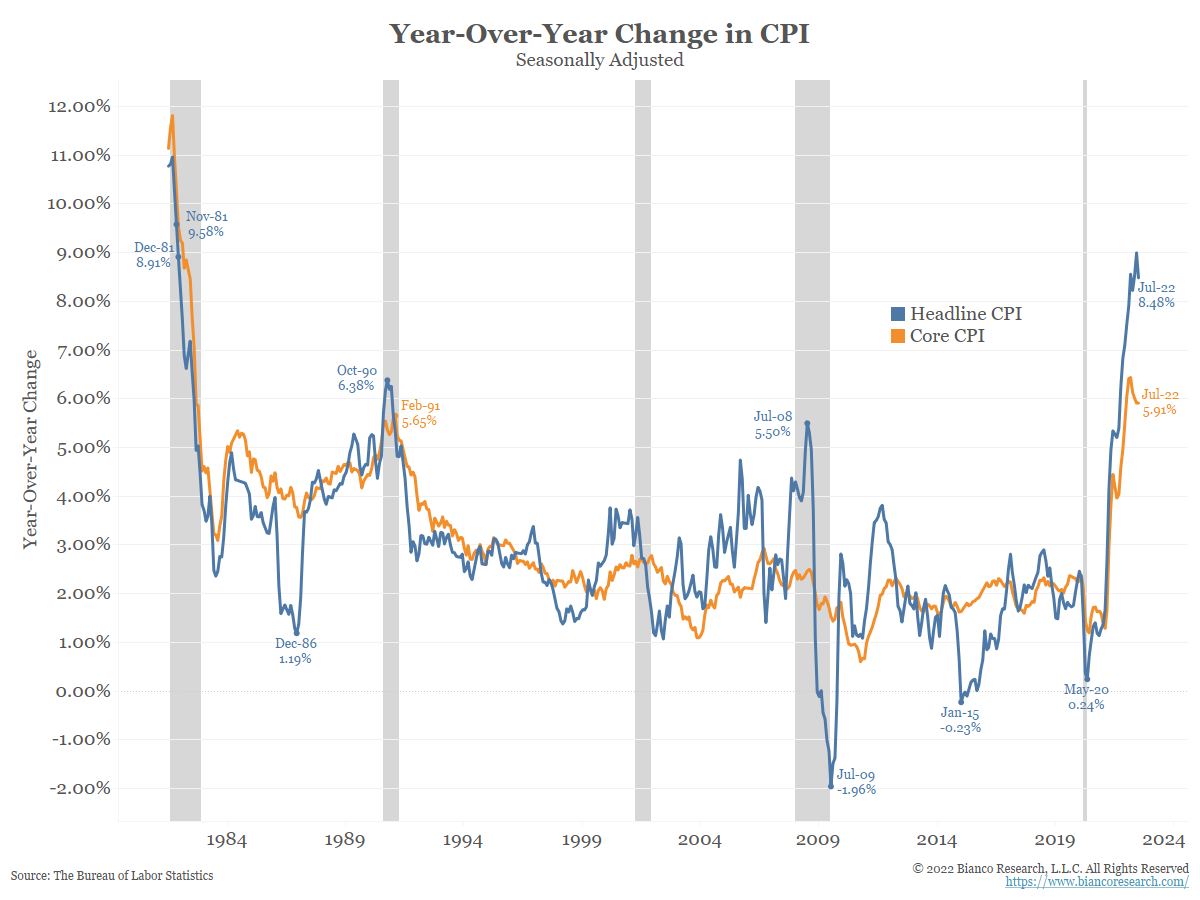

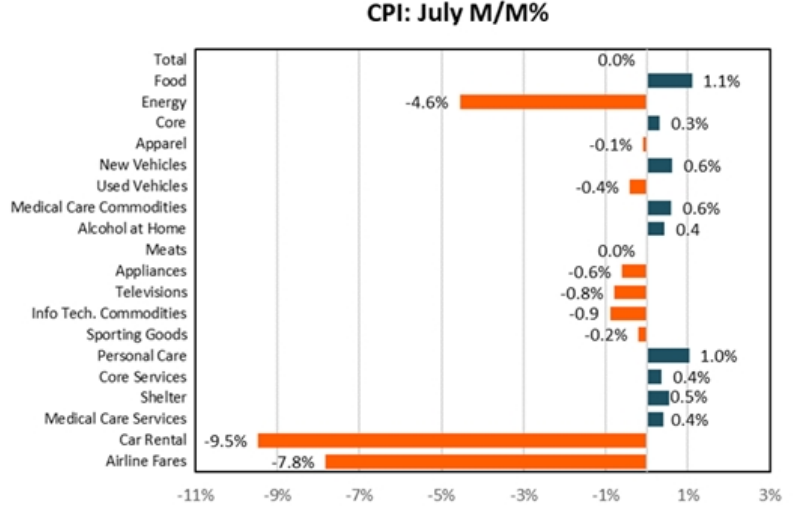

U.S. Headline CPI was flat from June to July, slowing to 8.5% YoY. The core CPI (ex food & energy) rose +0.3%, keeping the YoY number at 5.9%. Headline CPI had the lowest monthly overall reading since May 2020 (0.0%). The unchanged reading was driven by an expected decrease in gas (-7.7%) and a moderation in service expenses. Overall services rose just 0.3% vs. 0.7% in June. The slowing in services was driven by moderation in housing expenses which saw a gain of 0.4% vs. 0.8% the prior month.

It wasn’t all good news in the report, however. Gas prices did indeed decline during July, but YoY they are still up 44%. Food prices continue to rise with a 1.1% monthly gain vs. 1.0% in June and up 11% YoY. We aren’t out of the woods yet (sticky inflation components are still worrisome i.e., food, energy, and shelter) but the surprise to the downside was well received by the market (and US consumers) that the velocity of inflation is slowing.

Source: Bianco Research. As of 8/10/22

Source: Bianco Research. As of 8/10/22

Source: PSC. As of 8/10/22

Source: PSC. As of 8/10/22

So Inflation is Lower, When do We Get a Pivot?

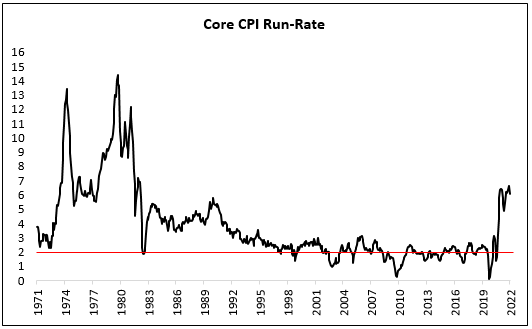

The graphics below displays the 6-month moving average of annualized MoM core CPI (what we’ll refer to as the “core CPI run-rate”).

Source: Jefferies. As of 8/10/22

Source: Jefferies. As of 8/10/22

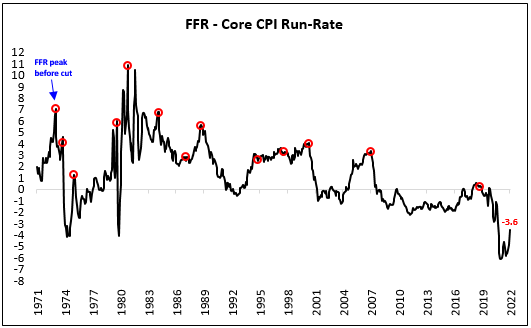

Source: Jefferies. As of 8/10/22. (Red Circles indicate Fed Rate Cuts)

Source: Jefferies. As of 8/10/22. (Red Circles indicate Fed Rate Cuts)

