strategas as of 06.20.2023

We continue to watch for significant slack to develop in the U.S. labor market. Jobless claims are a key leading indicator to watch.

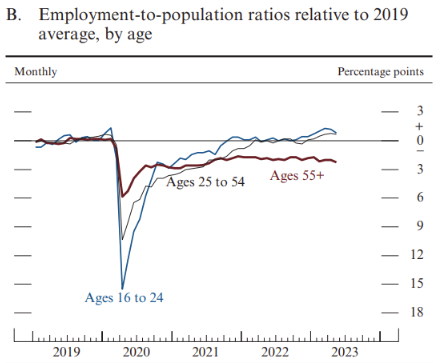

Ages 55+ Are Not returning to the Labor Market

Source: Fed Reserve ATL as of 06.20.2023

Source: Fed Reserve ATL as of 06.20.2023

In the Fed’s recent monetary policy report, they showed how the labor shortage is partly due to early retirements. The labor force participation by those 55+ is notably below pre-pandemic levels and as of now, it does not look like it will recover.

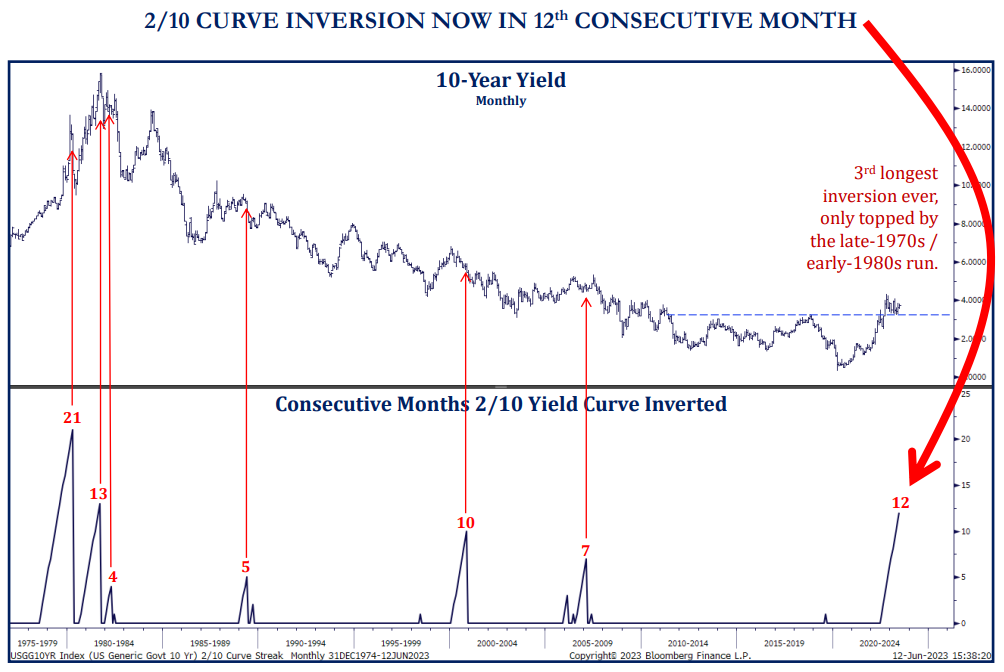

2/10 Year Yield Curve Inversion Remains Inverted for 12 Months

Many economists have pointed to yield curve inversions as being a sign of imminent recessions/economic weakness. The widely quoted 2/10 yield curve has been inverted now for 12 months.

Source: Strategas as of 06.20.2023

Source: Strategas as of 06.20.2023

While a recession is sure to come at some point in the future, the timeliness of the indicator could be skewed given what some believe to be a distortion of long-term rates as well as the unusual economic cycle we’re facing post pandemic.

