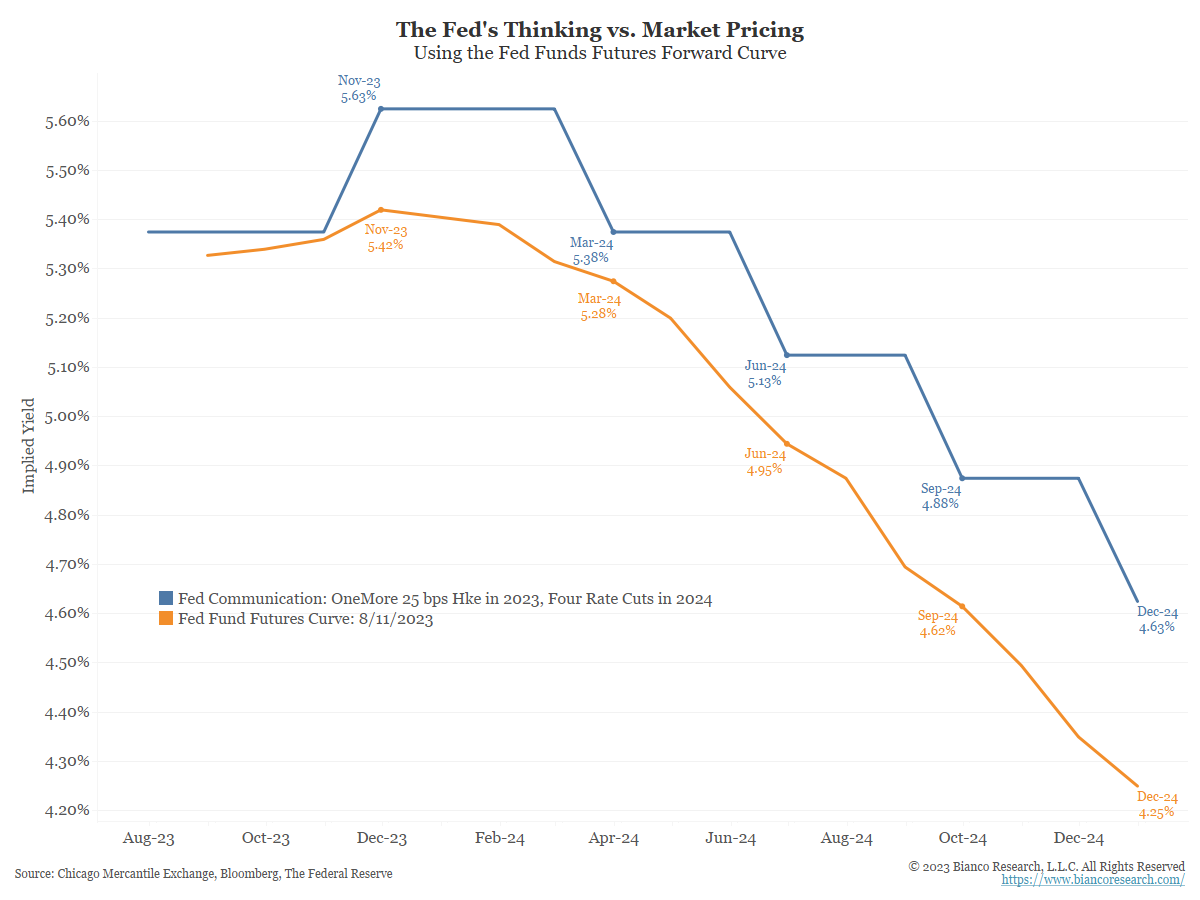

Global central bankers will gather later this month in Jackson Hole, WY for their annual meeting. We anticipate markets will seek to understand Powell’s desire to push back on market pricing that the Fed will cut its key rate to around 4% by January 2025 from its 5.25-5.5% range now.

