Investing Framework, How Are Returns Generated?

The Aptus investing methodology revolves around a Yield + Growth +/- Multiple (Expansion/ Contraction) framework. The latter, multiple expansion or contraction, tends to not be fully additive or detractive over longer periods of time. Thus, we do not include it in our formula.

When looking at a stock, bond, real estate, or just general asset allocation, over long periods of time, investors can expect to earn: the yield on the investment (interest income or dividends) + the underlying growth of the asset. As a bond example, we’ve included this Yield + Growth metrics of the Vanguard Total Bond Market Index since 11/2001:

Source: Bloomberg LP. As of 12.13.21.

What Makes Stocks Different than Bonds?

Companies have levers to pull to grow their company’s earnings: sales growth, margin expansion, M&A, buyback shares, etc. A bond has zero ways to grow. The long-term return potential from a bond is the interest income + multiple expansion or contraction from interest rates moving up/down or credit spreads repricing. Historically, interest income has made up most all of bonds total return – 93.6% over the last 20 years (example above).

Since late 2001, we looked back at the Vanguard Total Bond Market Index (Ticker VBTLX) to analyze the attribution of returns. Since 11/12/2001, of the 124.46% total return only 7.85% came from price appreciation, the other 116.61% came from income (yield). Since late 2001, the 10yr Treasury has gone from 5.0% to 1.5% today… we believe both the level of yields and associated re-investable income will be a giant obstacle for future fixed income returns.

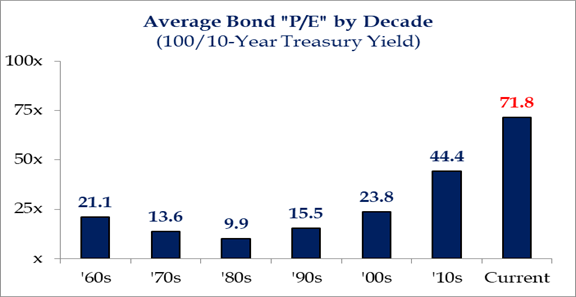

So Where Are Current Bond Valuations?

Source: Strategas. As of 12.1.21.

Looking ahead and thinking about future return potential, we think the current valuation of bonds is nothing short of scary, and that’s before considering inflation. Right now, the P/E ratio for a 10yr Treasury is 71.8x its current, forward, and forever earnings. 71.8X. 71.8 times earnings that cannot grow, cannot defend against inflation, and cannot give you enough re-investable income to offset the loss of purchasing power.

For a comparison, the S&P 500 is trading at 21x the projected ’22 earnings (~$225) multiple. In ’19, the S&P 500 had earnings of $152, we will exit ’21 with ~$206 in earnings – 36% growth in earnings in the span of two years (with a lot of bumps in between!) all while basically maintaining the same multiple. The point of all this… stocks prices grow over time BECAUSE the underlying companies have the ability to grow. Simply put, it is reasonable for an investor to pay a premium valuation for a growing asset (stocks, real estate, etc) – not one that is not growing.

So, Is Your Bond Allocation Safe?

As we approach the end of 2021, it looks as if we will see the first time ever that the 2-year Treasury shows an annual loss (yes, even in nominal terms). Historically, the bond’s income has been enough to reinvest back into higher yielding securities as rates rise but given that 2-year Treasuries started 2021 at 0.12%, re-investable income has been sparse.

Source: Bloomberg LP. As of 12.14.21.

But, It Gets Worse…

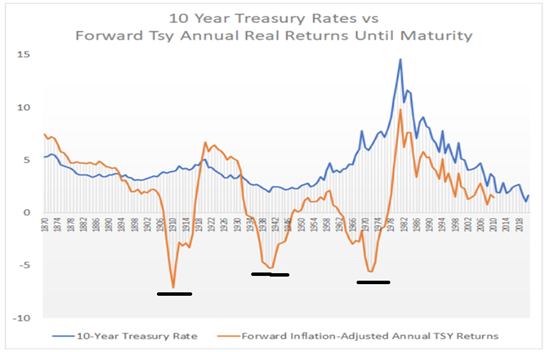

We think the graphic below is one of the most powerful visuals we’ve seen showing the silent erosion of bond investor’s capital during a negative real yield environment…

(10yr UST @ 1.5%) – (CPI @ 6.81%) = Real Yield of -5.31%.

Looking back at history, we can see the inflation-adjusted effect on bonds returns during periods of low yields and high inflation. 3x in the last ~100 years, bond holders were stuck holding the bag of compounding capital at negative real returns. These periods equate to a loss of purchasing power…

Source: Lyn Alden. As of 11.30.21

Power of Compounding Works Both Ways

The yield on the 10-Year Treasury Bond currently sits around 1.50%. This is before you take inflation into account. Because inflation eats away at your purchasing power, that makes the real return on the 10-Year Treasury Bond negative (remember -5.31% above). Essentially, bondholders are losing 5.31% of their money on a yearly basis. And if inflation is higher than what the CPI estimates, then that loss is even higher.

This is what we refer to as going broke slowly. This is a risk becoming more pervasive in retirement accounts today, stemming from an asset class traditionally known for its conservative risk profile and ability to provide income on a consistent basis. Every investor knows the importance of compounding returns. Well, it works in the other direction, too.

Compounding negative returns can get very ugly very quickly. Suppose you put $100 in those 10-Year Treasury Bonds we referenced above. If that $100 compounds at the current real return rate of negative 5.31% per year over 5 years, that $100 magically turns into $76.12 and just like that you’ve lost 24% on your “safe” money.

With rates this low, and inflation reappearing after a long absence, we think investors should be really thoughtful about their use of fixed income. Stocks may seem expensive, but the ability of companies to raise prices and grow over time can at least give holders a built-in way to maintain their purchasing power. The fixed coupons of traditional bonds can’t do that, eroding real value for as long as inflation exceeds returns…a sneaky danger but a costly one for sure.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Vanguard Total Bond Market Index Fund invests in U.S. Treasuries and mortgage-backed securities of all maturities (short-, intermediate-, and long-term issues).

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2112-11.