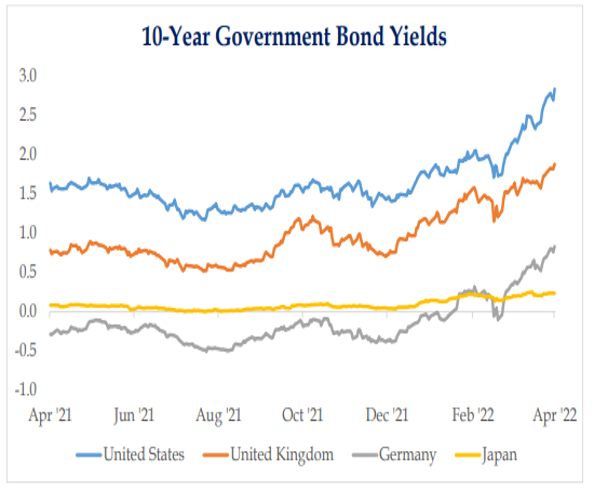

* Why Are Yields Rising: Rising yields are a consequence of falling bond prices, which occurs when investors sell bonds. This is an obvious point, but it’s important to realize that yields aren’t rising by themselves—they are only rising because investors are selling bonds. The selling has been intense as the 10-year Treasury yield has risen from 1.52% on Jan. 1 to 2.93% now, which is the highest level since 2018. The front end of the curve is rising too, the 2-year hit its highest level since late 2018. Yields are quickly approaching the psychological 3% mark. Bottom line: Investors typically sell bonds for (2) reasons: 1) they expect a stronger economy 2) they fear higher inflation.

* Alternatives to USTs are Seeing Rising Yields: The 10- year German bund yield has surged to positive 92 basis points, up from -18 basis points to start the year. And now that German Bund yields have turned solidly positive, we’re seeing foreign investors sell Treasuries and rotate back into Bunds. As other global yields move higher and become a more attractive alternative to USTs it could be another tailwind on rising yields.

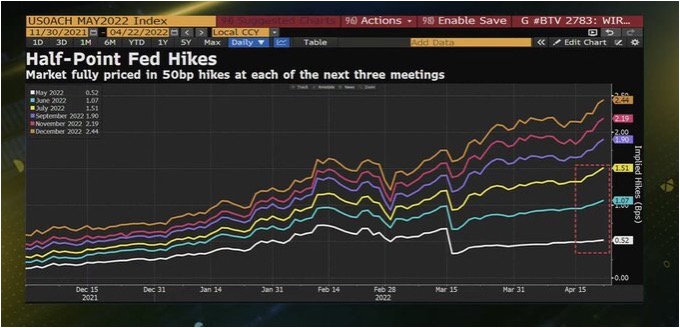

* What is the Yield Curve Telling Us? It appears that the bond market is at another inflection point, where one of two things could happen. Either the 10s-2s spread will continue to widen as the 10- year yield rises (what we’ve seen the last few weeks) which implies that inflation will be higher for longer, or 10s-2s will roll over and head back towards inversion, implying the bond market thinks the Fed may go through with cooling the economy to slow inflation via aggressive rate hikes/ QT. Too the right, the graphic shows rate hike expectations for ’22. Expectations are hitting new highs at nearly 10 hikes. We expect a 50bps hike at the May meeting and a growing likelihood of multiple 50bps hikes over the next few months given the white-hot inflationary pressures. Fed fund futures agree (i.e., pricing 50bps hikes at the next 4 meetings).

All data and Charts sourced from Bloomberg LP as of 4/21/22

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards and political and economic risks. These risks are enhanced in emerging market countries.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2204-21.