Source: Bianco as of 08.14.2023

Source: Bianco as of 08.14.2023

We are reminded that the recent history of betting against the Fed has proven painful. Given that inflation is still not completely tamed, we wouldn’t be surprised if Powell errs on the hawkish side.

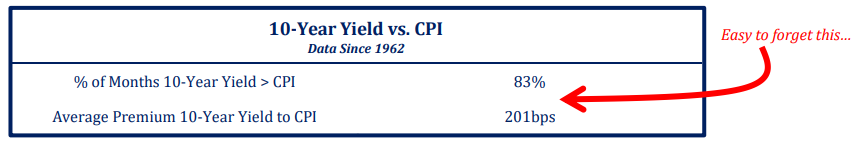

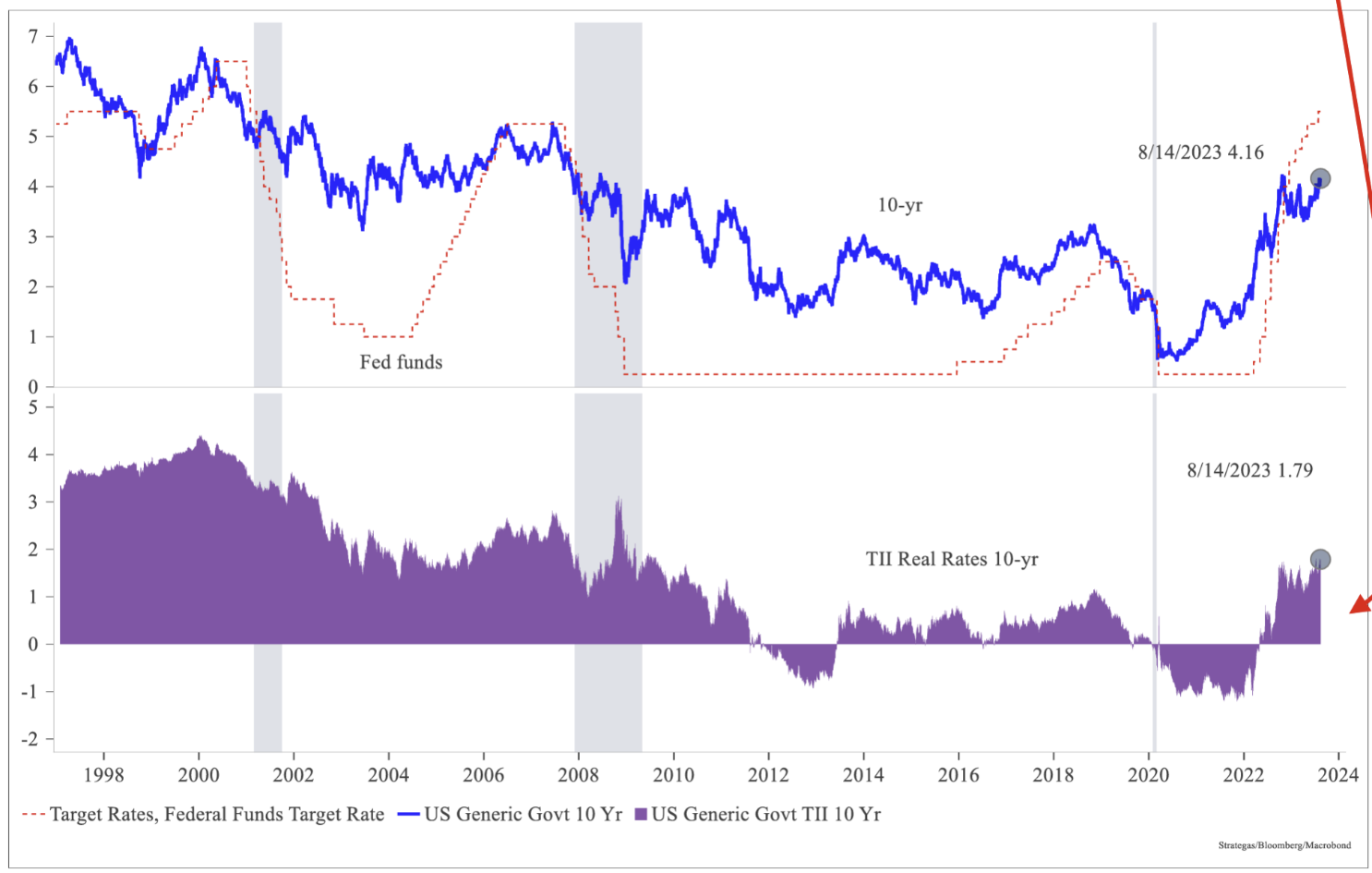

Term Premiums Still Compressed

In the US bond market, we’ve seen pressure on the long end of the curve following a combination of the policy changes in Japan (lifting cap on YCC), Fitch’s downgrade of US debt, the larger- than-expected US Treasury issuance, rising oil prices and resilient growth.

Source: Strategas as of 08.14.2023

Source: Strategas as of 08.14.2023

As expected, term premia have ticked up; but, on an absolute basis, they remain compressed in negative territory and not least relative to historical norms.

Source: TS Lombard as of 08.14.2023

Source: TS Lombard as of 08.14.2023

As we spoke about in our last update, we expect term premiums to continue to pressure long-end yields higher, and believe the effectiveness of long-duration bonds in hedging risk assets will be muted.

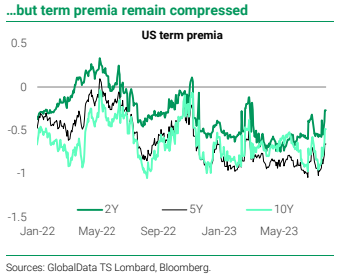

Real Yields Continue to Push Higher

We subscribe to the school of thought that real interest rates reflect investment demand in the real economy. We view rising real rates as a positive sign for the future.