The effective Fed Funds Rate (“FFR”) has risen from 0.06% to 2.33%. However, relative to the core CPI run- rate, the FFR remains historically low, and negative at -3.6%. Over the past ~50 years, the Fed has not cut rates until the difference between the upper bound FFR and core CPI run-rate was positive.

The upper bound FFR is currently 2.50%. The 6-month moving average of annualized MoM core CPI is 6.10%. Not only is the market not expecting the FFR to need to surpass this level to quell inflation (or, the market is expecting core inflation to crater lower), but the market is anticipating Fed cuts in May 2023.

A Fed pivot comes down to this. If the Fed is going to pivot, then actual inflation statistics must start to decline meaningfully. The Fed needs to see a “sure thing” degradation in inflation data to change their tune. We don’t believe one data point will give them that flexibility. This has been reiterated by Fed Governors the last few weeks.

Real Rates Need to Rise

Core inflation rate-of-change is turning negative. Core inflation on-an-absolute-basis is high. Both are true. In saying that, we believe the true debate on core inflation is not whether it is peaking, but rather a) how quickly it will take to return to 2%, b) how high real rates (the mechanism through which “Fed tightening” is affected) must rise to return core inflation to 2%, and c) (per David’s earnings commentary) what happens to 2023 consensus EPS revisions, as the Fed continues through the tightening cycle.

Monetary policy is ultimately transmitted through real rates (inflation-adjusted interest rates > 0%). Today, the 10-year real rate is 0.3% and the core CPI run-rate is 6.1%. The 25-year average 10-year real rate is around 1.3% and core CPI run-rate 2.2%. December 2018 marked the last time that the upper bound FFR was 2.50%. The 10-year real rate, then, was 1.0% with the core CPI run rate at 1.9%. Now is not the time for a Fed pivot!