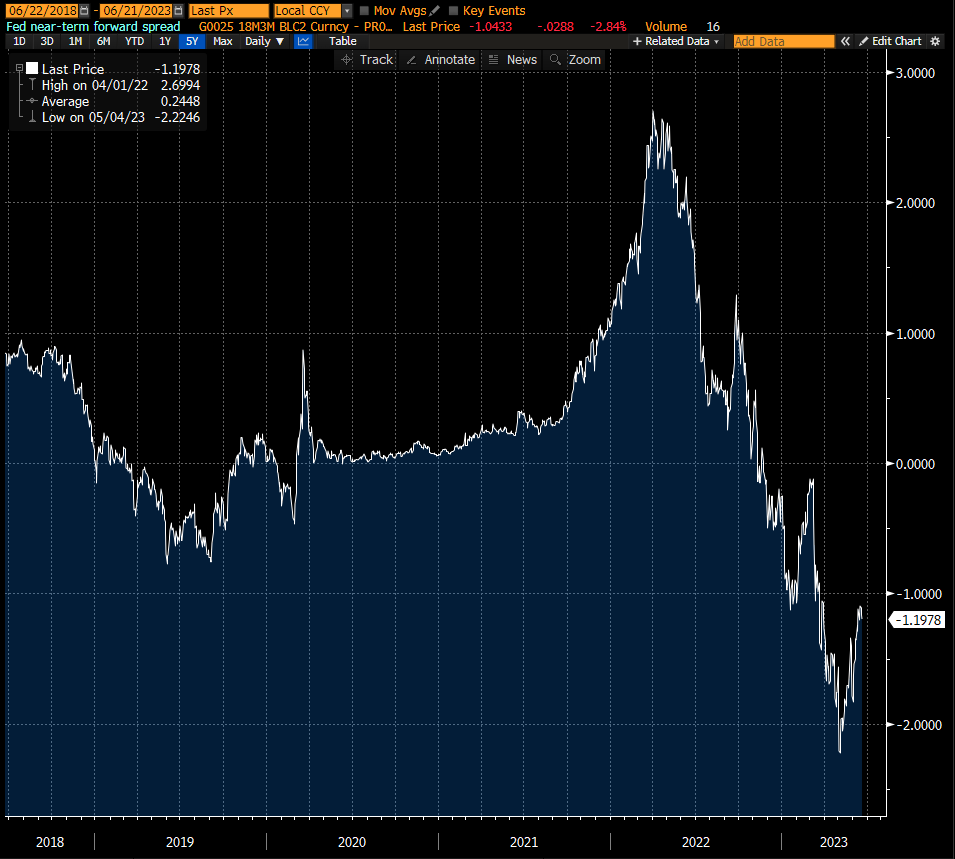

Source: Bloomberg as of 06.21.2023

Source: Bloomberg as of 06.21.2023

As a reminder, the Fed’s prefers the “near-term forward spread” over the 2/10 spread as a better recession/economic indicator. The Forward Spread is the difference between the 3-month and 18-month forward (shown above).

The gauge reflects investors’ expectations of the Fed Fund Rate roughly over the next year. A negative spread suggests that traders are predicting the Fed will cut rates because a recession is imminent in anticipation of an economic downturn. This forward spread first inverted in November of 2022 and made a low in early May. It has re-steepened by about ~50bps since early May although it’s still -119bps inverted.

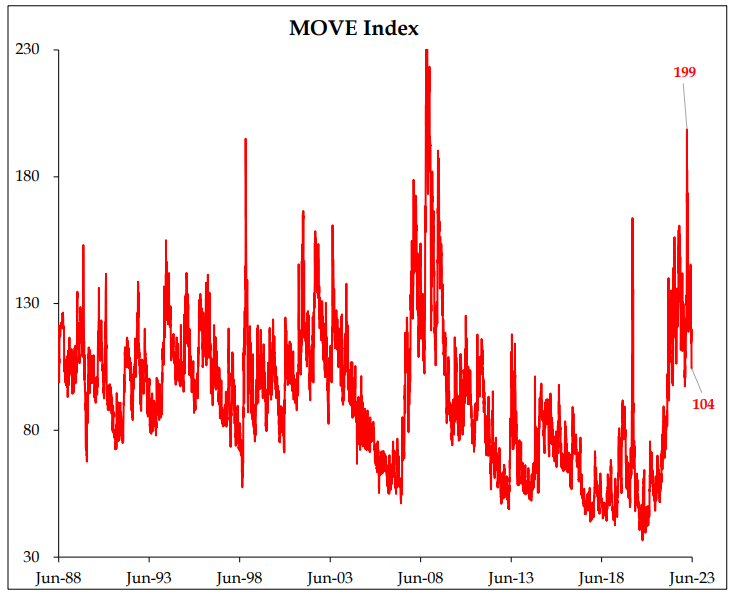

Bond Market Volatility Has Drifted Lower

The MOVE Index, which is another measure of bond volatility, has now returned close to its lowest level of 2023, further indicating that stress is easing.

Source: Strategas as of 06.20.2023

Source: Strategas as of 06.20.2023

In saying that, it appears we are settling in a range drastically above the pre-Covid levels.

Final Commentary: Can Inflation Slow Without Economic Damage?

Leading indicators have been flashing warning signs over the past year although history has not been a clear guide as to what we can expect in markets in the near term. As mentioned above, the U.S. yield curve looks consistent with future Fed rate cuts, which likely only happens if inflation slows significantly.

The ultimate debate is whether inflation comes down with pain or without pain. The former is the typical recession. The latter indicates that inflation fell and wages slowed without a large rise in unemployment. Getting through this period without a recession would require a “this time is different” story given the historical record. Ultimately, if the Fed cut rates only in response to falling inflation, that would be good for financial markets; equities do outperform during soft or softish landings. But if they cut in response to a recession, it would probably be bad news initially for risk assets.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2306-16.