Source: Strategas as of 08.14.2023

Source: Strategas as of 08.14.2023

The US economy suffered through years of weak growth after the GFC and we had low real rates to show for it. The 10-year real yield today is at its highest level since June of 2009 and is now approaching 2%.

The 10-year real yield today is consistent with the rates that prevailed prior to the GFC, and we believe that could mean we’re beginning a more normalized regime. The rise in real yields is tangible evidence of a confidence in the future that we haven’t seen in quite a while.

Higher rates should reduce the speculation that has run rampant through the economy during the post-GFC period, as real interest rates are critical to all economic decisions. On a positive note, this could mean that a recession will be easier to handle, with the real economy better prepared for it.

Labor Market Woes

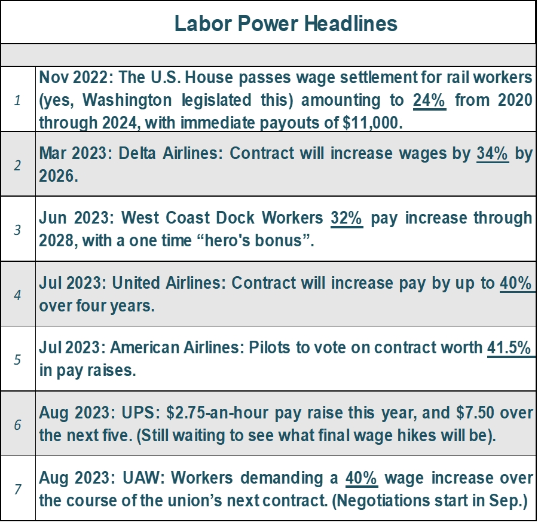

It increasingly looks like the easy part of the inflation slowdown is behind us, with labor tight and sticky wages, forcing companies to boost prices to protect margins and earnings.

Source: Piper as of 08.14.2023

Source: Piper as of 08.14.2023

*Fun fact: there are now more public sector union members (teachers, cops, firemen) in the U.S. than there are members of private sector unions.