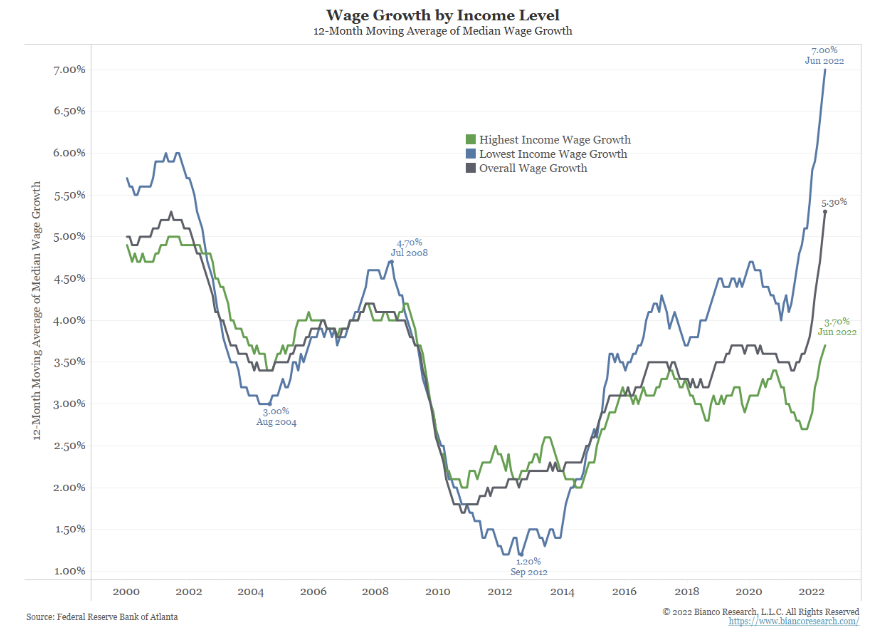

Wage Growth is Problematic

Assuming wage growth maintains a 4.0%+ annualized rate (the annualized MoM average hourly earnings was 6.0% in July, an acceleration from 4.6% in June) – we believe that a 4.0%+ wage growth will keep core CPI above 4.0%. If that is the case, we can expect the upper bound of the FFR to be 4.0%+ before peaking… 150bps to go!

Source: Bianco. As of 8/10/22

Source: Bianco. As of 8/10/22

Unit labor costs – which drive core inflation – exploded +9.5% YoY in 2Q. Also, unemployment made a fresh post-crisis low of 3.5% in July (in addition to lackluster labor force participation), signaling a continuation of a tight jobs market. To get and keep inflation down, we (and the Fed) need to see a continued slowdown/recession to build slack and squeeze out price pressures. It will be very hard to get inflation to 2% when wages are growing at the current pace of >5% YoY.

Is The Market Reaction Warranted?

The market has ripped higher following the softer than expected inflation print and a perceived dovish Fed in response. Inflation and Fed policy remain the two major influences on the market. But economic growth now is next in line in terms of market influence and for one clear reason. If inflation has peaked, then in order to get the economic soft landing, inflation will have to decline more rapidly than growth (so we have falling inflation but mostly stable growth). However, if growth falls faster than inflation, then that’s stagflation – which isn’t priced into the equity market in our opinion.

Bottom line

The Headline CPI YoY will almost certainly have peaked in June at 9.1%. That is good news. A long-term healthy economy requires price stability. Inflation peaking and moving lower gets us a step closer to price stability. What we saw in the July report was the combination of declining energy prices, the surge in goods inventories (Walmart/ Target earnings commentary), and reduced demand (lower real wages and sticker shock) begin to dampen inflation.

U.S. inflation is still too high, and monetary policy needs to continue to tighten in our opinion. We continue to look for the Fed Funds rate to approach 4% by early 2023 in addition to a Fed that is slow to start cutting rates. One thing we can gather is that the slowdown in MoM CPI inflation means the pace of rate hikes does not have to continue at the +75bp aggressive clip of the past 2 FOMC meetings, especially with QT ramping up.

While it’s important to listen to what Fed members are saying, it will be more telling to watch what they are doing. The last five months, the Fed has made a point to kill inflation. They’ve raised interest rates from 0.00% to 2.25% while beginning QT – these actions have helped the institution regain credibility. Fed governors continue to beat the drum on remaining hawkish and not letting up on the progress made up to this point. While we understand the monetary policy acts on a lag, we don’t see the Fed declaring victory on inflation anytime soon.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2208-17.