The “Hawkish” Pause

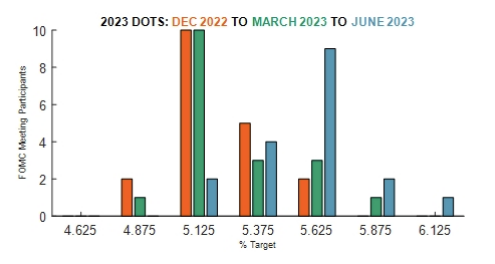

Yesterday the Fed left their target for the funds rate unchanged between 5% to 5.25%. Many labeled the pause a hawkish “skip” where further tightening is expected. The Fed DOT plot signaled that there could be two more rate hikes in 2023. QT is continuing at the $95bn per month pace.

The Fed is using the skip as an attempt to collect more data, while allowing past rate hikes to marinate on the economy (long lags of policy). The skip gives the Fed time to observe the evolution of bank- and non-bank credit conditions, ensuring that nothing else breaks before (likely) proceeding with another hike(s).

Source: Piper as of 06.14.2023

Source: Piper as of 06.14.2023

The median DOT, or the “terminal” for this cycle, moved up by 50 bps to between 5.5% and 5.75%, more than most expected. Only two of the eighteen meeting participants now expect the funds rate to end this year at the current target, implying broad support for further tightening. The dots also showed the same number of cuts in 2024, and thus a higher year-end 2024 policy rate as well (higher for longer).

The economic projections showed a significantly higher core PCE deflator forecast for the end of 2023 at 3.9% vs 3.6%. In addition, the median forecast for the year-end Unemployment Rate edged down to 4.1% from 4.5%. The Fed amended it higher considering the recent firming of economic data.

Our Reaction

It was a bit surprising that the Fed wouldn’t hike at this meeting given the revisions to the forecasts and the bump in the DOT plot. In addition, Powell’s comments on stubbornly high inflation suggest a strong concern about how hard it is going to be to get inflation back down to target.

Labor and Nominal Spending Remain Problematic

The U.S. labor market remains tight. Labor demand still exceeds labor supply although there has been some progress.

Elevated nominal spending is driving inflation. Given strong labor markets and nominal income growth in the 5-6% range, consumers can spend at an elevated level. When one category of inflation drops, the money just shifts to other things, keeping inflation elevated. Simply put, as long as consumers have jobs and disposable income, they will spend it, pressuring inflation upwards.

Future Direction of Policy

The Fed has made considerable progress in the past 15 months of its hiking campaign. They have certainly succeeded in slowing the rate of inflation from near-record levels. From here, there is still significant uncertainty regarding the estimates for how much more tightening it will take to get inflation back down to its 2% target.

Both the Canadian and Australian Central Banks paused their hiking regime earlier this year but inflation then firmed which caused them to reengage the hiking campaign. This will be fresh in the committee’s minds. Powell seemed to acknowledge this with his comments regarding rate cuts being “a couple of years away” and that a July hike is still “live”. There is nothing “dovish” in those comments.

Looking Ahead

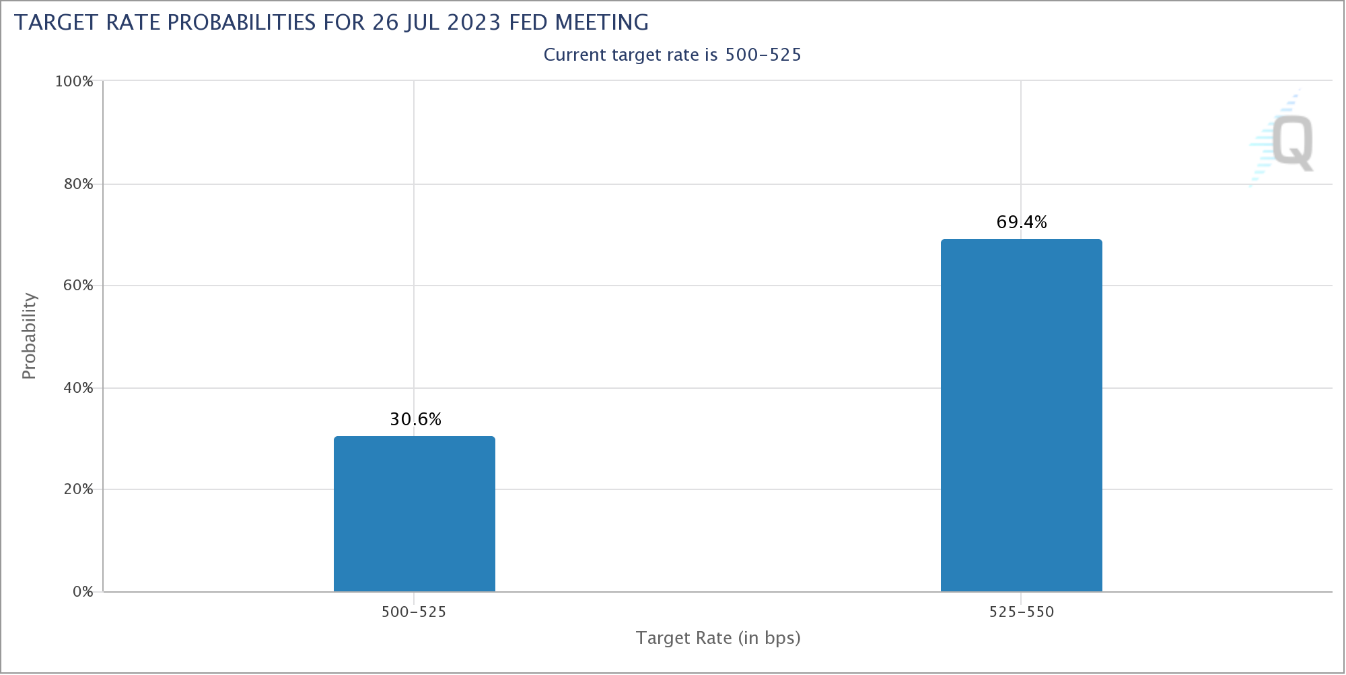

Source: CME as of 06.15.2023

Source: CME as of 06.15.2023

It’s now up to the data to show whether more hikes are justified. Currently, the market believes the Fed will deliver on their DOT plot, at least for the rest of this year. The market is pricing a July hike with ~70% certainty as of the morning of 6/15. Keep in mind there is a lot of new data yet to come before the next meeting (along with the massive 2022 June CPI comp rolling off as mentioned in our recent update).

Ultimately, we think the bar for one more hike is relatively low, while the bar for two or more is high. Whether they hike again or not, the bottom line is the Fed has more work to do and will likely hold their target rate higher for longer to maintain a restrictive policy to squeeze out inflation. Powell must guard against backing off too soon, as the pain from the “stop and go” policy of the 1970s needs to be avoided.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Core Personal Consumption Expenditure Price Index provides a measure of the prices paid by people for domestic purchases of goods and services, excluding the prices of food and energy.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2306-14.