While this isn’t what we’d consider a “wage-price” spiral, the level of wage increases and firmness of the labor markets are a real concern to taming inflation. The above graph shows a few of the data points that point to substantial pressure on increasing wages to attract talent.

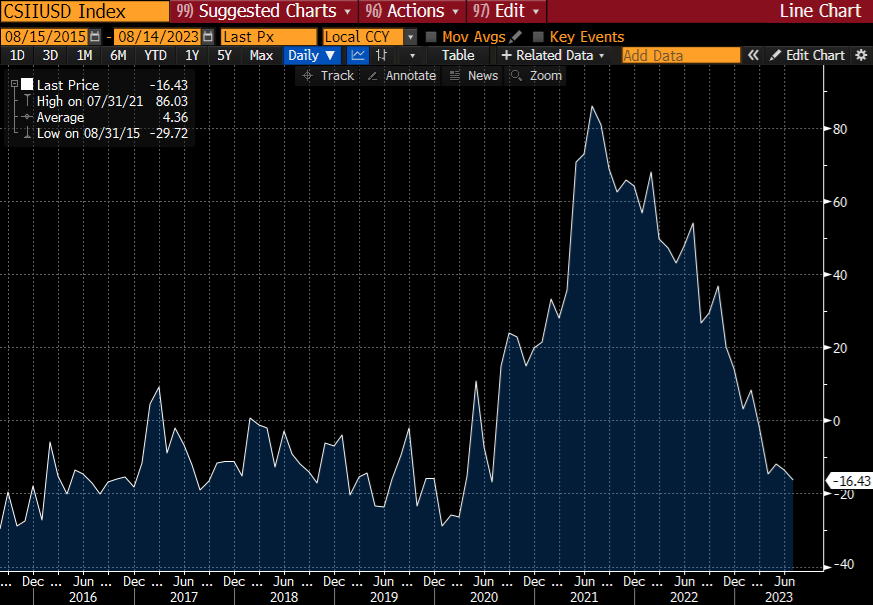

Citi Inflation Surprise Index Drastically Lower

The Citi Inflation Surprise Indices measure price surprises relative to market expectations. A positive reading means that inflation has been higher than expected and a negative reading means that inflation has been lower than expected.

Source: Bloomberg/Citi as of 08.14.2023

Source: Bloomberg/Citi as of 08.14.2023

The indicator correctly predicted the surge in inflation experienced in the last couple years, and we think the indicator should be monitored closely to see whether it bounces or continues sliding downward.

