We’ve written extensively about the debt ceiling, and how it could impact markets (see Part One and Part Deux).

While uncertainty remains around the various market impacts of a default, the more pressing client question is “Are the T-bills I just bought going to be OK?”

For context, normally the Treasury bill curve trades on top of the Fed Funds forward curve. But the front end is now diverging due to the debt ceiling and “X” date.

All of the Treasury bills maturing before this date are far below the forward curve, and the maturities during the potential debt ceiling window are trading well above the Fed Funds rate. These are the bills money funds are avoiding out of fear of default.

In a nutshell, money funds see the potential headaches to owning T-bills that may be at risk of technical default. Because these funds have to offer daily fair value pricing, they don’t want to be left holding defaulted securities, even if the securities are likely to be paid off after a short delay.

So, money funds, the biggest buyer of short-term debt, avoid bills around the debt ceiling date. They are not worth the headache. Why would a manager take the career and business risk to own them? Money is flying in the door, and fees are rolling in. So, avoid them and keep life simple.

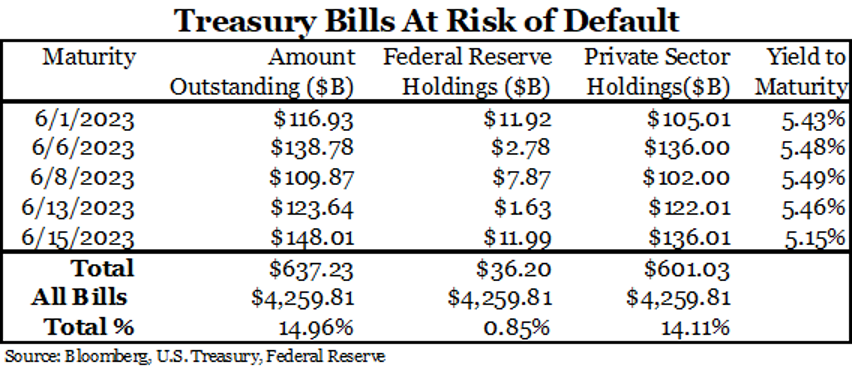

The market thinks the bills at risk are between June 1 and June 15. The table details how big this part of the overall bill market is.

Data as of 05.12.2023

Data as of 05.12.2023

As far as client holdings, remember these T-bills are explicitly guaranteed by the full faith and credit of the US Government. So, while there could be a temporary price implication, we believe they will eventually be money good regardless of what happens once the debt ceiling is adjusted.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2305-17.