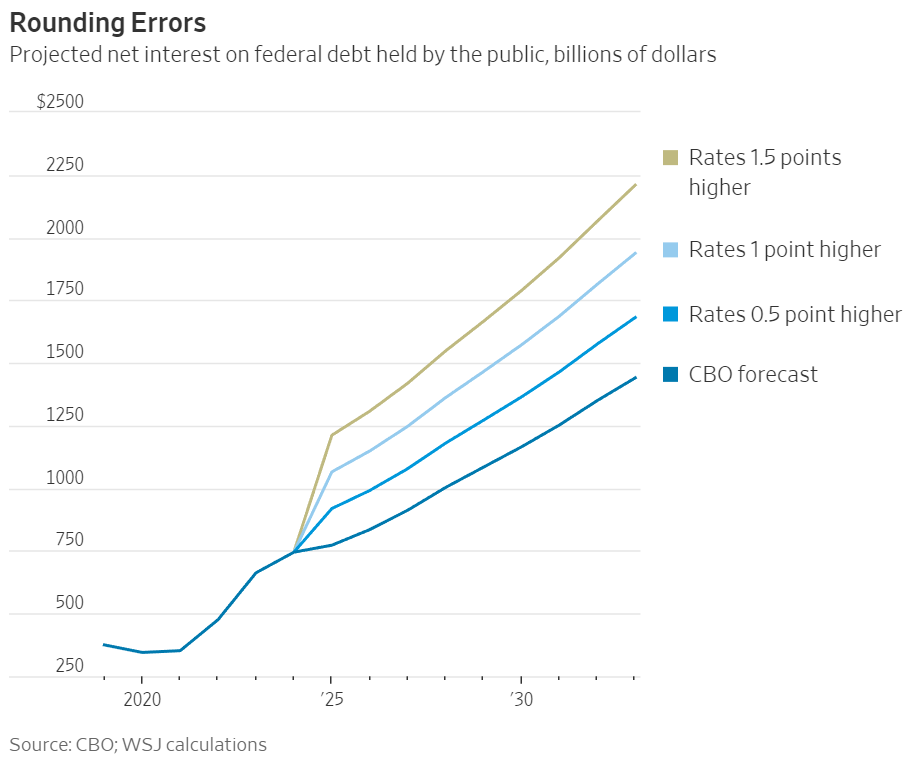

Cost of Debt is Rising… CBO (Congressional Budget Office) Might Be Overly Optimistic

Low interest rates and Central Bank bond buying reduced the strain on the fiscal situation since the GFC. One criticism we have against the Treasury is they didn’t seize the opportunity to lock in historically low rates and issue long-term bonds. Now, it appears it is too late.

Source: WSJ as of 08.14.2023

Source: WSJ as of 08.14.2023

The latest update from the Congressional Budget Office (CBO) says that U.S. debt held by the public will surpass GDP this fiscal year, and that interest on that debt will equal about three-quarters of discretionary, non-defense spending. They project that by 2031, it will be as large.

The problem is the CBO’s forecast looks too optimistic. It envisions the net interest rate paid on our nation’s debt barely topping 3% in coming years, even though the entire curve is currently > 4% and T-bills yield more than 5%! WSJ ran an analysis (graphic above) showing that minor changes in assumptions now have major consequences given the debt load.

Approximately three-quarters of Treasury’s must be rolled over within five years. Adding just 1 percentage point to the average interest rate in the CBO’s forecast and keeping every other number unchanged would result in an additional $3.5 trillion in federal debt by 2033. The government’s annual interest bill alone would then be about $2 trillion. For perspective, individual income taxes are set to bring in only $2.5 trillion this year.

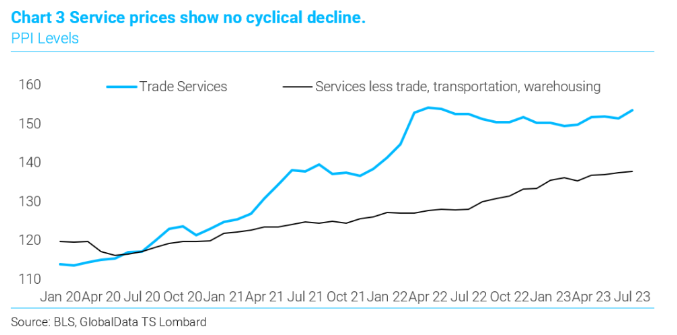

Services Inflation Thorn in Fed’s Side

The price of services for the service industry (without trade, transportation, and warehousing) continues its steady climb. Service prices are likely to remain hot until there is material weakness in the labor market.

Source: TS Lombard as of 08.14.2023

Source: TS Lombard as of 08.14.2023

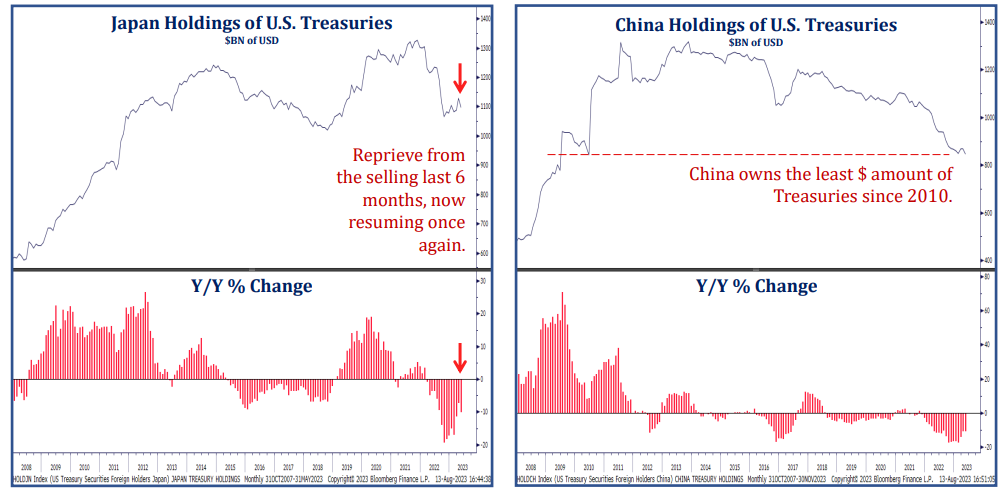

Keeping an Eye on Foreign Treasury Ownership

While this isn’t something that plays out overnight, Treasury bond ownership from some of our largest foreign holders is trending lower and is something to keep an eye on.

Source: Strategas as of 08.14.2023

Source: Strategas as of 08.14.2023

In line with our term premium commentary, without CBs buying Treasuries and the private markets forced to take on more duration, we expect the long end of the curve to continue to face upward pressure.

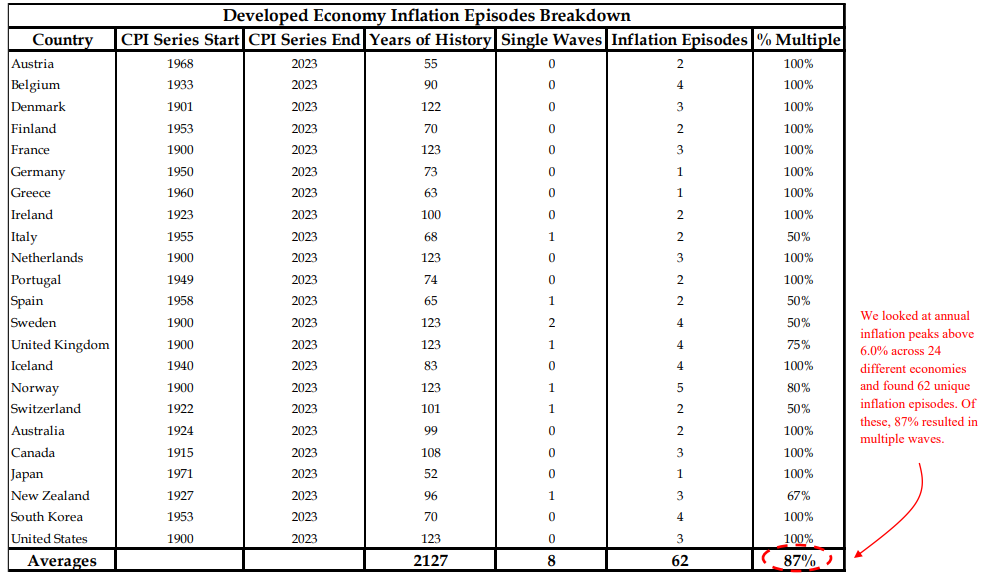

History Says Multiple Inflation Waves are Common

There’s been a symmetry to U.S. inflation: the faster CPI inflation rises, the faster it falls. This pattern has played out again this cycle, with the CPI peaking at 9% y/y in 2022 and falling to ~3% in the recent data. We’d caution that just because this wave of inflation is passing does not necessarily mean inflation returns to target and stays there.

Source: Strategas as of 08.09.2023

Source: Strategas as of 08.09.2023

Strategas examined over 2,100 years of economic history across 24 countries and counted 62 inflation episodes. Just 8 of them (13%) had only one wave of price surges. Inflation returning in multiple waves was the much more common pattern, something to watch as we reach the current low.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2308-14.